The insurance company does not pay for CASCO insurance, what should I do?

What to do if the insurance company does not pay for CASCO insurance

If an insurance company does not pay CASCO insurance, then various methods can be used to force it to fulfill its obligations. In any case, do not forget that this is a type of voluntary car insurance that guarantees compensation for damage in the event of certain situations.

What is CASCO and in what cases can you get a refusal?

On a voluntary basis, you can insure your vehicle against theft, theft or damage, but in this case the owner of the vehicle independently decides to enter into an agreement.

At the same time, various CASCO insurance programs may be offered, which differ not only in terms of registration, but also in the presence of conditions when the owner of the car can claim compensation from the insurer .

But the insurance company may refuse with or without any grounds. In the first case, the organization acts on the basis of the provisions of the legislative framework of the Russian Federation, that is, such a decision will be of a legal nature and protesting it is pointless.

But if there are no grounds, compensation for harm to the driver cannot be rejected; in this situation, you need to go to court to protect your rights. Often such decisions are made by insurance agents in relation to car owners who do not have much experience in receiving such refusals and resign themselves to them.

To avoid such a situation, you need to know that the insurer cannot unreasonably refuse to fulfill its obligations to compensate for damages provided for in the policy .

Grounds for refusal

Compensation for damage caused cannot be made if:

- The insurance company that entered into the agreement is at the stage of bankruptcy;

- Insurance policy details were identified in the database of stolen or lost documents;

- The insurance contract has ceased to be valid or it has been declared invalid;

- The deadline for submitting an application for payment of compensation was not met;

- The owner of the vehicle submitted false documents about the occurrence of an insured event;

- The driver driving the car was intoxicated;

- The causes of the collision were caused by special carelessness in order to obtain a benefit;

- The person driving the car is not included in the policy;

- The car driven by the insured driver was not inspected by an appropriate specialist (there is no inspection certificate):

- The cost of items that were in the stolen car is not subject to compensation;

- The collision occurred at a railway crossing with the barriers down;

- The accident occurred due to compliance with traffic rules;

- The accident occurred due to excessive speed of the vehicle;

- The car was driving in oncoming traffic;

- The incident occurred due to a machine malfunction;

- The insured vehicle was damaged due to a fire or explosion of a nearby car;

- The machine was damaged during loading or installation work;

- Safety rules were not followed during the movement;

- The driver of the car provided false information about the incident.

The owner of the damaged car may refuse to file claims against the person responsible for the collision . In this case, the insurer may refuse compensation for damage without qualifying such a case as an insurance case . The maximum list of circumstances under which the insurance company has the right not to compensate for damage is established by the terms of the contract.

What to do if the insurance company refuses to pay under CASCO

If the insurance organization refuses to compensate for the damage suffered, the car owner needs to file a complaint with the Russian Union of Insurers or the Central Bank .

In this case, you will need to present the relevant documentation and state the situation. If authorized organizations identify unlawful decisions in the actions of the insurance company, it will be obliged to review the negative decision.

If such a measure turns out to be ineffective, in the future it is worth solving the problem in court .

What actions to take

The provisions of civil law provide for insurance rules. They should be taken as the basis for the insurance obligations of the insurance company.

If they are not met, you will need:

- Find out the reasons for making a decision to refuse.

- Require a written justification indicating legal norms.

- Establish the validity of the verdict.

- The list of reasons that may serve as a motive for making a negative decision is regulated by Art. 963, 964 of the Civil Code of the Russian Federation. If the refusal is unlawful, it is necessary to prepare a claim for the insurer.

- If you do not receive a response within the prescribed period, you will need to send an application to the court.

The claim must include information about the circumstances of the case and the measures taken by the parties to the conflict. Requirements must be justified by the norms of current legislation.

The application must be accompanied by documentation confirming the accident.

If the damaged car has suffered extensive damage , it will need to be assessed by an independent expert.

When representing the interests of the car owner by a third party, it is necessary to present a power of attorney, executed by a notary.

In a situation where the amount to be reimbursed is underestimated by the insurance company , the policy purchaser needs to:

- Order an opinion on determining the amount of damage to the car from an appraiser;

- Send a request to the insurer to recalculate the amount of compensation;

- If you receive a refusal, file a claim in court.

In the event that the insurance company delays the issuance of CASCO payments , you will need:

- Submit a claim for the fulfillment of obligations, establishing a period for their fulfillment, in accordance with the terms of the agreement;

- If the requirements are not met, legal action should be taken.

Along with the statement of claim, the judge is presented with:

- A document proving the identity of the applicant and the powers of the owner of the vehicle.

