What does transport tax consist of?

How is the tax base for transport tax determined?

Payers of transport tax and the basic principles of its calculation

This tax is regional. It must be paid by individuals and enterprises that own registered vehicles (Article 357 of the Tax Code of the Russian Federation).

Individuals pay the tax amount based on a notification from the Federal Tax Service, which is generated based on information provided by the authorities registering vehicles.

Enterprises calculate tax and advances on it themselves. Moreover, until 2020 (that is, for the tax for 2019 inclusive), they are required to report on it to the Federal Tax Service. For the 2020 tax year, the filing of transport tax returns for organizations has been cancelled, and the Federal Tax Service must send them messages with the amount already calculated (similar to how it now does it for individual entrepreneurs and individuals). But legal entities will still calculate their taxes independently. First, they must know the amount in order to make advance payments throughout the year (if they are established in the region). And secondly, the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. After all, she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Therefore, it is also important for companies in 2020 to know the basic principles of tax calculation. And they are as follows:

- the tax is calculated as the product of the tax base and the rate (unless otherwise reflected in the Tax Code of the Russian Federation);

- advances payable for tax are determined for each reporting period as ¼ of the tax base multiplied by the tax rate (Article 362 of the Tax Code of the Russian Federation);

- enterprises calculate tax payable as the difference between the amount accrued for the year and advance payments that were paid during the year; advance tax payments are not provided for individuals;

- the final amount of tax and the amount of advances on expensive cars is determined taking into account the increasing coefficient (from 1.1 to 3), established depending on the cost of the car and the number of years that have passed since its release (clause 2 of Article 362 of the Tax Code of the Russian Federation).

Tax base for transport tax

The tax base for transport tax in 2019–2020 is calculated differently for certain types of vehicles (Article 359 of the Tax Code of the Russian Federation).

Type of vehicle (VV)

Tax base for calculating transport tax

Transport tax on cars in 2018

How much will you have to pay tax for a car in 2018, how to do it and how to calculate the amount of the fiscal contribution when calculating the transport tax.

At the end of 2017, Russian motorists were excited by the news about the authorities’ supposed plans to raise the amount of transport tax. The information turned out to be untrue. The transport tax even decreased slightly for certain categories of cars.

What does the transport tax consist of in 2018?

The tax on vehicles is regulated by Chapter 28 of the Tax Code of the Russian Federation. Its value consists of three components:

- Tax rate (a value determined at the local level, which cannot be lower than 10 times that set in the Tax Code);

- Tax base (one horsepower is taken per unit);

- Increasing factors that are affected by the cost and age of the car.

The tax rate is determined by the authorities of the territories and regions of the Russian Federation. Only deputies of regional parliaments can make changes to it.

The tax base is another key element that affects the size of the fiscal collection. The unit of measurement is one horsepower. In other words, the more power your car has, the more tax you will have to pay.

How is transport tax calculated?

The tax office provides the official formula for calculating transport tax.

Tax amount = tax rate * tax base * increasing factor * (number of months of ownership / 12)

Increasing coefficients are enshrined in the Federal fiscal legislation.

Transport tax rate by region

Northwestern Federal District

Central Federal District

Southern Federal District

Volga Federal District

Ural federal district

Siberian Federal District

Far Eastern Federal District

Who can avoid paying transport tax?

For some categories of cars you do not need to pay transport tax. This is stated in the country's main fiscal document.

- passenger cars equipped with manual controls (for use by disabled people);

- passenger cars up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law;

- cars that have been stolen (subject to a corresponding certificate from the police).

Transport tax benefits

The state provides transport tax benefits to some categories of citizens. The most common group of citizens are pensioners. There are other categories, but there is no single federal list of those exempt from paying the fiscal fee for the “iron horse”.

The fact is that the right to exempt (in whole or in part) from paying transport tax is given to the regions. Therefore, there are two effective ways to find out whether you are entitled to this tax break or not: contacting the tax office at your place of residence and using a special service from the official fiscal service.

If everything is clear with a personal appeal, then using the service requires clarification.

