The procedure for compensation for damage in case of an accident under compulsory motor liability insurance

How to recover all damage from an accident under compulsory motor liability insurance

Have you been in an accident and want fair compensation from your insurance company? Our organization is ready to help you solve this problem! Before taking any action, read the plan that our specialists have developed; it will help you get a general idea of what needs to be done to independently assess the damage from an accident under compulsory motor liability insurance. By following this plan, you can easily overcome all the difficulties on the way to solving the problem.

The procedure for compensation for damage from road accidents within the framework of compulsory motor liability insurance

In this article, the commonly used concepts of “car damage assessment”, “examination of the cost of car repairs”, “independent auto examination”, etc. imply the determination of the market value of spare parts, materials and work to bring the car to a pre-accident state .

The reimbursement procedure is developed for the most general situation:

- the culprit of the accident can be clearly identified;

- Only vehicles were damaged in the accident;

- The liability of all participants in the accident is insured (there is a compulsory motor liability insurance policy).

Preliminary steps before filing an application for compulsory motor liability insurance

1. First of all, you must be sure that you have received from the traffic police all the necessary documents about the accident that occurred:

- certificate of accident (with a list of all visible damage);

- copies of the protocol on an administrative offense, a resolution on a case of an administrative offense or a ruling on the refusal to initiate a case on an administrative offense, if they were issued to you by the traffic police.

2. Check that you have an insurance notice about an accident, which should have been filled out at the scene of the accident.

3. Make sure you have information about the culprit’s compulsory motor liability insurance policy:

- policy number and date of issue;

- the name of the insurance company that issued the policy;

- phone number of the insurance company representative office.

4. Within 5 days after the accident, notify your insurance company about the occurrence of the insured event. To do this you need:

- call the insurance company by phone and provide the information you have about the accident and the culprit, and the specialist who received your call must tell you the case number for settling the damage caused to you;

- Try to fax the accident notice to the insurance company, ideally send a copy of the notice with return receipt requested by mail.

Transfer of documents to the insurance company

5. Prepare a package of documents to submit to the insurance company. You must provide:

- application for insurance compensation;

- notification of an accident;

- certificate of accident;

- copies of the protocol on an administrative offense, a resolution on a case of an administrative offense or a ruling on the refusal to initiate a case on an administrative offense, if they were issued to you by the traffic police;

- a copy of the documents for the vehicle (PTS, registration certificate, power of attorney to drive the car, compulsory motor liability insurance policy);

- a copy of your passport;

- copies of telegrams calling for inspection;

- checks for postage;

- damage assessment report;

- agreement, acceptance certificate and receipt for payment for assessment services.

7. After 20 days from the date the insurance company accepted the application for insurance payment, submit a written application requesting a copy of the insured event report, which will indicate the final amount of the insurance payment. If you are not satisfied with the payment, plan to organize an independent examination after the accident.

Organization of an independent examination of damage from road accidents

8. Select an independent expert organization that will assess the damage received as a result of the accident. If you are ready to entrust the examination to us, then:

- contact us by phone +7 (495) 74-83-007;

- Find out which assessment-related services we can perform for you.

- choose how and when it is more convenient for you to sign an agreement for the provision of selected services;

- Find out what documents are needed for the examination.

7. Agree with an expert technician on the date and location of the inspection of the damaged vehicle based on the following requirements:

- An insurance company expert must be present at the additional inspection if there are hidden damages;

- the culprit in the accident may be notified of the planned inspection at least 3 full working days in advance (6 working days if the place of inspection and the place of residence of the culprit are in different cities).

8. Wait until the expert technician makes the calculation and agrees with you on the results obtained. Today, expert organizations are required to use price guides lobbied by insurance companies in their calculations. In the context of the rapid devolution of the ruble, the gap between reality and “market value” according to reference books instantly became very significant. A way out of this situation may be a ruling of the Constitutional Court, which explains that the victim has the opportunity to recover the missing part from the culprit of the accident. Therefore, it is highly desirable that the expert report calculates two values:

- Cost of repairs according to a unified methodology and RSA reference books

- Market cost of repairs based on average prices for spare parts, labor and materials.

9. Be sure to receive your copy of the acceptance certificate for services performed, as well as a document confirming payment (check or receipt for payment through a bank).

Next steps

10. Further steps to fully compensate for losses caused as a result of an accident:

- preparing a pre-trial claim with attachments and sending it to the culprit;

- if the culprit does not compensate for the remaining damage voluntarily, it is necessary to prepare documents to submit to the court.

The only way to deal with the discrepancy between the insurance payment and the real market cost of repairs is to go to court. If you are denied payment or underpaid, do an independent assessment of the damage and go to court.

