Statute of limitations for repayment of administrative punishment

Article 4.6 of the Code of Administrative Offenses of the Russian Federation. The period during which a person is considered subject to administrative punishment

New edition of Art. 4.6 Code of Administrative Offenses of the Russian Federation

A person who has been imposed an administrative penalty for committing an administrative offense is considered subject to this punishment from the date the decision on the imposition of an administrative penalty enters into legal force until the expiration of one year from the date of completion of the execution of this decision.

Commentary on Article 4.6 of the Code of Administrative Offenses of the Russian Federation

The administrative-legal status of a person against whom proceedings are being conducted for an administrative offense is established by Article 25.1 of the Code of Administrative Offences. At the same time, the period for the entry into force of a decision in a case of an administrative offense is regulated by Articles 31.1, 31.2 of the Code of Administrative Offences, and the end of the proceedings to execute the decision on the imposition of an administrative penalty is regulated by Article 31.10 of the Code of Administrative Offences. These norms must be taken into account for the correct calculation of the period during which an individual, official or legal entity is considered subject to administrative punishment, and from the date of completion of the execution of the decision on the imposition of an administrative penalty, from which one year begins to run.

When applying an administrative punishment calculated for a certain period (deprivation of a special right, administrative arrest and disqualification), the end date of execution of the punishment is indicated in the resolution on its appointment.

Another comment on Art. 4.6 of the Code of the Russian Federation on Administrative Offenses

The essence of the period established by this article is that a person who has been imposed an administrative penalty for committing an administrative offense is considered subject to this punishment within one year from the date of completion of the execution of the decision on the imposition of an administrative penalty.

The period during which a person is considered subject to an administrative penalty is the period for repayment of this penalty. It performs a certain educational and preventive role in preventing the commission of new administrative offenses.

Recognition of a person as subject to administrative punishment entails legal consequences for him. Under certain conditions, punishment can be considered as a circumstance aggravating administrative responsibility and serve as a qualifying feature for the application of a more severe penalty. However, recognizing a person as subject to administrative punishment cannot affect the qualification of an administrative offense: no matter how many times the same person commits an administrative offense, none of the offenses committed can be transferred to another legal entity.

The repayment period of an administrative penalty is not differentiated depending on the type, duration and amount of the administrative penalty. It is equal to one year.

The repayment period begins on the date of completion of the execution of the decision on the imposition of an administrative penalty: in the case of imposition of an administrative penalty in the form of a warning, the beginning of the repayment of the one-year limitation period coincides with the day the penalty was imposed; The deadline for the execution of an administrative penalty when imposing a fine, administrative arrest, deprivation of a special right, or disqualification coincides, respectively, with the payment of the fine, with the end of the actual serving of the administrative arrest or with the expiration of the period for which the citizen was deprived of a special right, as well as with the expiration of the disqualification period for the official faces; The statute of limitations for forced administrative deportation is calculated from the moment of actual deportation.

The commission of a new administrative offense interrupts the limitation period for paying off the administrative penalty. It begins to flow from the moment of execution of the administrative punishment imposed for a newly committed administrative offense.

A person exempted from administrative liability due to the insignificance of the administrative offense is not considered subject to administrative punishment.

The basis for full repayment of administrative penalties is the expiration of the one-year period provided for in this article and the failure to commit a new administrative offense during the specified period. From the moment a person’s administrative punishment expires, the fact that he committed an administrative offense in the past when committing a new one cannot be taken into account as a circumstance aggravating administrative liability.

If the guilty person is subjected to primary and additional punishment, then the repayment period is calculated from the date of completion of the execution of the penalty that was executed last.

Article 4.6 of the Code of Administrative Offenses of the Russian Federation. The period during which a person is considered subject to administrative punishment

A person who has been imposed an administrative penalty for committing an administrative offense is considered subject to this punishment from the date the decision on the imposition of an administrative penalty enters into legal force until the expiration of one year from the date of completion of the execution of this decision.