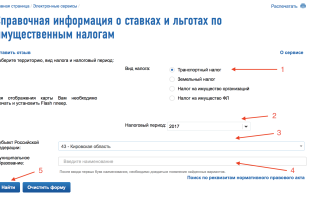

First, you need to go to the appropriate section of the official website of the Federal Tax Service.

Next, fill out the form as shown in the screenshot:

- select "transport tax" in the right column

- lower tax period (year for which you need to pay the fiscal fee)

- even lower - your region

- start typing the city

- click the "Find" button

After clicking the “Find” button, a field will appear, where you need to click on the “More details” link.

In the form that appears, open the “Regional benefits” tab and check the box next to the “Individual” item. Click the “Show” button, after which the system will show all categories of beneficiaries that are enshrined in local legislation.

When and how to pay tax

The basis for paying the tax is a notification that inspectors must send to the owner of the vehicle.

The paper is sent by Russian Post 30 days before the due date for payment of the fiscal fee. The deadline to deposit money for the “iron horse” into the budget is no later than February 1.

Many motorists complain that they do not receive notifications. Unfortunately, lost paper is not grounds for non-payment of taxes. Therefore, if you have not received it, contact the tax office at your place of residence.

The same must be done if the notification contains errors or inaccuracies. A special application is attached to the form, which must be filled out, indicating all the flaws in the document and sent to the fiscal department.

Amnesty for transport tax in 2018

On January 1 of this year, the government of the Russian Federation announced a tax amnesty. However, this will not affect everyone, but only those citizens whose property tax debts arose before January 1, 2015. Transport tax is included in the pool of fiscal payments, debts for which are recognized as bad and written off .

The law regulating the procedure was promptly adopted by the State Duma in three readings at once.

Debt write-off from citizens and individual entrepreneurs will be carried out unilaterally. This means that you do not need to submit any documents or statements to the tax authorities.

Tax officials, in turn, will not warn about debt write-off. But all information can be tracked in the “Taxpayer’s Personal Account”.

Transport tax

What is transport tax, the calculation procedure, benefits at the federal and local level, methods of paying and checking the tax, whether pensioners should pay car tax - we have prepared all this information for you in an accessible form.

What is transport tax?

Transport tax is a tax levied on vehicle owners. Transport means are: cars, motorcycles, scooters, buses, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, jet skis, motor boats and other water and air vehicles.

Not all vehicles are subject to taxation.

For example, the following exceptions exist: - rowing boats, as well as motor boats with an engine power of no more than 5 horsepower

- vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by an authorized body.

The full list of exceptions is indicated in Article 358 of the Tax Code of the Russian Federation.

Payers of transport tax are both individuals and legal entities.

Is it possible to find out and pay car tax online?

How to calculate transport tax?

The amount of transport tax is calculated based on the following parameters:

— Tax rate

The tax rate is established by the laws of the constituent entities of the Russian Federation per one horsepower of engine power.

Depends on power, gross capacity, vehicle category and year of manufacture of the vehicle. Tax rates can be increased or decreased by the laws of the constituent entities of the Russian Federation by no more than 10 times the rate specified in the Tax Code of the Russian Federation.

— Tax base

This parameter is set depending on the type of vehicle.

For cars, motorcycles and other vehicles with an engine, this is the engine power in horsepower - Ownership period

The number of complete months of ownership of the vehicle during the year.

— Increasing coefficient

For passenger cars with an average cost of 3 million rubles. a multiplying factor is applied. The list of such cars is available on the website of the Ministry of Industry and Trade of the Russian Federation.

Who is entitled to transport tax benefits?

At the federal level, the following categories of citizens are exempt from paying transport tax:

- Heroes of the Soviet Union, heroes of the Russian Federation, citizens awarded Orders of Glory of three degrees - for one vehicle;

- veterans of the Great Patriotic War, disabled people of the Great Patriotic War - for one vehicle;

- combat veterans, disabled combat veterans - for one vehicle;

- disabled people of groups I and II - for one vehicle;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War - for one vehicle;

- one of the parents (adoptive parents), guardian, trustee of a disabled child - for one vehicle;

- owners of passenger cars with an engine power of up to 70 horsepower (up to 51.49 kilowatts) inclusive - for one such vehicle;

- one of the parents (adoptive parents) in a large family - for one vehicle;

- owners of vehicles belonging to other preferential categories.