- Correspondence with the insurer.

- Insurance agreement and receipt of payment of insurance fees.

- Receipt for payment of the state duty amount.

- Power of attorney for representation of interests by a trusted person.

The claim must contain information about:

- Name of the court;

- Details of the applicant and his contacts;

Information about the insurance company;

• The circumstances of the case;

• Claims made against the defendant (amounts of compensation, penalties, costs of litigation).

The legislation provides for the obligation of insurance agents to compensate for the cost of damage when a car is stolen, regardless of the situation . That is, there are no grounds when payment of compensation can be refused.

In addition, the insurer has no right not to compensate for damage even if the car was stolen due to the negligence of its owner .

How to receive insurance compensation under CASCO? Terms, conditions, reasons for refusal

As practice shows, receiving CASCO payments is not always easy. Insurance companies use various tricks to reduce the amount of payments or avoid them altogether. How to protect yourself, what to pay attention to when drawing up a contract and what to do if an insured event occurs?

CASCO is voluntary motor insurance. Ideally, if you purchase CASCO, you protect yourself from almost any problems with the car, even if you were the culprit of the situation. CASCO covers theft, partial damage, and even complete destruction of the car.

However, the statistics are such that many requests for CASCO payments are refused. You can blame this on insurance companies, who resort to various tricks to avoid paying out. However, in most cases, the policyholders themselves are to blame for the current situation: they inattentively read the terms of the contract, and act incorrectly when an insured event occurs.

First, let's figure out in what situations you may not receive your CASCO payment.

Refusal to pay under CASCO

There are many situations in which you may be denied compensation for damages:

Serious traffic violation . Read your contract carefully; it may contain a clause that states that insured events do not include road traffic accidents that occurred due to the fault of the insured. Such violations include: severe speeding, driving through a prohibiting traffic light, driving under the influence of alcohol or drugs.

By the way, according to traffic rules, you must operate only a serviceable car (which is confirmed by a technical inspection). Therefore, if you have an accident and the maintenance was not completed on time, the insurance company has the right to refuse compensation for damage. Or you will have to prove that the cause of the accident was not a vehicle malfunction. This is very difficult to do.

Conclusion : No insurance will relieve you of liability on the road and compliance with traffic rules.

Incorrect actions of the policyholder upon the occurrence of an insured event . Often we deprive ourselves of the opportunity to receive compensation for damage because we do not know how to act correctly in a given situation.

- You wrote a statement that you have no complaints against anyone , and after this the culprits will definitely not be found, since search activities will not be carried out, and a criminal case will not be initiated. According to the Civil Code of the Russian Federation, the insurance company can recover damages from the culprit, but with your statement you will deprive it of the right to subrogation, which may cause a refusal to pay.

Conclusion : Do not rush to sign documents while under stress. Try to calm down and look at the situation rationally. Don't give in to pressure.

- You did not immediately call the police/traffic police or provided false information about the accident .

Let's say you left home in the morning, are in a hurry to get to work, but notice that your car is scratched or dented. The temptation to go by car on business and call the police in the evening is great. But, most likely, the report will note that no traces of third parties were found at the scene of the accident, since the car will be parked in a different place. The reason for the refusal in this case is obvious: the damage does not correspond to the stated circumstances, which is why you will be suspected of fraud. We can talk about intentional and unintentional provision of false information in many situations.

Conclusion : Call the traffic police the moment an accident occurs or you discover damage. Read the protocol carefully before signing.

- You have carried out a complete or partial repair of the vehicle . Despite the fact that this point seems absurd, such situations arise quite often. Obviously, after examining the car by an insurance company expert, you will receive a conclusion that it is impossible to correctly determine the damage, and as a result, a refusal to pay.

Conclusion : Do not carry out any repairs to the car before the examination.

Various wording in the contract, which can be interpreted in two ways . If you have not carefully read the contract, then many surprises may await you when an insurance situation arises. For example, problems may arise with obtaining the insurance amount in the following cases:

- The car was damaged as a result of an explosion or fire of another car that was stationary next to yours.

- The vehicle was damaged due to special work being carried out near it (cleaning, loading, etc.).

- You failed to take necessary and reasonable steps to minimize the damage.

- The car was stolen, not stolen (the concepts of “theft” and “theft” are interpreted differently).

Conclusion : Carefully read the contract and insurance rules in advance, clarify all the points for yourself. You have the right to ask for an exception or new wording of points that you do not like or do not comply with the Civil Code of the Russian Federation.