Comments to Art. 4.6 Code of Administrative Offenses of the Russian Federation

1. The person against whom the proceedings were conducted is considered to be subject to administrative punishment from the moment the decision imposing an administrative penalty enters into force (for the timing of the entry into force of decisions in cases of administrative offense, see the commentary to Article 31.1). A person is in a state of so-called administrative punishment both during the period of execution of the administrative punishment and also during the period specified by law after the execution of the punishment. This period is the statute of limitations for paying off an administrative penalty. It is equal to one year, calculated from the date of completion of the execution of the decision on the imposition of an administrative penalty. After the expiration of this year, the person is considered not to have been subjected to administrative punishment.

2. The period for paying off the punishment is a kind of probationary period, during which the person held accountable must prove that he has reformed. Therefore, the starting point of the one-year period for repayment of punishment is not the moment of the decision to impose an administrative penalty, but the day of the actual end of execution of the imposed punishment.

3. A one-year repayment period for administrative penalties is established for all administrative penalties, regardless of their type, size and timing.

4. If an administrative penalty is imposed in the form of a warning, the beginning of the one-year limitation period coincides with the day the penalty itself was imposed.

5. The deadline for the completion of execution of a punishment when an administrative fine, administrative arrest, deprivation of a special right, or administrative suspension of activities is imposed coincides, respectively, with the moment of full payment of the fine amount, the day of the end of the actual serving of the administrative arrest, with the expiration of the period for which the deprivation of a special right was assigned or administrative suspension of activities.

6. If the guilty person is subjected to primary and additional punishments, then the one-year period is calculated from the date of completion of the execution of the punishment that was executed last.

7. Repayment of an administrative penalty after the expiration of a one-year period occurs automatically and does not require execution by a special document.

8. Repeated commission of a homogeneous offense during the period that has not expired for the previous punishment is considered as a circumstance aggravating administrative liability (see paragraph 2, part 1, article 4.3), and in some cases can serve as a qualifying criterion for the application of a more severe measure of administrative liability (see, for example, part 2 of article 5.27).

Statute of limitations for repayment of administrative punishment

The Supreme Court returns the driver's license - part four Photo from the site www. The inattention of judges during the investigation of the circumstances of the case and when drawing up judicial acts led to erroneous decisions. The police found signs of intoxication in the driver: “the smell of alcohol on his breath, impaired speech and behavior inappropriate for the situation.” In addition, Rasskazov refused to be tested for alcohol intoxication, without denying that he had consumed alcohol the day before. The driver was forcibly sent to undergo a medical examination at the Smolensk Regional Narcological Dispensary.

Limitation period for an administrative fine

Driving instructors remind you that failure to pay a fine on time will result in punishment. However, there are cases when you no longer need to pay the receipt. Terms of the ruling Here's what driving instructors advise you to pay attention to if you receive a ruling about a violation: As written in Article 4.

That is, there is no need to pay a fine in this case. The same article states: if a case of an administrative violation on the road was considered by a judge, then a decision on it should be made three months but no later than from the moment the offense was committed. Article Counting the period It is important to note that the two years mentioned above are not counted from the date of the decision, but only after 10 days.

It is this period that is given to appeal the decision, and after these 10 days the decision comes into force. For example, a decree about an offense came to the car owner 2 years and 10 days after it was issued.

In this case, it is invalid and the fine does not have to be paid. But there is one BUT! In this case, the calculation of the statute of limitations is resumed from the moment of discovery of the violator himself, his income or things that can be subject to administrative penalties based on the decision made. By the way, administrative arrest as a punishment is not applied for failure to pay fines for violations that were recorded by photo and video recording systems operating in automatic mode.

Calculation example Let's take this example. Today is November 30th. Subtract two years and 10 days from this date. It turns out that all fines for violations that were committed before November 19 of the year do not need to be paid.

But penalties for misconduct after this date will still have to be paid. But there is one nuance here. If the car owner appeals the ruling on an offense in court, then two years will be counted after the ruling comes into force.