You can find out more about possible options for solving a problem that has arisen with an insurance payment on the website of our partners LLC Legal Company Legard - legal assistance or call +7 (499) 4 00 3 00 2 for free legal advice.

Documents required for the examination of car damage from an accident under compulsory motor liability insurance

To carry out an examination of the damage to the car, we need the following documents (or copies thereof):

- passport;

- power of attorney to drive a car (if you drive a car under a power of attorney);

- technical equipment passport for the car;

- vehicle registration certificate;

- a certificate from the traffic police, which lists the participants in the accident and the damage caused as a result of the accident;

How to compensate for damage in case of an accident under compulsory motor liability insurance?

The MTPL policy provides an opportunity to avoid significant financial losses for the culprit of the accident, and for the injured party to reimburse part of their expenses. This rule applies only if an accident causes property damage or harm to health (life). Moral damage and moral suffering are not included in insurance payments.

Often, the amount of compensation can cover only part of the expenses incurred during the accident. Anything that goes beyond the insurance limit is subject to recovery from the person whose fault the collision occurred.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

It's fast and free!

Legal basis

The procedure for reimbursement of damage from a road accident is reflected in the Federal Law “On Compulsory Motor Liability Insurance”.

Based on this law, all car owners are required to insure their civil liability risks. If an incident occurs, the insurer of the driver who caused the accident will compensate for losses under the contract.

Is compensation for damages due to an accident under compulsory motor liability insurance?

Every driver needs to remember that a compulsory insurance policy covers damage from an accident, but all other risks do not. The concept of “traffic accident” includes any actions between cars that result in damage to vehicles or people, even those sustained at a parking lot.

The object of an accident can be any vehicle of all categories. Based on the compulsory insurance policy, compensation for losses is due only to the injured party.

Is the culprit entitled to compensation for damages in case of an accident under compulsory motor liability insurance?

A driver found guilty of a traffic accident will not be compensated for damages under the MTPL policy.

Direct Damage Rules (DCR)

The PPV implies that the car owner injured as a result of a collision has the right to apply for compensation for damage to his company, with which he has signed an MTPL agreement.

Situations in which the use of PES is possible:

- in the event of an accident, no damage was caused to health or life;

- participants in the accident - 2 cars, the owners of which have valid insurance;

- the culprit's IC license is valid;

- mutual guilt of the parties has not been established.

To receive the amount according to the PES rule, you must provide the entire package of documents and receive a referral for an examination; if the decision is satisfactory, the funds are transferred to the current account specified in the application.

The procedure for compensation for damage under compulsory motor liability insurance

- if a road incident occurs, you must report the incident to the insurance company in compliance with the deadlines specified in the contract;

- together with documents about the accident, provide a statement of the occurrence of an insured event (CA);

- on the basis of papers drawn up by representatives of the traffic police or the drivers themselves at the scene of the accident, the insurance company makes a decision on the fact of the occurrence of an insured event or its absence; and the provision of payments or their refusal;

- upon recognition of the CC, an independent examination is appointed to assess the damage, based on the results of which the amount to be compensated is determined, and within the established time frame the funds are transferred to the applicant.

Insurance Company Notification

The policyholder is obliged to notify the company in the manner and within the time frame specified in the agreement:

- Notification may be sent by any means of communication. Written information is considered transmitted on time, regardless of the fact of its receipt by the insurer, on the basis of Art. 194 Civil Code of Russia.

- Not only the participants in the accident, but also the beneficiary under the insurance contract, if he intends to receive compensation, are required to immediately notify about the accident.

- The statutory obligation of the policyholder to immediately notify the company of the occurrence of an insured event is essential because:

- the insurance company representative gets the opportunity to immediately inspect the subject of insurance, record the extent of its damage, and prevent the possibility of additional losses;

- upon receipt of notification in a timely manner, the insurer can independently take measures to reduce losses or save property, give instructions to the policyholder, and organize a search for the loss;

- timely information is required for the insurance company when building relationships with the reinsurance company.

Failure to comply with the obligation to notify of an accident does not serve as the only reason for refusal to pay insurance. If notification of an incident is not received on time, the insurer has the right (and not the obligation) not to compensate for losses.

Documents to be submitted to the Investigative Committee

The payment application must be accompanied by:

- certificate of traffic incident;

- determination to refuse to initiate an administrative case;

- passport;

- notification of an incident;

- protocol and resolution on violation of Traffic Rules;

- vehicle registration certificate, PTS;

- if, in addition to transport, other property is damaged, then documents confirming ownership of them;

- rental or leasing agreement (if the car belongs to another person);

- checks, receipts for payment for tow truck services for transporting the car to the place of repair or parking;

- an expert’s conclusion and a receipt for payment for his services (if the examination was carried out at the initiative of the victim);

- receipts for payment for car parking services from the moment of the accident until the day of the examination;

- bank account number, name and bank details;

- If the interests of a citizen are represented in the insurance company by a representative, then a notarized power of attorney is required.