In addition to the federal list of preferential categories of citizens, there are regional benefits. For example, in some regions of the Russian Federation, pensioners pay only 50% of transport tax, or are completely exempt from it. The situation varies greatly depending on the region. For example, in Moscow there are no benefits for pensioners, and in St. Petersburg pensioners are completely exempt from paying transport tax for a domestically produced car with an engine power of up to 150 horsepower.

You can find out the availability of regional benefits on the tax service website, in the “electronic services” section. On this page you must select a subject of the Russian Federation, municipality (city), type of tax and year. After this, you will receive complete information about all types of transport tax benefits for individuals.

It is important to know that the tax authority does not have the right to provide a transport tax benefit based solely on age information. Benefits are of a declarative nature, as a result of which it is necessary to submit to the Federal Tax Service the taxpayer’s application in the prescribed form, which indicates the basis for providing the benefit (reaching retirement age).

How to calculate the number of complete months of car ownership?

If a vehicle is delivered or deregistered during the year, then the transport tax is calculated with a certain coefficient. This coefficient is defined as the ratio of the number of complete months during which a given vehicle was registered to the number of calendar months in a year (12).

The procedure for determining the number of full months of car ownership is calculated in accordance with paragraph 3 of Art. 362 Tax Code of the Russian Federation. A registration month is considered complete if the vehicle is registered before the 15th day inclusive. The month of deregistration is considered complete if the car is deregistered after the 15th day.

For example, if a car was registered after the 15th, then this month is not complete and is not taken into account when calculating the car tax.

KBK for payment of transport tax

The budget classification code (BCC) for paying transport tax in 2018 remained the same as in 2017 - 182 1 06 04012 02 1000 110.

If the tax payment was not made on time and a penalty was accrued, then to pay the penalty you must use the BCC - 182 1 06 04012 02 2100 110.

To pay off the fine (if there is a court decision) for unpaid transport tax, use KBC - 182 1 06 04012 02 3000 110.

Transport tax rates by region of the Russian Federation

The transport tax rate depends greatly on the specific region.

For example, in Moscow and St. Petersburg the transport tax rate is 35 rubles per hp. for passenger cars with engine power 101-150 horsepower. In the Sverdlovsk region, in a similar case, the rate is 9.4 rubles. The full table of transport tax rates in 2018 for passenger cars owned by individuals in all regions can be viewed here.

When is it necessary to pay car tax?

Payment of car tax must be made once a year no later than December 1 of the year following the expired tax period (calendar year). For example, transport tax for 2018 must be paid before December 1, 2019. Because In 2019, December 1 is a day off (Sunday), then the last day to pay transport tax without penalty is December 2, 2019.

Has the transport tax been abolished in 2018?

No, the transport tax has not been cancelled.

It is unknown where the information about the cancellation came from, which is being actively discussed on the Internet, but the Federal Tax Service has repeatedly come out with clarifications that Law No. 436-FZ in no way abolishes the car tax. This law only specifies the writing off of uncollectible debts. Property tax debts of individuals, including transport taxes, are considered hopeless, for which the tax authorities will not carry out the full range of measures for forced collection. It is important to note that only arrears on these taxes incurred by individuals as of January 1, 2015 are written off.

Transport tax is charged to all vehicle owners.

As soon as the owner of a car, motorcycle, air or water transport sells his property, from the month following the month of sale, he is exempt from paying tax on these vehicles.

Similarly, when a person purchases a vehicle, from that month he is required to pay transport tax.

It is not the taxpayer's responsibility to calculate the amount of tax. Often in our country situations occur in which tax is calculated incorrectly.