That is, after the court hearing and plus the legal period for appeal. Responsibility for non-payment According to the article, an administrative fine for violating traffic rules must be paid no later than 30 days. This period begins to be calculated after the resolution enters into legal force. Plus 10 days to appeal. In simple words, you have 40 days to pay the fine.

Otherwise, other penalties will be applied. Video about what to do if a paid fine is listed as unpaid: Do not violate traffic rules and drive carefully! The article uses an image from the vkry website.

Statute of limitations for administrative traffic violations

Article 4 of the Code of Administrative Offenses of the Russian Federation defines deadlines after the expiration of which the possibility of imposing an administrative penalty is excluded. Firstly, the statute of limitations established by the legislator depend on the type and nature of the administrative offense; secondly, the timing of bringing to administrative responsibility depends on the type of administrative punishment; thirdly, for a certain category of cases, the timing of administrative penalties imposed on both individuals and legal entities has changed. A decision in a case of an administrative offense cannot be made after two months from the date of commission of the administrative offense. In case of a continuing administrative offense, the calculation of the period for imposing punishment and bringing to administrative responsibility is determined not by the moment of commission of the administrative offense, but by the moment of its discovery. In case of refusal to initiate a criminal case or its termination, an administrative penalty may be imposed no later than two months from the date of the decision to refuse to initiate a criminal case or to terminate it. The period during which a person is considered subject to administrative punishment. The period during which a person is considered subject to an administrative penalty is the period for repayment of this penalty. It performs a certain educational and preventive role in preventing the commission of new administrative offenses. Recognition of a person as subject to administrative punishment entails legal consequences for him.

If the statute of limitations for a fine has expired...

Limitation period for bringing to administrative responsibility 1. Rules Part. In this case: - we are talking about calendar months; — the countdown of the period begins from the next day after the day of commission of the unlawful act; 2 special.

Administrative liability: for what and when they can attract

Limitation period for the execution of a resolution on the imposition of an administrative penalty The document has been amended - see On the legal regulation before making the relevant changes, see: Limitation period for the execution of a resolution on the imposition of an administrative penalty 1. A resolution on the imposition of an administrative penalty is not subject to execution if this resolution was not enforced in within two years from the date of its entry into force. Federal Law No. The statute of limitations provided for in Part 1 of this article is interrupted if a person held administratively liable evades the execution of a decision imposing an administrative penalty. The calculation of the statute of limitations in this case is resumed from the day of discovery of the specified person or his things, income, on which, in accordance with the resolution on the imposition of an administrative penalty, an administrative penalty may be applied. In the event of a postponement or suspension of the execution of a decision on the imposition of an administrative penalty in accordance with Articles In the case of an installment plan for the execution of a decision on the imposition of an administrative penalty, the limitation period is extended by the installment period.

Article 4.5. Limitation period for administrative liability

Limitation period for administrative liability. The period during which a person is considered subject to administrative punishment Limitation period for bringing to administrative responsibility 1. This article defines the terms after the expiration of which the possibility of imposing an administrative penalty is excluded. Firstly, the statute of limitations established by the legislator depend on the type and nature of the administrative offense; secondly, for the first time in the Code of Administrative Offences, the terms of bringing to administrative responsibility are made dependent on the type of administrative punishment, although this trend is generally known to Russian legislation, for example, the Labor Code; thirdly, for a certain category of cases, the timing of administrative penalties imposed on both individuals and legal entities has changed significantly. A decision in a case of an administrative offense cannot be made after two months from the date of commission of the administrative offense.

Article 4.6. The period during which a person is considered subject to administrative punishment

How long a person is considered subject to administrative punishment. Statute of limitations for administrative offenses How long a person is considered subject to administrative punishment. Statute of limitations for administrative offenses An administrative violation is an action or inaction that is contrary to the law, but does not pose a serious danger to society and does not cause fundamental harm to it. An administrative offense, although not regarded as a crime, is not approved by society, is suppressed by it and presupposes punishment for the crime. The statute of limitations for administrative offenses applies both at the stage of bringing to justice and at the stage of enforcing the imposed punishment.