So, the clause about the explosion or fire of a stationary car located next to yours at the time of the accident can be asked to be excluded. In the paragraph about carrying out special work, it is advisable to clarify what exactly is meant by such work, in which cases you receive compensation and in what amount. Also find out what is meant by “necessary and reasonable” measures that you must take to minimize possible losses.

Note:

- If your car is stolen, the insurance company may ask you to provide a “Writ of Suspension of Criminal Proceedings.” If this clause is in the contract, then it makes sense to exclude it. Firstly, it is quite difficult to obtain such a ruling, and secondly, according to a court decision, it may not be issued.

- Avoid general language such as “current market prices,” since the insurance company and you may interpret this concept differently. The insurance contract (rules) must specify on what basis these prices are determined.

- Another common clause is that you bear all costs until the insurance pays out. Whether to leave it or not is up to you.

The general rule is that in order for the insurance company to act in your interests, you must demonstrate that you are capable of defending them yourself or with the help of lawyers. Read all documents carefully, do not hesitate to ask questions, and do not make hasty decisions.

Insurance rules and terms of payments under CASCO

To receive a CASCO payment, be sure to follow all the rules for filing an insurance claim.

At the scene:

- Immediately call employees of the competent authorities (depending on the nature of the incident, this may be the traffic police, police, or the Ministry of Emergency Situations).

- Do not touch or move the vehicle.

- Do not try to negotiate with your opponent on your own (this may later be regarded as deception of the insurance company).

- Carefully read the traffic police report, make sure that it takes into account all the details of the incident.

After the incident:

- Immediately contact your insurance company, reporting the occurrence of an event with signs of an insured event.

- Provide a complete package of necessary documents (including an application and a certificate from the police or other competent authorities stating that an insured event occurred). Keep all copies of documents with a date stamp.

- Provide access to the damaged vehicle to an insurance company expert for examination. Find out in advance which organization will conduct the examination and whether you can get a copy of the certificate in your hands.

- When the insurer receives all the documents, check your case number, registration date and review deadlines.

- Remind yourself regularly, do not wait until the deadline for review.

If you disagree with something:

- If you have a certificate of damage, you can challenge the decision of the expert commission conducting the examination in court or otherwise;

- If there is a delay in payment of compensation, write a claim to the insurance company demanding payment within the specified time frame, and if there is no response, go to court. You can also file a complaint with the authorities that oversee the activities of insurance companies;

- If you disagree with the payment amount, contact an expert company to double-check the damage. If the amount paid is really less than expected, then feel free to go to court. Remember: even with an insurance contract in hand, you are at the very beginning of the path to receiving compensation for damage.

Terms and procedure for compensation of damages under CASCO

There are two ways to compensate for damage under CASCO:

- repair of a damaged car at a service station;

- cash payment.

It is necessary to take into account that, unlike compulsory motor liability insurance, the terms of payments under CASCO may differ from different insurance companies. There is neither a law nor a legal act that regulates the exact deadlines. As a rule, they must be specified in the contract or specified in the rules of the insurance company, which, by the way, may also be referred to in the contract.

What can cause delays:

- If it takes a long time to agree on the cost of car repairs . To speed up the process, you can first go to the service station, receive a work order and an invoice, and then take all the documents to the insurance company, providing them with the covering letter “I request you to pay the bills of the service station.”

- If it's in the queue . This reason is adequate; this situation occurs quite often. But in this case, the company must provide you with written notice stating the reasons.

On average, the payment period ranges from 15 to 30 days. If the exact deadlines are not specified anywhere, then after this period you can send a pre-trial claim demanding compensation for damage within seven days. The requirement may be based on the Civil Code of the Russian Federation, which states that payment terms must be reasonable. If after this you have not received compensation, feel free to go to court and also demand payment of the penalty.

To receive payment under CASCO, you should carefully read the contract before signing and act thoughtfully in the event of an insurance situation. In addition, it is better to choose a large and reliable insurance company that has a good reputation in the insurance market and extensive experience.

Refusal to pay insurance compensation under CASCO

Refusal of insurance payment under CASCO is not a rare phenomenon, because... This insurance option, in combination with mandatory insurance, is extremely popular. Companies develop attractive conditions, so car owners are happy to use these services. But it is important to know that, unlike compulsory insurance, additional insurance is not regulated in any way by law. So what to do if the insurance company does not pay for CASCO insurance? Let's figure it out.

It is for this reason that many more controversial situations arise here, because... insurance institutions, in fact, are not prohibited from doing anything. Therefore, if the insurance company refuses to pay (fulfill the terms of the agreement), the motorist should prepare for a difficult and possibly long procedure of proving his case. If the insurance company does not pay for CASCO insurance, we will tell you what to do in these cases below.