For example, having bought a vehicle in the middle of the year, a person is preparing to pay only part of the tax amount , but a notification comes to pay the fee for all 12 months. In order to avoid such situations and clearly know how much you will have to pay, it is recommended to independently calculate its amount every year.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 938-40-67. It's fast and free!

Tax rates for vehicles are individual for each region. All tax rates are established by Article 361 of the Tax Code of the Russian Federation. All transport tax interest rates can be reduced or increased at the request of regional authorities, but not more than 10 times.

Below are the transport tax rates specified in the Tax Code.

What determines the transport tax rate?

The amount that is charged depends on several components:

- Type of vehicle (car/truck, bus, motorcycle, air transport, water transport, etc.).

- Vehicle engine power (horsepower).

- Year of car manufacture.

- The period of ownership of the vehicle in the year that is subject to taxation.

- The region in which the owner of the vehicle is registered.

Since 2014, changes have been made to the Tax Code - increasing coefficients have been established for cars whose cost exceeds 3 million rubles. The size of the increasing coefficients is presented in the table below.

Calculation formula

The formula for calculating the exact amount of transport tax payment when owning a vehicle for less than 1 year is as follows:

Tax amount = Tax rate for the region * Vehicle power (number of hp) * (Months of vehicle ownership per year / 12 months)

Formula for calculating transport tax when owning a vehicle all year:

Tax amount = Tax rate for the region * Vehicle power (number of hp)

Formula for calculating transport tax when owning a car more than 3 million rubles for less than 1 year:

Tax amount = Tax rate for the region * Vehicle power (number of hp) * (Months of vehicle ownership per year / 12 months) * Increasing factor

Formula for calculating transport tax when owning a car costing more than 3 million rubles for more than 1 year:

Tax amount = Tax rate for the region * Vehicle power (number of hp) * Increasing factor

Horsepower calculation

Based on the general rates specified in the Tax Code of the Russian Federation, it is clear that the more power (number of horsepower) a vehicle has, the higher the rate used to calculate transport tax.

This means that motor vehicle owners always have less money to pay than other vehicle owners.

Here it is necessary to make a reservation that in some regions, owners of cars and motor vehicles with the lowest hp value. are exempt from paying this fee.

Calculation examples

Calculation of the amount in several options.

General information: a car with a power of 140 hp, tax rates are taken from the Tax Code of the Russian Federation.

An example of calculating transport tax at general rates if a person owns a car with an engine power of 140 hp:

140 hp x 3.5 = 490 rubles

If he owns the car for 7 months:

140 hp x 3.5 * (7 months / 12 months) = 140 hp x 3.5 x 0.58 = 284 rubles

I own a car with a power of 140 hp. is located all year, while the cost of the car is 3.5 million rubles and 4 months have passed since the year of manufacture:

140 hp x 3.5 x 1.5 = 140 hp x 5.25 = 735 rubles

A car with an engine power of 140 hp is owned for 2 months out of a whole year, its cost is 6 million rubles:

140 hp x 3.5 x (2 months / 12 months) x 2 = 140 hp x 3.5 x 0.17 x 2 = 140 hp x 1.19 = 166.6 rubles

Calculation for a passenger car.

Engine power 270 hp

Tax rates are general.

A person owns a car all year:

270 hp x 15 = 4,050 rubles

If he owns the car for 5 months:

270 hp x 15 * (5 months / 12 months) = 270 hp x 15 x 0.42 = 1,701 rubles

I own a car with a power of 270 hp. is located all year, while the cost of the car is 4 million rubles and 2.5 years have passed since the year of manufacture:

270 hp x 15 x 1.1 = 270 hp x 16.5 = 4,455 rubles

A car with an engine power of 270 hp is owned for 6 months out of a whole year, its cost is 12 million rubles:

270 hp x 15 x (6 months / 12 months) x 3 = 270 hp x 15 x 0.5 x 3 = 270 hp x 22.5 = 6,075 rubles

Tax calculation for a motorcycle.

Engine power 40 hp.