The one-year repayment period for an administrative penalty with a one-year statute of limitations coincides with the day the penalty itself was imposed.

Driving instructors remind you that failure to pay a fine on time will result in punishment. However, there are cases when you no longer need to pay the receipt. Terms of the decision This is what driving instructors advise you to pay attention to if you have received a decision on a violation: As written in Article 4. That is, you don’t have to pay a fine in this case. The same article states: if a case of an administrative violation on the road was considered by a judge, then a decision on it should be made three months but no later than from the moment the offense was committed. Article Counting the period It is important to note that the two years mentioned above are not counted from the date of the decision, but only after 10 days.

Three years for political parties in terms of violations provided for in Article 5. Six years for countering terrorism in terms of violations provided for in the article What is a continuing offense The Code of Administrative Offenses contains such a concept as a continuing administrative offense. This term implies that an individual or legal entity systematically fails to comply with legal requirements over a certain period.

The decision to impose an administrative penalty is not subject to the expiration of the statute of limitations provided for in Part 1 of this article.

Encyclopedia of solutions. Statute of limitations for bringing an employer to administrative responsibility for violating labor and labor protection legislation Statute of limitations for bringing an employer to administrative responsibility for violating labor and labor protection legislation Proceedings in a case of an administrative offense cannot be started, and started proceedings must be terminated upon expiration statute of limitations for bringing to administrative responsibility p. Statute of limitations for bringing an employer to administrative responsibility for violation of labor legislation art. The statute of limitations for bringing to responsibility begins the next day after the day of the discovery of the administrative offense, part. How to determine the moment from which the statute of limitations for bringing to administrative responsibility for a particular violation begins to run is explained in paragraph. With regard to violation of labor legislation, which characterized by the employer’s failure to fulfill by a certain date the obligation provided for by a legal act, the statute of limitations for bringing to administrative responsibility begins to run from the moment the specified period occurs. Such violations include, for example, failure to pay wages, vacation pay, social benefits on time, failure to issue a work book on the day of dismissal, etc. Example An organization has established deadlines for paying wages: the 20th of the current month - advance payment, the 5th of the next month - the remaining part of the salary. Wages for February of the year were paid to employees on April 3 of the year and without payment of monetary compensation for the delay under Art. Since Art.

The specified period is equal to one year, calculated from the date of completion of the execution of the decision on the imposition of an administrative penalty. After the expiration of this year, the person is considered not to have been subjected to administrative punishment. The period for repayment of the penalty begins not at the time of the decision to impose an administrative penalty, but on the day of the actual completion of the execution of the imposed penalty. A one-year repayment period for administrative penalties is established for all administrative penalties, regardless of their type, size and timing. If an administrative penalty is imposed in the form of a warning, the beginning of the one-year limitation period coincides with the day the penalty itself was imposed. If an administrative penalty is applied in the form of an administrative fine, the end date of execution of the penalty coincides with the date of voluntary or forced execution of the decision imposing a monetary penalty in the form of an administrative fine. When applying an administrative penalty calculated for the period of deprivation of a special right, administrative arrest and disqualification, the end date of execution of the punishment is indicated in the resolution on its appointment. It should be taken into account that the period for execution of an administrative penalty in the form of deprivation of the right to drive vehicles assigned to a person already deprived of such a right is calculated not from the time the decision on the application of this type of punishment entered into legal force, but from the day following the day of expiration of the administrative period. punishment applied earlier paragraph

Statute of limitations for administrative offenses

An administrative violation is an action (or inaction) that is contrary to the law, but does not pose a serious danger to society and does not cause fundamental harm to it.

An administrative offense, although not regarded as a crime, is not approved by society, is suppressed by it and presupposes punishment for the crime.