How does SK work?

As the insurer receives all the documents and checks them and ensures they are filled out correctly, he has the right to order an independent examination of the car if any discrepancies are found in the nature or extent of damage to the car.

So, within 30 working days, counting from the date of receipt of the application, the insurance company is obliged to:

- inspect the damaged vehicle - no later than 5 days from the date of receipt of the application;

- if necessary, conduct an examination in an independent institution within 5 days after inspecting the transport;

- fill out the SS certificate or issue a vehicle referral for repairs;

- pay insurance or issue a referral for repairs;

- if the case is recognized as not being covered by insurance, then send a notice indicating the reasons for the refusal.

How much does an insurance company pay under compulsory motor liability insurance?

To establish specific amounts of compensation, an inspection of the damaged vehicle is carried out, and, if necessary, an examination:

- If the car is partially damaged, the compensation will be the amount necessary to restore the car to the condition it was in before the accident.

- When the cost of repairing damaged property equals or even exceeds the price of the property itself, then we are talking about its complete loss. The payment will be the amount of the actual value of the car on the date of the accident.

- If traffic police officers were not called to the scene of the accident (if there is no damage to life or health), then the victim can count on a payment amount of no more than 25,000 rubles.

- If repairs were made or the car was scrapped before inspection by the insurer, then he has the right to refuse payment.

Payment terms and limits

The insurance company is obliged to pay compensation within 30 days from the date of filing the application for insurance (more details about the deadlines). The maximum possible payment amounts vary depending on the date of purchase of the policy.

If the person at fault for the accident purchased insurance before October 1, 2014:

- maximum 120,000 rubles if the car of one victim is damaged;

- maximum 160,000 rubles if damage is caused to several cars.

If the culprit of an accident purchased a policy after October 1, 2014, each victim has the right to a payment in the amount of no more than 400,000 rubles.

If the contract was concluded after 04/01/15, then for damage to the vehicle each of the victims is entitled to an amount of no more than 400,000 rubles. for harm caused to life or health - up to 500,000 rubles.

Reasons for refusal of insurance payment from MTPL

Reasons for refusal to pay insurance stated in the contract (legally):

- mutual guilt of the drivers was established;

- The accident occurred due to the transportation of goods;

- the victim demands payment of moral damages or lost profits;

- damage was caused to a cultural monument or antique;

- the car involved in the accident is not specified in the policy;

- the accident occurred during a training ride, while participating in competitions;

- the fact of fraud on the part of the participants in the accident was established

- bankruptcy of the company (you should apply for compensation to the Russian Union of Auto Insurers (RUA));

- an incomplete package of documents was submitted upon application (the case is subject to renewal after submission of the missing papers);

- the policy turned out to be fake (in this case it is necessary to contact the police and RSA);

- the application occurred after the expiration of the terms specified in the contract (in this case, you will not be able to count on insurance);

Illegal refusals to make payments, occurring due to the insurer’s bad faith, when the client is accused of violating the terms of the contract or the law:

- intentional damage to property;

- invalidity of the contract at the time of the accident;

- the diagnostic card has expired;

- or a link to the fact that the culprit of the accident:

- was in a state of alcoholic or other intoxication;

- he did not have the right to drive a vehicle, he was not included in the MTPL policy;

- fled the scene of the accident.

How to reduce the likelihood of an insurance claim being denied

Let's look at a few recommendations that you can follow to significantly reduce the risk of your insurance claim being denied:

- It is necessary to comply with all insurance rules and carefully read the contract and the documentation attached to it when signing.

- Notify the Investigative Committee in a timely manner about the occurrence of an accident.

- Pay attention to the correctness of filling out documents about the accident by traffic police officers, check the correctness of contact information, addresses, full names, registration numbers and names of the car.

- Prepare in advance copies of documents that will be sent to the Investigative Committee, ask the company representative to mark the acceptance of the originals, so that if they are lost, you can present copies.

- If a refusal to pay does occur, ask the insurer for a written argument.

The procedure for a person to take in order to be guaranteed to receive payments from the insurance company without filing a lawsuit

The rules of compulsory motor liability insurance detail the entire principle of action of a person who wants to receive guaranteed compensation for damage:

- The victim during the accident, at a convenient opportunity, must notify the culprit’s investigative committee about the incident, with a brief description of the situation and clear answers to the questions asked.