Possible reasons for refusal

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Request a consultation via the form.

- Use the online chat in the lower corner of the screen.

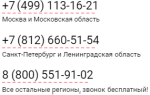

- Call:

- Moscow region: +7 (499) 938-42-57

- Leningrad region: +7 (812) 467-32-98

- Federal number: +7 (800) 350-83-26

It should be noted that, in contrast to the provided compulsory insurance, it is impossible to provide a list of reasons for the so-called illegal refusals - after all, we noted earlier that there is no legislative framework in our country on this issue yet.

Therefore, the main source for finding a solution in such cases is the contract. Those. If any party violates the specified conditions, then the issue should be resolved in pre-trial and judicial procedures.

But there are non-core legislative acts, such as the law on consumer rights, on insurance, norms 961, 963, 964 of the Civil Code of the Russian Federation, etc. Therefore, unlawful actions or decisions of the Investigative Committee can always be challenged. Refusal to pay under CASCO and its possible reasons can be expressed in the following list:

- the terms of application have been violated (as specified in the agreement itself)

- Before contacting the insurance company, partial repairs were carried out on our own

- the case is not insured, because not included in the package

- the motorist made no attempts to minimize the damage

- malicious violation of traffic rules (a special case, which is also specified in the agreement: deliberate driving into oncoming traffic, alcohol intoxication, violation of safety requirements, etc.)

- deprivation of the insurer's right to subrogation (for example, the car was stolen, but the owner does not want to write a statement to the police, hoping that the insurance company will compensate for everything anyway)

- delay in contacting the traffic police (the event occurred in the morning, and the policyholder contacted the traffic police only in the evening)

These are the most common reasons given by most insurance companies. An insurance company's refusal to pay under CASCO may be motivated by non-compliance/violation of the terms of the agreement, which may be completely different for two individual insurers. Therefore, before you begin to challenge a decision, you must carefully study the contract itself.

Pre-trial settlement of the issue

Of course, not all companies offer their products on “transparent” terms: substitution of terms, ambiguous wording, hidden context - these are frequently used techniques today. Therefore, almost no refusal to pay under CASCO is left without a counter-reaction from the motorist.

Before taking practical actions, it is necessary to clarify the decision of the Investigative Committee:

- This may be an unreasonable understatement of the amount,

- Or a complete refusal to pay insurance compensation under CASCO.

The procedure will be as follows:

Independent examination

If an independent examination can be carried out, then this should be the first step. If property was lost (for example, a car was stolen), then it is necessary to stock up on evidence (criminal case materials) and start drawing up a targeted claim to the insurance company (similar to a refusal to pay under compulsory motor liability insurance).

Next, we’ll tell you how to file a claim with an insurance company.

Filing a claim with the insurance company

The first step is to outline the range of factors that play in your favor. Those. a simple “naked” demand in this case will not lead to anything positive.

The claim form for the insurance company in the CASCO option is not standard - i.e. compiled in free form. The appeal should mention all the circumstances in accordance with which the company’s decision is unlawful. If an independent examination was carried out, then data on its testimony should also be mentioned in the document. If the insurance company paid an underestimated amount, then after a third-party examination, the sample pre-trial claim to the insurance company must necessarily contain the amount of the remaining difference.

It will finally become clear how to write a claim to an insurance company after reading the sample claims to the insurance company attached to this article. (you can download it here - the Insurance underestimated the amount and the Insurance does not pay at all).

There are 2 examples of contacting the insurance company - in case of a complete refusal and in case of underestimation of the amount. If the insurance company does not pay the money even after this, then it is necessary to resort to the last step - going to court. For example, in the case of compulsory motor liability insurance, this step may be preceded by an application to the RSA, but this structure does not consider complaints regarding CASCO policies (again due to the lack of a legislative framework).

Calculation periods in the case of CASCO insurance are not regulated by current legislation. But this period must be specified in the agreement when taking out the policy. As for the terms for consideration of the pre-trial claim, the applicant indicates them independently. But this must be a reasonable period of time - usually this period is similar to the period for calculating the amount of insurance compensation. In most cases, for large SCs it is approximately 14-20 days.

Going to court

A citizen can file a claim against an insurance company with a written response to the claim, or in the absence of any response at all from the insurer.

What threatens the insurance company?