The statute of limitations for administrative offenses applies both at the stage of bringing to justice and at the stage of enforcing the imposed punishment. At the same time, the statute of limitations and the procedure for calculating them may vary somewhat depending on the composition of the offense.

Responsibility and punishment in administrative law

Otherwise, the violator will be held accountable before the court according to the law (legal liability).

Administrative liability is one of the types of legal liability and is regulated by the Code of Administrative Offenses (Federal Law No. 195 2001/30/12, edition 2016/05/12 and 2016/21/12).

Administrative responsibility

Any unlawful intentional or careless act that violates civil rights, morality, established public order, health, ecology, and all types of relations within society is classified as an administrative offense.

Administrative liability arises precisely upon the fact of an offense and leads to restriction of access to certain public goods:

- narrowing the scope of personal and legal freedom of the offender;

- property and material costs;

- belittlement;

- damage to reputation and restriction of activities.

Administrative punishment

Being a reasonable reaction of the state to an offense (violation), punishment serves as a measure of the responsibility of the “troublemaker.”

Punishment, which aims to restore justice and legal balance in society, has not only a punitive function, but also an exemplary and educational one - so that others are discouraged (Administrative Offenses Code Art. 3.1).

When determining the degree of punishment, they rely (CAP Chapter 4) on the nature of the administrative offense and its potential consequences for society, but they must take into account the identity of the offender (the status of the enterprise, if the culprit is a legal entity), his financial situation, mitigating and aggravating circumstances of the case.

Administrative sanctions may be expressed as follows:

- censure (remark, reprimand, warning, etc.);

- imposition of a fine;

- deprivation of a special right (hunting, driving a vehicle, using special equipment) granted earlier, and confiscation of the weapon (object) that resulted in the offense;

- arrest and forced labor (up to 30 days);

- expulsion from the country (non-citizens of the Russian Federation);

- disqualification (removal from position) and freezing of activities.

In case of a combination of violations considered within the framework of one process, the punishment is not summed up, but is assigned under a more stringent article (Administrative Offenses Code, Article 4.4, paragraph 2).

Limitation period for administrative offenses

What is the statute of limitations for administrative offenses established by law?

Administrative liability, unlike criminal liability, is not so severe, and therefore does not entail a criminal record and is characterized by more flexible statutes of limitations.

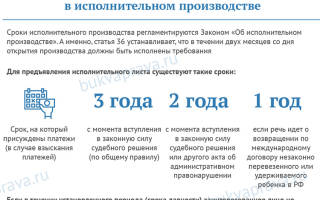

In general, the limitation period for administrative violations is calculated as follows:

- 2 months – prosecution (3 months during judicial review);

- 2 years – execution of the imposed punishment.

For a number of offenses (Article 4.5, paragraph 1), the statute of limitations for prosecution is 1 year. For violations in the financial sector – 2 years. In corruption cases, the statute of limitations is 6 years.

According to the general rule, after a year, a person guilty of an administrative offense, who accepted and carried out the punishment, is already considered “clean” and has not been brought to justice. In other words, a citizen is classified as “brought to administrative responsibility” (subjected to punishment) from the moment the decision is made plus the time for execution plus one year after the “fact of retribution” has occurred.

The period begins to be calculated from the next day after the violation occurred and, accordingly, it came to the attention of the official.

Attempts to bring to justice after the expiration of the statute of limitations for an administrative offense are illegal (Article 24.5, paragraph 1, paragraph 6). In this case, the proceedings cannot be initiated, and if the procedure has already begun, it is immediately terminated (the case is closed).

The statute of limitations for execution of the punishment begins to be calculated from the moment the decision is made, which loses its legal force after 2 years. If during this time the resolution is not implemented, then it can be considered annulled. There cannot be a repeated prosecution for the same offense (Article 4.1, paragraph 5).

In the event that there is a delay, installment plan or suspension in the execution of the decision (Administrative Code Articles 31.5, 31.6), then the statute of limitations is extended for this period of time, that is, it is interrupted, then the period of installment plan/deferment/suspension is counted, then the statute of limitations continues. .