- Traffic police officers who arrive at the scene of the collision will draw up a certificate of the accident, and drivers will issue a notice to insurers. If the parties decide that there is no need to call the traffic police, then they need to fill out a general notification with a detailed description of the circumstances, time, location of the collision, indicating the culprit.

- Before the expiration of 15 days from the date of recording the fact of the accident, the victim must come to the insurance company, write an application for insurance in the maximum amount and provide the entire package of documents.

Based on the information presented in this article, brief conclusions can be drawn:

- According to the MTPL policy, compensation for losses is due only to the injured party.

- The law provides for direct damages to the innocent victim in his company.

- It is necessary to notify the Investigative Committee of the SS attack as soon as possible.

- Be careful when filling out documents at the scene of an accident; submit documents to the Investigative Committee only under the signature of his representative or by filling out the register of submitted papers.

- The entire procedure for the return of losses is outlined in the law “On Compulsory Motor Liability Insurance”.

- You should not waste your time if the insurance company has legal grounds for refusing to pay insurance.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Compensation for damage in case of an accident under OSAGO/CASCO

Where should you start when recovering damages after an accident? Of course, by contacting an insurance company, where you can receive not only a cash payment that can partially or fully cover the costs of restoring the vehicle, but also competent advice from a specialist on preparing the necessary documents to receive insurance payments. Each of us thinks so, but in reality it turns out completely differently - insurers are reluctant to “part” with the funds owed to policyholders by law, who will have to go through more than one instance before achieving justice.

Compensation for damage in case of an accident under compulsory motor liability insurance

OSAGO is a type of compulsory insurance, without which no driver operating his vehicle on the territory of the Russian Federation can drive a car. OSAGO is a guarantor of compensation for damage in the event of an accident to the injured party, however, due to the presence of various nuances in insurance legislation, the need for litigation is increasingly arising. The algorithm of actions for compensation for damage after an accident under compulsory motor liability insurance is extremely simple - you need to notify the insurance company about the occurrence of an insured event, then collect the necessary documents and submit them along with the application and the car to the insurer for making a decision. Let's look at each stage in more detail.

Important! Since 2014, in the event of an insured event, the victim has the right to apply for an insurance payment from his insurance company if: only two cars were involved in the accident, both drivers are insured under compulsory motor liability insurance, and there were no injuries in the accident. If at least one of these conditions is violated, the victim must contact the culprit’s insurance company.

Notification to the insurance company. According to the law on compulsory motor insurance and the Rules of compulsory motor liability insurance, the victim after an accident must notify the insurance company about the incident, to which he plans to apply for insurance payment within 5 working days from the date of the accident. However, even if you are late with the notification, the law does not stipulate anywhere that the insurer has the right to refuse you insurance payment on this basis. However, compliance with these deadlines will allow solving the problem of paying damages in a shorter period of time. Documents required to be submitted to the insurance company:

- application for insurance compensation (each insurance company has its own sample application)

- notification of an accident to the insurance company;

- a copy of the protocol, resolution or determination issued by the traffic police;

- a copy of the documents for the car - PTS (registration certificate);

- a copy of the victim’s compulsory motor liability insurance policy;

- a copy of the passport of the person applying for insurance payment;

- damage assessment report from an independent expert (if available);

- copies of the agreement, the transfer acceptance certificate and receipts for payment for the services of the appraisal company (if available).

How does an insurance company operate? After accepting all documents and inspecting the car, the insurance company, within 20 working days (clause 21 of article 12 of the Law on Compulsory Motor Liability Insurance) must consider the victim’s application for compensation for damage after an accident and make an insurance payment or issue a referral for restoration repairs of the car or send him a motivated refusal.

Important! The practice of compensation for damage in case of an accident from an insurance company is such that insurers significantly reduce the amount of damage when assessing it, therefore it is recommended to resort to the services of an independent appraiser either before the insurance inspection or after, if there are doubts about the correctness of the calculations. We remind you that all costs of the victim can be recovered from the insurance company in the amount of the established limit or from the culprit of the accident.

How much does the insurance company pay under compulsory motor liability insurance? According to Article 7 of the Federal Law “On compulsory insurance of civil liability of vehicle owners,” the insurance company, upon the occurrence of an insured event, compensates for:

- no more than 400 thousand rubles to one victim;

- no more than 500 thousand rubles in terms of compensation for damage caused to the health of each victim.

If the damage caused to the vehicle exceeds the insurance company's limit, then payment of the difference must be demanded from the culprit of the accident in pre-trial or judicial proceedings.