We consider general tax rates. Owning a motor vehicle all year round:

40 hp x 5 = 200 rubles

The motorcycle was owned for 9 months out of a full year:

40 hp x 5 x (9 months / 12 months) = 40 hp x 5 x 0.75 = 40 hp x 3.75 = 150 rubles

The cost of motor vehicles does not affect the calculation of the amount of transport tax.

Bus tax calculation.

Engine power 300 hp

Rates are general. Owning a bus all year:

300 hp x 10 = 3,000 rubles

A person owns a bus for 8 months:

300 hp x 10 x (8 months / 12 months) = 300 hp x 10 x 0.67 = 300 hp x 6.7 = 2,010 rubles

The cost of the bus does not affect the calculation of transport tax.

Calculation by region

Regional authorities themselves regulate the coefficients by which transport tax for all citizens. Typically, rates change annually. Local authorities also establish the number of benefits and the categories of citizens who fall under them.

Transport tax rates for each region of Russia may differ significantly. The rate depends on the territorial location of the region and its industrial development.

In most cases, this means that the more vehicles are registered in a particular region, the higher the transport tax rate for that region.

Below are the rates for several individual regions.

Tax calculation for a passenger car. Engine power 200 hp, cost 3 million rubles and ownership period 4 months out of the taxable period (1 year), the car was released from the assembly line 1.5 years ago.

Moscow, St. Petersburg, Leningrad region, Arkhangelsk region, Chelyabinsk region, Krasnodar region:

200 hp x 50 x (4 months / 12 months) x 1.3 = 200 hp x 50 x 0.34 x 1.3 = 4,420 rubles

200 hp x 47 x (4 months / 12 months) x 1.3 = 200 hp x 47 x 0.34 x 1.3 = 4,154.8 rubles

Ulyanovsk and Nizhny Novgorod regions:

200 hp x 45 x (4 months / 12 months) x 1.3 = 200 hp x 45 x 0.34 x 1.3 = 3,978 rubles

200 hp x 35 x (4 months / 12 months) x 1.3 = 200 hp x 35 x 0.34 x 1.3 = 3,094 rubles

200 hp x 34 x (4 months / 12 months) x 1.3 = 200 hp x 34 x 0.34 x 1.3 = 3,005.6 rubles

200 hp x 32.7 x (4 months / 12 months) x 1.3 = 200 hp x 32.7 x 0.34 x 1.3 = 2,890.7 rubles

200 hp x 30 x (4 months / 12 months) x 1.3 = 200 hp x 30 x 0.34 x 1.3 = 2,652 rubles

Yamalo-Nenets Autonomous Okrug:

200 hp x 25 x (4 months / 12 months) x 1.3 = 200 hp x 25 x 0.34 x 1.3 = 2,210 rubles

This is an example of calculating transport tax for certain regions of Russia.

For each individual case, you must independently calculate the amount of tax.

On the website of the Federal Tax Service of Russia you can use a calculator that will calculate the cost of transport tax for the required vehicle.

The lowest rates for transport tax are in the Republic of Tyva, the Magadan Region, the Chukotka Autonomous Okrug, the Trans-Baikal Territory and the Chechen Republic. Tax rates for all vehicles are shown below.

The Tax Code establishes a deadline before which payments for transport tax cannot be made - February 1 of the year following the taxable year.

The taxpayer receives a notification from the Federal Tax Service, which must indicate: the amount of payment, payment details and deadlines for paying the fee.

Transport tax payments are the responsibility of the tax office.

In case of late payment or non-payment of the accrued amount, the tax inspector has the right to issue a fine in the amount of 20% of the unpaid amount or charge a penalty for late payment.

If the car is not deregistered, but is not in use, disassembled, scrapped, etc., transport tax must be paid until the vehicle is deregistered at the local traffic police.

Every car owner should know how vehicle tax payments are calculated. This will help avoid confusion and promptly resolve any controversial issues with tax inspectors. We talked about how the calculation is made, as well as what the procedure and deadlines for paying transport tax for individuals are in this article.

You can find more information about how transport taxes are calculated for individuals and legal entities in other articles on the portal.