All the same rules apply here as for compulsory motor liability insurance - i.e. You can ask the court to recover funds not only in the form of the required insurance compensation, but also in the form of moral damage, a possible fine (in accordance with the disposition of Article 13 of the Federal Law “On the Protection of Consumer Rights”) and penalties for late fulfillment of obligations.

That is, in the event of a positive decision regarding your case in court, the insurance company can pay:

- Insurance compensation;

- Compensation for moral damage;

- Fine;

- Penalty.

Which court should I go to?

Difficulties in this process may begin with the question, “which court should I go to against the insurance company?”

There is nothing complicated here:

- If the total amount of the claim against the insurance company under CASCO is less than 50 thousand rubles, then you must apply to the magistrate’s court and only at the location of the company;

- If the amount is more than the specified threshold, then the claim must be filed in the district court.

By the way, the vast majority of appeals are considered by the district court, because all requirements in total usually exceed 50 thousand rubles. We seem to have figured out which court to file against the insurance company, now let’s turn our attention to the claim itself.

Judicial practice in CASCO cases

It should be noted that CASCO cases do not reach the district court as often as, for example, in the case of compulsory motor liability insurance. This is explained by the fact that here everything, even the smallest features of the agreement, are reflected in the contract itself. Those. The key link here is not the judicial resolution of the issue itself, but the pre-trial stage - investigation of the event, technical examination, etc. It is these processes that should be given more attention.

Collection of insurance compensation

Judicial practice in cases of refusal/understatement of payments under CASCO is as follows. There are usually no difficulties with the first element (insurance compensation) of the total amount - an independent examination is carried out and the car owner already has data on the damage.

Recovery of moral damages

As for the remaining requirements, a different approach is needed here. Firstly, there is no formula for calculating moral damage today. Those. the applicant may indicate any amount that he considers commensurate with the inconvenience and distress caused to him. Of course, here you need to be extremely careful and indicate the amount correctly, otherwise the court may refuse to satisfy this requirement or to consider the claim as a whole.

Collection of penalties

The previously specified penalty is calculated in accordance with the provisions of the contract (usually such a clause is present), or in accordance with the disposition. 395 of the Civil Code of the Russian Federation - i.e. in the form of 1% of the amount per day.

The final result is indicated in the claim and the accrual of interest stops there. Filing a lawsuit against an insurance company is subject to state fees. The amount of the fee is calculated in accordance with the disposition of Article 333.19 of the Tax Code of the Russian Federation. Plus, this fee is not included in the number of so-designated legal expenses (for example, for lawyer’s services), which can then also be recovered from the insurance company.

A sample statement of claim to court against an insurance company (you can download it here - Claim against insurance company in court) must be accompanied by a receipt for payment of the specified fee.

Collection of a fine

Finally, a possible fine of 50% of the total amount can only be recovered if the applicant's claims are satisfied. Those. if our total amount of the claim (including penalties, moral damages, etc.) is, for example, 100 thousand rubles, then if the process has a positive outcome, a total of 150 thousand rubles will be recovered from the insurance company + our legal costs. A sample lawsuit against the insurance company is also attached to this material. If there is a refusal to pay under CASCO, you already know what to do in these cases.

We hope we helped you figure out what to do if your insurance company refuses or underestimates your CASCO payment. If you have any questions, write in the comments or use the feedback form.

Lawyer at the Legal Defense College. Specializes in the conduct of administrative and civil cases related to traffic violations, compensation for damage, disputes with insurance companies, appealing decisions and decisions of the traffic police, and consumer protection.

The insurance company does not pay for CASCO

» data-ulike-status=»1″ class=»wp_ulike_btn wp_ulike_put_image wp_likethis_2540″>

CASCO allows you to protect your interests in the event of an accident, car theft or others provided for in the insurance contract. The downside is that not all cases are covered, even if they are covered by the policy. What to do and how to receive payment if the insurance company does not pay for CASCO, but the reasons are legal? There are suitable solutions in the law.

Possible reasons for refusal to pay

To get out of any controversial situation, you must first understand the current situation. It is important to determine the reasons why failure occurs. These include:

- The policyholder has lost his copy of the contract

- The deadlines for contacting the insurer regarding an insured event were not met

- There is no resolution on the event from the traffic police

- The car does not have a maintenance or vehicle registration certificate

- Documents for the car, including keys, were inside the stolen vehicle

- The car had no alarm

- Damage is not covered by insurance

- The police report states that the owner of the car has no claims regarding the incident from any of the parties

The above list is indicative and may change depending on the current situation. In addition to specifying the reason for the refusal, some insurers may do this without specifying the reason and delay the consideration of the application. In any case, in the absence of “full CASCO” problems may arise.