In case of deliberate evasion of the prescribed punishment, the statute of limitations is restored in its course from the moment of discovery of the culprit or his property.

In other words, an administrative penalty cannot be imposed after 2 years if the decision was made and forgotten about. If measures were taken, if they worked with the “client”, but he stubbornly hid, then the limitation period was interrupted and resumed every time after his discovery - thus, the 2-year limitation period could be noticeably lengthened.

Continuing offense

An offense is considered ongoing if it continues for a long time and does not cease until it is discovered by an authorized person (Resolution of the Plenum of the Supreme Court No. 5 2005/24/03, paragraph 14).

On the other hand, if the deadline for fulfilling a specific obligation is clearly defined by legislative acts, but compliance has not followed, then the statute of limitations for an administrative violation should be counted from the moment the deadline expires (Letter of the State Customs Committee No. 01-06/2058 2002/27/05; Resolution of the Plenum BC No. 5 clause 14 paragraph 2).

In this case, the day of discovery (the starting point) is set as the day the protocol was drawn up and signed by an authorized person (Administrative Code Art. 4.5, p. 2).

Didn't find the answer to your question?

Find out how to solve exactly your problem - call right now:

+7 (499) 288-73-46;

8 (800) 600-36-19

It's fast and free!

Statute of limitations for administrative offenses of the State Traffic Safety Inspectorate

Traffic police fines, being administrative, must be paid within 2 months.

If payment is made within 20 days, the amount of the fine is halved (Administrative Code Art. 32.2, paragraphs 1, 1.3).

The countdown begins 10 days after the offender receives the order.

If the fine is not paid, the bailiff initiates enforcement proceedings (Administrative Code Article 32.2, paragraph 5). Upon the opening of SSP production, the draft dodger is given 5 days to voluntarily cover the debt (Federal Law No. 229 2007/02/10, edition 2016/01/10, Article 30, Clause 12). After this, all income and property of the debtor come into the view of the bailiff. If the amount of traffic police fines exceeds 10 thousand, the bailiff imposes a temporary ban on the debtor traveling abroad (Federal Law No. 229, Article 67, paragraphs 1, 3).

The statute of limitations for imposing a fine is 2 months (through the court - 3 months), and for collection (a common offense) it is limited to 2 years from the date of the decision to impose an administrative penalty. The following provisions are available for appeal:

- 10 days – with the head of the state traffic inspectorate;

- 60 days – in court.

If the inspector does not issue a fine on the spot, then after 2 months he cannot bring the offender to justice. After 3 months, the statute of limitations for this violation expires completely and irrevocably.

Example. M exceeded the speed limit on January 15, 2014, was stopped by an inspector and fined. The decision to impose a fine became effective on January 25, 2014 (it was not appealed). On January 26, 2014, the statute of limitations began to run, which expired on January 26, 2016. Over the past 2 years, no one bothered him (no measures were taken) or tried to forcefully bring him to justice.

The traffic cop’s demand to pay the “debt” presented to him after the named date is not legal, since M did not hide or evade (they didn’t even try to find him), and the statute of limitations had expired - the resolution lost its force.

The statute of limitations for CCTV fines is no different from traditional fines.

The only difference is the imposition of punishment for malicious non-payment. In this case, arrest for 15 days is not possible (Administrative Code Art. 20.25, paragraph 3).

Any administrative violation implies responsibility for the act and punishment, which is assigned by special authorized persons (bodies).

The limitation period for filing claims and imposing penalties is generally limited to 2 months. The limitation period for executing a foreclosure order expires after 2 years. This does not mean that you can “wait it out” and thus hide from responsibility. If a draft dodger is identified, the measures that will be applied to him are very severe.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7 (499) 288-73-46 , St. Petersburg +7 (812) 317-70-86 .