Useful video

You can learn more about how to calculate transport tax by watching a short video:

A car owner does not have to be a major tax specialist, but, as Benjamin Franklin said, everyone must pay taxes and die.

Knowing the intricacies of transport tax will help a person more effectively control the economic side of his life.

Transport tax must be paid by both citizens and organizations. The latter must take into account the nuances that relate to their activities in terms of calculation and payment of the above-mentioned tax.

The legal obligation to pay this tax applies to persons who possess registered transport devices.

The tax base is determined by the engine power, gross tonnage or vehicle unit and is adjusted according to the vehicle category.

Transport tax (car tax)

You can calculate your transport tax here.

Since 2003, every owner of a vehicle that meets certain criteria becomes a transport tax payer. The Tax Code of the Russian Federation clearly states that transport tax has the status of a regional tax. This status was assigned due to differences in living conditions, availability and operation of roads in different regions of Russia. The regional government itself can determine the payment mechanism, car tax rates and the frequency of these revenues.

In general, the transport tax was originally invented and introduced to provide the state with funds for the maintenance, repair and development of roads throughout the country. Of course, the compliance of the actions carried out by the state with its obligations regarding roads is a controversial issue, like most cases in Russia. But it is worth noting that, having once introduced a car tax, the government is in no hurry to abolish it, but rather only increases rates.

The basic concepts, features and mechanism for collecting transport tax are established by the twenty-eighth chapter of the Tax Code of the Russian Federation. Also, any of the regions, based on the Tax Code, can adopt additional regulations to resolve issues regarding transport tax.

There are differences in the calculation and payment of transport tax for individuals and legal entities.

Transport tax for individuals

Article 358 of the Tax Code of the Russian Federation lists in detail all vehicles, the ownership of which requires the mandatory payment of transport tax. They can be divided into three groups: land (motorcycles, cars, snowmobiles, etc.), water (yachts, boats, etc.) and air (planes, helicopters, etc.) means of transport. In addition, it lists vehicles that are not subject to transport tax, for example, rowing boats, tractors, combine harvesters, and so on.

After a certain period established in the code, that is, once a year, the person for whom the vehicle is officially registered, and therefore considered its owner, is obliged to pay transport tax.

If the car was stolen and is wanted by the internal affairs authorities, then transport tax should not be charged. But in order to avoid an error, you should bring to the Tax Service in advance a document certified by law enforcement agencies that the car has been stolen. If the vehicle was found and not deregistered, then you will be charged tax on the car from the month in which it was officially found.

If the car is not used, this does not give the right to exemption from transport tax, that is, if a car is registered with you, and you, for example, do not drive in winter, then the tax will be charged for the whole year. The same is true if the car is not deregistered, even though it is a pile of rusting scrap metal.

If the car is transferred to another person under a general power of attorney, but the purchase and sale agreement has not been drawn up, then the responsibility for paying transport tax can be transferred to the person to whom the power of attorney is issued. In addition, you should definitely inform the tax office about this. But the opportunity to transfer the tax burden is provided only for powers of attorney signed before July 29, 2002. If the power of attorney is issued later than this date, then the payer is the one for whom the car is officially registered.

In order to calculate the tax, the concept of “tax base” was introduced into the system. In fact, this is what the tax is calculated on, in our case, the characteristics of the vehicle. For each transport, an individual tax base is determined depending on its belonging to a particular class of means. For example, the tax base for vehicles with an engine will be their power, expressed in horsepower, and for those without an engine, it will be their capacity in tons. Sometimes the engine power in the documentation is expressed in kilowatts; to make the calculation you need to convert kilowatts into horsepower, 1 kilowatt is equal to 1,359 hp.

The Russian calculation of transport tax is fundamentally different from the global one in that the rate at which the tax is calculated is based on the weight of the vehicle or its environmental properties.

Individuals, that is, ordinary citizens in whose name a car or any other vehicle is officially registered, do not themselves calculate transport tax; the tax authority in the region where it is registered does this for them. Every year before the first of June after the tax period of one year has passed, the Internal Revenue Service will issue a special notice indicating the total amount of car tax that must be paid. Experts advise checking the amount every time, as tax authorities often make mistakes. You need to pay the tax office before the first of February next year. Moreover, if for some reason the notification letter did not reach you, and you did not pay within the specified period, but the tax office confirms that it was sent, you will be forced to pay a penalty.