Reasons for refusal of insurance payment from MTPL. The grounds for refusal of insurance compensation are always specified in the insurance rules of the individual company, therefore, you must familiarize yourself with them before signing the insurance contract. There is also an unspoken list of refusals that are especially common today:

- failure to provide a complete set of documents for registration of an insured event;

- documents are filled out incorrectly;

- intentional actions of the insured that led to the occurrence of the insured event;

- driving the injured vehicle while under the influence of alcohol or drugs;

- driving the injured car without a driver's license or the person who is the driver is not included in the insurance contract;

- operation of a vehicle that has not passed technical inspection;

- the damage occurred as a result of a manufacturing defect, etc.

Compensation for damage in case of an accident under CASCO

Under a CASCO policy, absolutely any car can be insured, including a vehicle that is not registered with the traffic police. A voluntary insurance policy protects against theft, fire, natural disasters, falling of various objects, illegal actions of third parties and, of course, against damage received as a result of a traffic accident. Both the victim and the culprit of the accident can receive an insurance payment under a CASCO policy. The main difference between CASCO insurance and MTPL is the indemnity limit, which in the latter case is strictly limited to 400,000 rubles. Compensation under CASCO is equal to the insured value of the car.

Options for indemnifying the car owner's insurance risks under a CASCO policy:

- Full or partial restoration of the car;

- Payment of compensation in cash equivalent;

- Compensation in monetary terms for the cost of repairs performed by the car owner. The price includes the services of technical stations and the cost of purchasing spare parts.

The type of insurance compensation is chosen by the policyholder when concluding an insurance contract.

The procedure for compensation for damage under CASCO. The participant in an accident must contact the insurance company for compensation for damages under CASCO as soon as possible from the moment of the accident, preferably no later than 15 working days. The insurance company must accept an application for an insured event from its client, to which the necessary documents must be attached (identical with insurance payments from compulsory motor liability insurance). The law establishes a 20-day period for the company to make a decision on insurance payment, after which the policyholder must be paid or notified of a reasoned refusal.

Reasons for refusal of CASCO insurance payment

- insurance payment under CASCO is not provided when the damage was caused not to the vehicle, but directly to the driver or passenger; here, compensation for damage can only be claimed under OSAGO;

- if the insurance company believes that the car owner intentionally caused damage to his car;

- if the insured vehicle was driven by a person who does not have a driver’s license;

- if the driver was under the influence of alcohol or drugs;

- if the vehicle was used for purposes not mentioned in the insurance contract - for example, in auto racing.

How to reduce the likelihood of receiving a refusal of insurance payment under OSAGO and CASCO

Insurance payment under MTPL or CASCO can only be made in strict accordance with the requirements of the law, therefore, in order to avoid refusal, you should be extremely careful in your actions:

- do not forget to promptly warn the insurer about a traffic accident;

- carefully monitor the completion of all papers, especially at the scene of an accident (any errors in the protocol may result in a refusal to pay or significantly reduce its amount);

- make copies of all documents, especially originals, that must be given to the insurer;

- require the necessary mark to indicate acceptance of the notification of an accident and documents for insurance payment;

- if the insurance company refuses to pay, demand written reasons so that you can subsequently turn to the judicial authorities to resolve the dispute on the merits.

Instructions for compensation for damage in case of an accident from an insurance company under an MTPL agreement

For MTPL policies concluded on April 28, 2017, new rules for compensation for damage after an accident under MTPL contracts came into effect. In our article we will provide step-by-step instructions for car owners who have been involved in an accident and want to receive monetary compensation for the restoration of the vehicle or damage to health or moral harm from the insurance company according to the new rules.

When is damage subject to compensation and what are the amounts of payments under compulsory motor liability insurance policies?

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to follow any of the suggested options:

- Request a consultation via the form.

- Use the online chat in the lower corner of the screen.

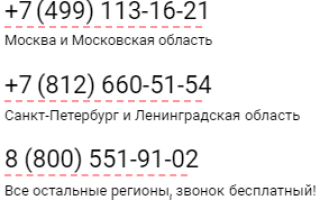

- Call:

So, a citizen can demand compensation under compulsory motor liability insurance in the following cases:

- property was damaged as a result of a traffic accident ;

- As a result of an accident, there are victims, i.e. harm caused to health ;

- the policyholder can also apply for compensation of lost earnings ;

- funeral expenses;

- In addition, you can apply for compensation for expenses caused by the loss of a breadwinner .

The maximum compensation (Article 7 of the MTPL Law) that can be received under MTPL, depending on the above cases, is contained in the following table:

Remember that in case of any accident, the damage for which does not exceed 50 thousand rubles. you can draw up a “Europrotocol” (without traffic police officers); read more about what it is and how to fill it out in our article.