Pre-trial settlement of the issue

If a claim arises against an insurer, the first step is to contact management. You should understand that there is a human factor, and if you cannot resolve an issue with a specific employee. Then you should write a complaint to his manager (for the branch or for the company). It should be understood that any company that wants to preserve its reputation, if the client is right, will meet him and resolve the issue peacefully.

To file a complaint or pre-trial claim, you can apply in the following ways:

- Come to the company office with a completed claim or fill out a form with an employee. You need 2 copies: one for yourself, the second for transfer. Each of them is marked with the date of receipt of the signature of the applicant and the person who accepted the appeal.

- Send by registered mail with notification.

- Write to the company email, but this requires an electronic signature.

Independent examination

The opinion of an independent expert in assessing the consequences of an incident allows us to assess the damage and the cause of its formation. If the car was stolen, then you should have the materials of the criminal case and file a targeted claim.

Claim to the insurance company

A claim is a type of complaint about certain actions in order to prove correctness. It should not be oral, but written. It is compiled in free form, but indicating all the issues that require resolution and the reasons that led to this. When contacting the insurer, it is important to indicate:

- at the top of the form the full name of the insurance company, location address, full name of the director

- applicant's passport details

- policy number

- the reason for the appeal, indicating the clauses of the contract that are not observed

- expected response time

- account details for transferring payment, if it is expected in the essence of the matter

Photocopies of documents should be attached to the application, including:

- road accident document

- appraiser's conclusion

- other evidence of what happened

Timeframe for consideration of a claim

The processing time for the policyholder's application in most cases is 2–3 weeks. You can set the restriction yourself in the document form. The response is a written decision to satisfy the claim or to refuse with justification of the reasons.

Complaint to the Central Bank of the Russian Federation

Having a negative written response to the filed complaint, you can contact the authorities that control the activities of insurers. There are many supervisory authorities, and the first on the necessary list is the Central Bank of the Russian Federation. Citizen complaints are also within its competence. If, as a result of the inspection, there is an order to satisfy the requirements of the policyholder, and it is ignored, then the insurer may be fined or even deprived of a license for this type of activity.

Methods of contacting the Central Bank of Russia:

- Via the official website. To do this, fill out an electronic application form and upload scanned documents.

- By mail

- By email, but with an electronic signature

The appeal, similar to the previous description, contains information about the applicant, the company against which there is a claim, and a detailed description of the essence of the issue. Review time is 30 days. If it is necessary to extend it, written notification must be received. If the answer is negative, then it is advisable to send the next appeal to the court.

Going to court

If supervisory organizations monitor compliance with the requirements of the law, then the court can help with questions about monetary compensation and compliance with contract clauses. To contact this authority you must do the following:

- Preparation. It includes:

- filing a pre-trial claim

- independent examination to clarify the cost of damage, which requires the mandatory presence of a representative of the insurer

- calculating the costs of working to prove your rights. If the case is won, the insurance company will have to compensate them.

- collecting all the evidence in the case

- Filing a claim in court in accordance with Part 2 of Art. 131 Code of Civil Procedure of the Russian Federation. The statement states:

- name of the court

- complete information on the passport of the applicant or his representative indicating the address of residence

- information about the defendant

- essence of the appeal

- claim price

- list of documents that are attached

- receipt for payment of duty.

- a copy of the application for the insurance company.

- copies of all documents related to the case. Originals must be brought to the hearing.

- petitions. The plaintiff has the right to request a hearing without his presence, including requesting evidence that is important to the case, but which he was unable to obtain.

What threatens the insurance company?

The car owner has the right to ask the court not only to recover funds spent on the fact of the accident, spent on resolving the issue, but also for moral compensation (Federal Law “On the Protection of Consumer Rights”) for penalties for unfulfilled obligations.

Thus, in the event of a positive court decision, the applicant can receive payments for:

- Insurance compensation

- Compensation for moral damage

- Fine

- Penalties

Which court should I go to?

The application should be made to the court that is located in the same area as the insurance company with which the dispute arose. Today you can do this:

- personally

- through a proxy

- by mail

- through the Internet

If you disagree with the decision after going to court, the plaintiff may contact:

- appeal procedure (until the decision comes into force)

- cassation after refusal in the above method

- supervisory court through the Supreme Court after refusal of cassation

Arbitrage practice

The processing time for an application under CASCO is approximately a month, which depends on the workload of a particular court. All evidence and video materials on the basis of which a decision is made play an important role.

Important! The insurance company has the right to appeal the court decision.