Article 31.9. Limitation period for execution of a decision imposing an administrative penalty

Article 31.9. Limitation period for execution of a decision imposing an administrative penalty

1. Applying the rules of Parts 1 and 2 of Art. 31.9, the following must be taken into account:

1) they are devoted to the limitation of execution of administrative punishment. This institution should be distinguished from the statute of limitations for bringing to administrative responsibility (see commentary to Article 4.5);

2) the decision on an administrative penalty is not executed if a one-year period has expired from the date of its entry into legal force. Wherein:

a) the day of entry into force is determined according to the rules of Art. 31.1 (see commentary to it);

b) in part 1 of Art. 31.9 refers to the calendar year (i.e., when calculating it, non-working days are not excluded);

3) running of the limitation period:

a) is interrupted only if the person evades serving the assigned sentence;

b) resumed (in this case, the elapsed period is not added to the statute of limitations calculated after the break) from the day of discovery of the person to whom an administrative penalty was imposed, or his belongings, income, which may be subject to collection. In practice, the question arises: are there any contradictions between the rules of Art. 3.1, 3.2 (and other norms of the Code of Administrative Offenses, where a new legal institution is consistently applied - “administrative punishment”) and Art. 31.9, where is the concept of “administrative penalty” (characteristic of the Code of Administrative Offenses of the RSFSR) used? No, there is no contradiction. The fact is that with the phrase “administrative penalty” the legislator in this case does not mean the type of administrative sanction, but the fact that during the execution (for example, an administrative fine), collection is carried out at the expense of money and other property of the person to whom the administrative penalty has been imposed. Moreover, such a penalty is based not on the norms of private (i.e. civil), but public (in this case, administrative) law. On the procedure for determining the beginning of the calculation of the period mentioned in Part 1 of Art. 31.9 and the procedure for calculating the deadlines specified in Art. 31.9 see clauses 1, 2 of Letter No. 115.

2. Specifics of the rules of Part 3 of Art. 31.9 is that:

1) they are devoted to the suspension of the above-mentioned statute of limitations. In contrast to the interruption of this period, in the case of suspension, part of the period (expired before the moment of suspension) is added to the remaining (after the resumption of the period) part;

2) they comprehensively provide for:

a) the grounds for suspending the deferment of execution (a period that cannot exceed one month, see commentary to Article 31.5);

b) suspension on the grounds and in the manner established in Art. 31.6 (see commentary to Articles 31.6, 31.8);

3) in accordance with them, after the expiration of the deferment or suspension periods, the statute of limitations continues to run. In this case, no definition is required.

3. Features of the rules of Part 4 of Art. 31.9 are that:

1) they are devoted to an independent institution - the extension of the above-mentioned statute of limitations;

2) in accordance with them, the only basis for such an extension is the installment execution of the decision (see commentary to Articles 31.5, 31.8);

3) they provide that the limitation period is extended for the entire installment period (it cannot exceed 3 calendar months). The statute of limitations is extended by determination.

3. Analysis of judicial practice shows that:

1) in parts 2-4 tbsp. 31.9 provides for cases when the limitation period for execution of a decision is interrupted or suspended. In addition, execution is subject to termination on the basis of clause 4 of Art. 31.7 upon expiration of the statute of limitations established in Part 1 of Art. 31.9; (clause 36 of Post. No. 5);

2) Part 1 Art. 31.9 establishes only the deadline for the execution of the executive document, and the Law on Execution. production sets a deadline for presenting this document for execution (clause 16 of the Review dated November 29, 2006);

3) after a year has passed from the date of its entry into force, the execution of the resolution is subject to termination, regardless of the fact that the execution was not carried out or was not carried out in full (information letter of the Presidium of the Supreme Arbitration Court dated October 24, 2006 N 115).

See also paragraph 32 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 22, 2006 N 25 “On some issues related to the qualification and establishment of requirements for mandatory payments, as well as sanctions for public offenses in bankruptcy cases” and paragraph 36 of the Post. N 5.