New rules in the law on compulsory motor liability insurance in 2017

Since 2017, the legislator has limited the right of citizens to receive monetary compensation for insured events; now they can only be received in the following cases:

- in case of complete loss of a vehicle

- if the limit (400 thousand rubles) under compulsory motor liability insurance was exceeded;

- if in an accident the victim was injured or died;

- if the victim is disabled;

- if the insurer is not able to repair the car at a service station that meets the requirements of the law.

In all other cases, the victim will be compensated for damage in kind, i.e. The car will be repaired at a service station.

Step-by-step instructions for compensation for damage in the event of an insured event under OSAGO

To receive the monetary compensation (reimbursement) required by law, you must follow the step-by-step instructions written below.

Step #1. We notify the insurance company about the occurrence of an insured event. .

It is important to understand that if the victim wishes to claim the right to benefit from insurance compensation, he must notify the insurance company (IC) about the insured event within the prescribed period ( usually 15 days from the date of the accident, more precisely written in the rules of your insurance company) (requirements of Federal Law No. 40, clause 3, art. 11).

Also, the participant in the accident (driver) needs to notify other participants in the accident of his intention to file for damages, provide data from the compulsory motor liability insurance policy (its series and number, name, address and telephone number of the insurer).

- If, as a result of an accident, damage was caused exclusively to property (without injuries), or the accident occurred involving two vehicles (including trailers), the owners of which have a valid MTPL policy. Then you need to contact your insurance company for compensation for damage caused to property .

- In all other cases, claims for compensation for damage caused to the property of the victim must be addressed to the insurance company of the person responsible for the accident .

Step #2. Necessary documents to be provided to the insurer .

The list of required documents is quite extensive, there is a main list that each victim will need to collect, and there is an additional list, let's look at them in more detail.

The main list of documents is as follows:

- application for insurance compensation;

- a copy of the passport certified by a notary, or the original passport provided to the insurer and, after taking the copy, certified by their employee on the spot;

- a notarized power of attorney from the representative of the victim (if you are not the one handling the compensation);

- details of the victim’s personal account if you plan to receive monetary compensation by non-cash method;

- if the victim has not reached the age of 18, then permission from the guardianship and trusteeship authorities is required;

- certificate of accident (you can read about it in our separate article);

- notification of an accident.

An additional list of documents, depending on the case, is given below.

Causing damage to the victim's property:

- a document confirming ownership of the vehicle (usually a title);

- expert assessment of a specialist (examination conclusion), and documents confirming its payment (if an independent expert was hired);

- a receipt for the cost of towing the vehicle (if you want to receive compensation for this);

Documents confirming the costs of storing the car (counted from the date of the accident to the date of inspection of the car by the insurer or an independent expert).

Compensation for lost earnings due to injury to the victim’s health:

- documents from medical institutions proving injury or mutilation (for example, a certificate of a period of incapacity for work);

- conclusion of a forensic medical expert on the degree of loss of general or professional ability to work (if any);

- if the medical examination was carried out at the scene of the accident, then a corresponding certificate from the ambulance team is needed;

- a document confirming official income, for example, a 2-NDFL certificate or a tax return, is required only in case of compensation for the lost income of the victim.

Reimbursement of treatment costs and additional expenses:

- You need to request an extract from your medical history from the organization that treated you;

- receipts, checks and other documents proving that you paid for the services of a medical institution;

- receipts for purchased medications;

- doctors’ conclusion that you need additional nutrition, a nurse, installation of prostheses, treatment in a sanatorium, etc. (necessary for reimbursement of additional expenses);

- and other documents confirming your expenses, for example, for a wheelchair, a receipt or certificate from a sanatorium, etc.

Compensation for loss of a breadwinner:

- a statement containing the details of all family members who were dependent or had such a right;

- a copy of the death certificate;

- birth certificate of children, if at the date of the accident, the deceased had dependent children;

- if there are disabled children in the family, then an appropriate certificate is needed;

- a certificate from a university, lyceum and other educational institutions that a family member dependent on the deceased studied at one of them;

- certificate of need for outside care;

Reimbursement of funeral expenses:

- a copy of the death certificate;

- documents confirming funeral expenses incurred.

- the amount to be reimbursed for funeral expenses will not exceed 25,000 rubles.

Step #3. Provide documents to the insurance company .

No later than 5 working days after the traffic accident, you must hand over all the papers to a representative of the insurance company or during a personal visit to the insurer. The delivery methods are as follows:

- sending a registered letter with notification by Russian Post;

- during a personal visit, it is important to ask the insurance employee to make an inventory of the accepted documents and put his signature, seal and current date.

Step #4. Examination of a damaged car .