Collection of insurance compensation

To receive money in your hands, you must have a writ of execution. After this, you should perform one of the suggested actions:

- Contact the bailiffs at the location of the insurer.

- In accordance with the Federal Law “On Enforcement Proceedings,” contact the bank where the insurer has an account (you need to know about it, as well as that there is money in this account). Based on the writ of execution and the applicant’s details, money can be transferred 3 days after the application for payment. If there are no funds, then you need to look for other banks and accounts.

Recovery of moral damages

To obtain money for moral damages, the algorithm of actions is similar. The downside is that if the insurer has an account, payment under this item will be made in accordance with Art. 111 Federal Law “On Enforcement Proceedings”.

Collection of penalties

Payment of the penalty occurs in accordance with Art. 395 of the Civil Code of the Russian Federation. Recovery is similar to receiving basic compensation. According to this article, additional interest may be demanded from the debtor, the amount of which is determined by the Central Bank. According to the latest data, it was 9%. It is charged on the entire amount of the refund.

Collection of a fine

According to paragraph 6 of Art. 13 of the Federal Law “On the Protection of Consumer Rights”, if the insurance company refuses to pay for an insurance event in accordance with the CASCO agreement, it will be charged not only a penalty, but also a fine. It represents half of the amount that the court ordered the applicant to pay. In fact, accrual may occur for insurance compensation, moral damage, or compensation.

Features of different types of problems

As mentioned above, the car owner may face various reasons for refusal of payment or underestimation. Let's look at the most popular cases.

CASCO for theft

In the event of a car theft, the policyholder contacts his insurance company to receive compensation, but he may be offered another solution to the problem: enter into an agreement. Its meaning is to renounce the rights to the car in favor of the insurance company, and only the subsequent transfer of compensation. This action is indeed provided for by law (clause 5 of article 10 of the Federal Law “On the organization of insurance business in the Russian Federation”) and involves payment of 100% of the cost excluding depreciation of the vehicle or that indicated in the CASCO policy.

The insurance company underestimates the amount of payment

Almost all insurers try to underestimate payments for an insured event. Those people who do not want to challenge the decision or go to court, agree to what they give. Another category proves its rights. The general scheme of actions is described above, but you should start with an independent examination in the presence of the insurer. After this, an appeal for additional payment, and later (in case of refusal) an appeal to the court.

SK does not pay on time

The terms of payment under CASCO are not mentioned. This point must be specified in the policy and the rules of a particular company. If the specified requirements are not met, the deadline is not specified, you should start the “fight” with a complaint to management. The following diagram has a standard form.

The insurance company went bankrupt

An unexpected situation in which a motorist may find himself, in addition to an insured event, is the bankruptcy of the insurance company. In such a situation, there is virtually no one to get compensation from, but some tips may be useful:

You should file an application with the court hearing the bankruptcy case. It indicates a request to be included in the register of creditors, which is relevant before the start of bankruptcy proceedings or before the sale of property. It is impossible to say about the reliability of receiving a payment, but there is a chance of it.

If the other party is at fault for the incident, seek payment from their side, which is also required to have a compulsory motor liability insurance policy.

Important! You should not rely on the help of RSA; in case of bankruptcy, they will not help, unlike an auto liability policy.

How to avoid problems

The risk of negative actions on the part of the insurer cannot be eliminated, but it can be minimized. Please pay attention to the following points:

- The rating of the insurance company, the level of their payments and the cost of the policy. The average price of full CASCO insurance is 7–12%; if it is lower, it is better to contact another company.

- List of insured events for which compensation is provided. It's better if theft is taken into account.

- Availability of additional services (evacuation, arrival of a company representative).

- Fixed payment (can be variable or stable).

- Storage conditions. Not only an alarm system may be required, but also staying in a guarded parking lot at night.

- Providing cash payments or repairs at your own expense in a car service center (may not be certified).

- The presence in the contract of a requirement for mandatory testing for the content of alcohol and narcotic substances in the blood (traffic police officers do not always do this).

- Providing keys and documents for a car if it is stolen. This clause cannot be guaranteed, so it is best to avoid it in the contract.

Approach the issue of car insurance carefully, starting with the execution of the contract. If in doubt, do not enter into it. Find the company that will satisfy your requirements and offer optimal conditions. In this case, the likelihood of receiving the due payment under CASCO will be increased.

Video: Refusal of insurance payment from MTPL and CASCO. What's legal and what's not?

The insurance company does not pay for CASCO insurance - what to do?