Detailed deadlines and possible features of payment should be found out in the Tax Office to which you belong. This is due to the fact that the transport tax is regional, so each subject of the Federation can introduce additional requirements and instructions.

Transport tax for legal entities

The main difference between the calculation and payment of transport tax for organizations is that they carry out all operations independently. Simply put, they themselves calculate and send a declaration to the tax authority where the transport is registered. Moreover, they must do this no later than the twentieth of January following the taxable year. Although in each region tax authorities have the right to set their own deadline for paying car tax. The transport tax declaration can be submitted in printed or electronic form, the main thing is that the data is accurate and without errors. Three times a year, organizations are required to provide reports on vehicles on the company’s balance sheet.

Calculation of transport tax

According to the Constitution of the Russian Federation, every citizen is obliged to pay taxes and other fees established by law. In this paragraph we will tell you how tax is calculated specifically for individuals. We have already noted earlier that citizens do not calculate taxes on their own; the Tax Inspectorate does this for them. This organization, in turn, is guided by the Tax Code and the information that registration authorities redirect to it. The period for which the car tax is calculated is one calendar year. If the car has been owned for less than a year, then when calculating the transport tax, not the whole year is taken, but a coefficient that is calculated by dividing the number of months of ownership by twelve, that is, by the number of months of the reporting period.

The total amount of transport tax required to be paid consists of several characteristics and indicators, such as the class of the vehicle, the power of the engine installed on it, the accepted tax rates in a particular region, the availability of tax benefits and the period of time for which the vehicle is owned specific person.

Thus, it is possible to derive a general formula for calculating transport tax, for example, for a car. The amount of tax on a car is equal to the tax base (for a car - engine horsepower), multiplied by the tax rate and the reporting period (usually one year).

How to calculate transport tax

It is also worth remembering that no matter what date the car was registered or deregistered, the whole month will be taken into account. If registration and deregistration actions were carried out within one month, then only this month will be taken into account. If your car was stolen, and after some time law enforcement agencies found it and provided information about this to the Tax Inspectorate, then you will be charged transport tax from the month from which it is again in your possession.

If you have not received a notification about the accrual of transport tax, then to avoid problems, contact the Tax Inspectorate yourself and find out all the actual debts.

Transport tax rate

One of the important components for calculating the amount of transport tax is the transport tax rate. The Tax Code of the Russian Federation establishes the so-called basic transport tax rates, which are reflected in the table.

Basic rates for calculating transport tax

But you should remember about the regional nature of the transport tax. That is, simply put, any subject of the Federation, by its legislative act, can increase or decrease the rates of this tax tenfold. They may also raise rates not for all categories of transport, but for some individual ones.

Transport tax benefits

Since the transport tax is a regional tax, in addition to the rates, calculation procedure and tax period, the subjects of the Federation can establish or reduce transport tax benefits for certain categories of citizens. Benefits typically apply to only one vehicle owned by the eligible person. Basically, car tax benefits are provided to the following persons:

1. Heroes of the Soviet Union, Heroes of the Russian Federation.

2. Veterans of the Great Patriotic War and disabled people of the first and second groups.

3. Cars with an engine power of less than one hundred horsepower, received from special social services.

4. Cars registered to the Ministry of Defense, Internal Affairs Directorate, Ministry of Emergency Situations, criminal investigation authorities, drug control authorities.

An example of the introduction of additional benefits for citizens from paying transport tax is the Moscow legislative act, which exempts from tax owners of cars whose engine power is less than seventy horsepower.

Thus, we can conclude that the regional nature of the transport tax sets it apart from other taxes and imposes certain specifics, so when in November 2009 the Government wanted to double the transport tax rates, the population strongly opposed it. The president supported the population, and the increase was cancelled, but time will tell how taxation of transport will be in our country.