If you, as an injured person, want to receive compensation for damage caused to your car as a result of an accident, then it is your responsibility to submit your car to the insurance company for inspection within five working days (after filing the application). The insurer, in turn, must assess the damage caused within 5 days on its own or with the involvement of an independent expert.

If the vehicle is not running, then the insurance company must be informed of the vehicle's location address.

If the results of the assessment are satisfactory to both parties, they agree with the results and the amount of damage assessed by the insurance expert, then additional checks are not necessary; if not, then an independent expert is involved.

Step #5. Wait for the insurance compensation to be paid .

The insurance company must issue a direction for repair work, pay monetary compensation or send a reasoned refusal to the injured party within 20 days (not taking into account weekends and holidays) from the date of receipt of the necessary list of documents from the victim, if payment is made in kind form, then the vehicle will be repaired at a service station from the list provided by the insurer to the injured party - within a month.

When an insurer can refuse insurance payment under an MTPL policy

There are many reasons why an insurance company may refuse to pay, here are the most common ones:

- an incomplete list of required documents was provided;

- the documents provided show signs of falsification;

- there were gross errors in the documents;

- The accident occurred as a result of fraudulent actions of the insured;

- there is a conclusion that the victim was under the influence of alcohol or drugs;

- the victim did not have a driver’s license or it had expired, or he was not included in the MTPL insurance policy;

- the vehicle has not undergone a proper technical inspection;

- the damage occurred as a result of a manufacturing defect, etc.

What to do if the insurance company does not pay

Car owners involved in an accident very often find themselves in a situation where, having claimed their right to an insurance payment, it does not meet their expectations, or they are denied everything. If this happens, then they need to:

- Conduct an independent examination of the damaged vehicle and collect evidence of harm caused to life or health.

- Draw up and deliver a claim in person or by sending a letter with notification to the insurer (here is an article on how to draw it up).

- Complain about the actions of the insurance company to the Russian Union of Insurers (RUA).

- Submit a complaint against the insurer to the Insurance Market Department of the Bank of Russia.

- Prepare a statement of claim and submit it to the court.

How does compensation for damages occur in case of an accident under the MTPL policy?

A compulsory car insurance policy is an indispensable companion for any road user. In the event of a transport accident, it is he who guarantees the injured party compensation for damages under compulsory motor liability insurance.

But despite the fact that the civil liability protection system has been in place in Russia for a long time, not all drivers know how to receive compensation from the insurer in the event of an accident.

How is compensation for damages to victims under compulsory motor liability insurance now carried out?

Legislation in the field of civil liability insurance is regularly improved. Often, a new calendar year brings with it changes that all car enthusiasts should be aware of. 2017 was no exception. Law No. 49-FZ of March 28, 2017, which came into force in April, changed the procedure by which insurance compensation was previously collected under compulsory motor liability insurance contracts.

Currently, the insurer no longer offers the injured party to receive compensation in cash. A car damaged in an accident is sent for repair to a service center accredited by the insurance company. In fairness, it is worth noting that a motorist has the right to independently choose a service station to repair his car, but before transferring the car into the hands of specialists, he needs to coordinate this service with his insurer.

The new insurance rules apply only to those contracts whose conclusion date preceded the entry into force of the law. Their introduction was caused by the need to prevent possible cases of falsification of accident data by individuals or insurance companies in order to obtain monetary compensation.

But, like any rule, this legislative norm provides for a number of exceptions:

- the victim suffered moderate or severe injury or died as a result of the accident;

- the car was so severely damaged that it cannot be restored;

- the cost of repair work exceeds the amount of compensation limited by law, and the owner refuses to make additional payment from his own funds;

- the insurance company and the injured party have entered into a corresponding written agreement;

- In the event of a collision, a disabled person of group 1 or 2 was harmed.

In these cases, recovery under compulsory motor liability insurance will be made in cash.

Financial compensation will be calculated taking into account the wear and tear of the car at the time of the collision, and the in-kind form of compensation does not take into account the wear and tear of the car.

Amount of compensation for an accident

In 2014, the limits of insurance payments approved by the law “On Compulsory Motor Liability Insurance” were revised upward, and now they amount to quite impressive amounts. Considering that not only a car, but also a person can suffer in a road incident, the types of payments are divided into compensation:

- property damage;

- harm to health and life;

- loss of earnings;

- burials;

- loss of a breadwinner.

The easiest way is to compensate for material damage incurred by a car. Its owner can count on receiving 400 thousand rubles from the insurer. Of course, this is the maximum amount. The actual amount of compensation to be paid to the driver whose car was damaged as a result of the actions of the guilty party is determined based on expert data. The calculation will take into account:

- machine wear;

- the number and nature of injuries received;

- market value of the car.