As you know, OSAGO is compulsory car insurance in Russia, and CASCO is voluntary. And all car owners who have purchased a CASCO policy are confident that they are reliably insured against all problems. Therefore, the refusal of the insurance company to pay the seemingly due amount becomes a very unpleasant surprise. Let's figure out together what to do in such a situation.

Motor insurance legislation

There are a number of bills and regulations that apply in the field of voluntary CASCO car insurance:

- Article 943 of the Civil Code, which defines the rules of insurance.

- Article 3 of Law No. 4015-1, dedicated to the same topic.

- Articles 963 and 964 of the Russian Civil Code, which indicate in which cases the insurer may refuse to pay for car insurance.

- Review of the judicial practice of the Russian Supreme Court No. 1, which was approved by its presidium in 2017.

In general, the field of auto insurance in our country is quite developed and regulated; it is these standards that should guide both insurance companies and car owners.

How to check the correctness of a refusal to pay under CASCO

Let's start with the fact that the insurance company is obliged to issue you a written refusal to pay the amount of compensation under the CASCO policy. Without this document you will not be able to move forward! Representatives of the insurer are required to indicate which clauses, articles, and norms of legislation they relied on when deciding to refuse to pay you. This is also important; the refusal must be reasoned.

Having received such a written refusal from the insurance company, you simply must carefully study Articles 963 and 964 of the Civil Code. Let us remind you that they indicate the reasons why the insurance company has every right not to pay compensation to its client.

Didn't find any matches? You have every reason to file a claim with the insurer, which we will discuss below.

Filing a claim against an insurance company

There is no clear form for a claim against the insurance company, but it is drawn up according to generally accepted rules for maintaining business documentation, of course, without errors, insults, or deviations from the topic.

The claim to the insurance company must include:

- Demand to pay insurance compensation. Actually, this is why you are writing a complaint.

- A list of all the circumstances that give you the right to demand compensation for the insured amount.

- An indication of the legal provisions that allow you to claim insurance compensation. Don’t be lazy, study the laws and the articles of the Civil Code indicated by us.

- Indicate the time period given for consideration of the claim. Usually it is 10 days.

- Be sure to tell the insurer what actions you intend to take if your claim is unsuccessful. For example, write that you will go to court.

- The document must contain your full name, insurance policy number, insurer details and other contact information.

- The date and signature are the same without them.

Do not forget that the claim must be written in two copies. If you hand over a document to a representative of the insurance company in person, then on your document he must put the date, time, incoming number, his position and signature, which will indicate receipt of the claim.

Let us note that filing a claim often helps resolve a case of non-payment of compensation under a CASCO policy without going to court, peacefully. However, if you decide so, you don’t have to send a claim at all, but go straight to court.

Taking legal action against an insurance company

So, you filed a claim, more than 10 days have passed, and the insurance company still does not intend to pay under the CASCO agreement. Well, all that remains is to go to court.

First, you need to draw up a statement of claim, indicating the date and time of the insured event, all the actions you took, and attach the insurance company’s refusal. Everything needs to be presented dryly, in a business style, but without missing out on details, in chronological order. Justify your requirements based on the law.

Attach to the claim all documents related to the case: a copy of the insurance contract, the insurer's refusal, papers issued by the traffic police, your claim, the insurer's response to it, and so on.

Please note that disputes under property insurance contracts are considered in accordance with the provisions governing the protection of consumer rights. Therefore, you, as a policyholder, have a number of advantages. For example, you can file a claim in court at your place of residence, not pay the state duty, and also receive a fine and penalties in the amount of 50% of the amount that will be collected from the insurer.

Let's imagine a situation where the insurance company, in general, did not refuse to pay you, but significantly underestimated its amount. You need to take the following measures:

- Organize an independent assessment examination.

- Demand that the amount of insurance compensation be reviewed based on the assessment examination.

- If the insurance company still refuses to increase the payment amount, go to court with a claim.

Another possible situation is that the insurer delays payment and does not give you funds on time. In this case you can:

- Submit a claim to the insurance company, indicating that the payment deadline has already passed. In this case, you must rely on the insurance rules regulated by law.

- If the claim remains unanswered or is negative, go to court again with a statement of claim.

Let us note that in the vast majority of cases, the insurer’s refusal to pay compensation for car theft, if this is implied by the CASCO policy, is considered unlawful. So you have every chance to receive the payments due to you.

Conclusion

You have the right to demand that the insurance company pay compensation under the CASCO agreement if an insured event occurs. Moreover, in full and on time. Otherwise, we advise you to start with a claim and then go to court. We will not tire of repeating that you must protect your rights, and our articles will help you with this.