If the insurer determines that the damage caused to the car exceeds the legal limit of 400 thousand rubles, the cost of the difference in the cost of repairs will have to be borne by the person responsible for the accident.

Completely different amounts are paid if, as a result of the accident, damage was caused not to property, but to the life and health of the victims. The law provides for payment in such situations:

- 500 thousand rubles for causing harm to health;

- 475 thousand to close relatives in the event of the death of the victim;

- 25 thousand additional for close relatives for funerals;

- 50 thousand to distant relatives for the burial of the deceased.

In addition, practice shows that insurers pay compensation taking into account the gradation of health damage:

- 500 thousand upon receipt of 1st degree disability;

- 350 thousand if a person has become disabled 2nd degree;

- 250 thousand for a 3rd degree disabled person;

- 500 thousand if a child becomes disabled as a result of an accident.

In addition, the procedure for calculating compensation for damage to health also implies the degree of damage received:

- 35 thousand can be paid for internal bleeding, implying loss of up to 1 liter of blood;

- A victim with major blood loss will receive 50 thousand.

Whose insurance company pays for the damage?

Often, after filling out the papers recording the fact of the accident, the motorist does not know which insurance company he should send an application for damage compensation to:

- to an organization with which he himself entered into an agreement;

- or to the company servicing the person at fault.

The answer to the question of who pays for damages under compulsory motor liability insurance in case of an accident is clearly given by the law on compulsory motor liability insurance.

- An injured motorist should contact their insurer if the following conditions are met:

- the number of cars involved in the traffic incident is 2 or more;

- none of the participants in the accident suffered any damage to their health, and none of them died;

- both drivers have valid compulsory insurance policies;

- As a result of the incident, the property interests of third parties are not affected.

- In all other cases where there is loss of life or damage to health, the injured motorist must submit a claim to the insurance company that protects the liability of the person responsible for the accident.

If the initiator of the collision does not have an MTPL policy at all and refuses to voluntarily compensate for the damage, the injured driver will have to go to court to obtain a decision on the forced collection of monetary compensation from the guilty party.

Procedure for compensation under the MTPL policy

Even the most careful driver can at any time become involved in a traffic accident through no fault of his own. And he will be even more offended if, due to mistakes made when registering an accident, the insurance company, on formal grounds, refuses him an insurance payment. And since insurers do not want to part with money, every motorist should know how to receive the due compensation.

In order to receive your insurance payment in a timely manner and in full, you must adhere to a clear procedure:

- Immediately after the occurrence of an insured event, turn on the alarm and display a warning sign. If there are injured people, immediately call doctors to the scene.

- File an accident. This can be done with the help of police officers or independently using the Europrotocol form. If drivers do not have a dispute regarding the amount of damage, which does not exceed 50 thousand rubles, and agree on the issue of guilt of the parties, they can:

- take photos and videos of the collision site;

- after this, remove cars from the roadway if they interfere with traffic;

- fill out the Europrotocol form yourself or go to the nearest traffic police post and contact the police to register the accident.

- Notify your insurer about the accident. The period within which the driver must notify his insurer of the damage received is stipulated by law and is 5 days.

- Collect a set of necessary documents. Their list is specified in the Regulations on the rules of OSAGO and includes:

- citizen's passport;

- power of attorney, if an intermediary, and not the owner of the car, contacts the insurance company;

- car registration document;

- a valid insurance policy;

- documents confirming the fact of the accident, for example, a copy of the traffic police protocol, the European protocol, a resolution to initiate an administrative case.

- Contact your insurance company. You should write a statement to the insurer, attach all the collected documents to it, and present the car for an expert inspection.

When following this algorithm, the motorist must remember that the law on compulsory motor liability insurance allows only 5 working days for contacting the insurance company with an application. And they are counted starting from the date of the accident.

The final step is to receive your refund, which can come in two forms:

- natural – implies car repair at a service station.

- cash - paid only in exceptional cases provided for by law in cash through the cash register or by wire transfer to the applicant’s bank account.

The insurer is obliged to pay compensation to the applicant or issue him a referral for car repairs within a period not exceeding 20 calendar days, with the exception of holidays. The deadline starts from the date of submission of the application and provision of the required documents. A month is allotted for repair work. If the insurer does not fulfill its obligations on time, the applicant has the right to recover from him a penalty in the amount of 1 percent for each day of delay.

The civil liability protection system for drivers has been in effect in Russia for a long time, but insurance legislation continues to change, presenting car owners with new surprises. To be sure that your MTPL policy will help cover damage incurred in an accident, you should monitor regulatory innovations and strictly follow traffic rules on the roads.