When will the transport tax be removed in Russia?

Will the transport tax be abolished in 2019?

Issues related to the regulation of transport tax are specified in Chapter 28 of the Tax Code of the Russian Federation. Also, Article 12 of Federal Law No. 436-FZ of December 28, 2017, amending the Tax Code, is devoted to it.

Was the transport tax canceled in 2019?

For quite a long time, information has been discussed on various resources that Vladimir Putin signed a decree abolishing the transport tax. But has the transport tax really been abolished in 2019? Answer: no. The document, which many perceive as a presidential decree on the abolition of the transport tax, is actually called Federal Law No. 436-FZ of December 28, 2017. In addition to amendments to other articles of the Tax Code of the Russian Federation, Article 12 deals with the recognition of bad debts for this type of tax obligations that arose as of 01/01/2015. Therefore, it is more correct to say that transport tax debts were canceled in 2019.

The tax amnesty will be carried out automatically. That is, vehicle owners do not have to go anywhere. If the car owner has regularly paid all his bills and has no debt obligations to the Federal Tax Service, he is not subject to Law No. 436-FZ, and no refund of funds from the budget is provided. Individuals and individual entrepreneurs can count on debt forgiveness. Consequently, legal entities will still have to repay all debts.

How and when to pay

Since the abolition of the transport tax in 2019 (Putin provided only an amnesty) is very illusory, it is worth talking about some of the nuances of paying this fee. According to the existing norms of the Tax Code of the Russian Federation, it must be paid annually before December 1 of the year following the reporting year. For example, for 2018 you must pay by December 1, 2019. The amount of the fee depends on:

- region of residence;

- vehicle brands and models;

- Year of release;

- engine power.

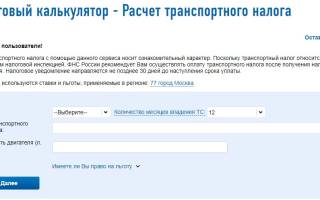

You can find out the amount by using a special online calculator on the official website of the Federal Tax Service.

In addition, the tax office must send a notice indicating the amount of the payment. Tax authorities must send this document no later than 30 days before the deadline for payment. Having received the notification, the vehicle owner can make a payment. If for some reason the notification is not received before December 1, you should not hope that the Federal Tax Service has completely forgotten about the payment. It is recommended that you contact the tax authorities yourself, this will allow you to avoid the accrual of penalties and fines in the future. If the notification is received, but the owner of the vehicle is in no hurry to transfer the funds, the Federal Tax Service has the right to collect the funds forcibly.

In addition, according to paragraph 3 of Article 363 of the Tax Code of the Russian Federation, the Federal Tax Service cannot send a notification for more than three tax periods. That is, this year the Federal Tax Service can send notifications for 2018, 2017 and 2016.

Cancellation of transport tax 2019 in Russia: pitfalls of amnesty

The amnesty for vehicle payments will not affect all debtors, as it might seem at first glance. Let's figure out why this situation has developed.

In 2019, tax authorities may send the payer a notice, which may include contributions for 2018, 2017 and 2016. Consequently, it will not be possible to recover amounts not paid before 2016. That is, in this case, the abolition of the transport tax (Putin signed the tax amnesty law) has no practical meaning.

Let's consider another case. The car owner has not paid for his vehicle, and the Federal Tax Service sends a corresponding notification. After this, the unscrupulous car enthusiast still did not repay the debt, and its amount began to exceed 3,000 rubles. In this case, tax authorities have the right to go to court to recover funds within six months. That is, the Federal Tax Service still retained the right to collect large debts. Moreover, the three-year collection period can be extended by court action.

If the debt does not exceed 3,000 rubles, tax authorities can monitor this debt for three years. And when it exceeds the established limit, you can apply for collection within six months.

From this we can conclude that the amnesty will affect those vehicle owners whose debt does not exceed 3,000 rubles.

Transport tax, cancellation 2019: State Duma news

Despite the fact that the adopted law is only an amnesty for debtors, it cannot be said that there is no chance that legislators will abolish the transport tax in 2019. After all, this issue is raised periodically in the State Duma. For example, in June of this year, bill No. 480908-7 was introduced. In it, legislators proposed canceling Chapter 28 of the Tax Code of the Russian Federation, and in return including the fee in the cost of fuel. This would allow for a more equitable taxation principle. Since the amount of the fee paid would directly depend on the frequency of use of the car. Despite the fact that this proposal received very wide public support, the project was rejected at the preliminary review stage. Thus, the law abolishing the transport tax from 2019 currently remains only a dream for car enthusiasts.

When will the transport tax be abolished in Russia?

The question of whether the transport tax (TN) will be abolished in Russia has been worrying drivers for a dozen years. Unfortunately, there is no hope for a positive solution to the problem in 2019. In the future, we can expect either the replacement of TN with an environmental fee, or an increase in gasoline prices. One way or another, car owners will most likely continue to pay for them.

We’ll talk more about the problem of canceling TN in this article.

When was the transport tax introduced and why is it needed?

Russian car owners have been paying car tax since 2003. Funds received from taxpayers go to the local budget and are spent on the needs of the region, including the construction and repair of roads. Cars wear out the road surface, so it is logical that car owners who are interested in the quality of roads contribute to their repair.

Why do drivers want the transport tax for passenger cars to be abolished in Russia in 2019?

Although the reasons for the existence of the car tax are clear, it has several disadvantages:

TN is not charged for the fact that you drive a car and thereby spoil the roads, but for the fact that you are the owner of the car. The amount of tax depends on regional rates, which can vary significantly in different parts of the country. This method of calculating car tax raises quite fair questions from drivers - why in the neighboring region the tax rate for the same car is many times less and what damage does my car cause to the roads if it has been sitting in the garage for almost the entire year?

Phys. persons cannot pay tax until they receive a notification from the Federal Tax Service with a calculation of the tax amount and details for payment. The notice is sent by mail and may not reach the addressee, which does not exempt you from paying tax. Loss of the notification leads to late payment with all the ensuing consequences - fines, penalties and visits from FSSP employees.

3 “Double” taxation.

The road fund is replenished not only by funds collected from fuel prices, but also from excise taxes on fuel, which the manufacturer is obliged to pay on each ton of product. The manufacturer includes excise taxes in the price of fuel sales, and fuel companies and gas stations, in turn, increase gasoline prices. This leads to the fact that excise taxes on gasoline are actually paid by car owners.

When will the transport tax on horsepower be abolished in Russia and what is proposed to replace it?

Despite the fact that the government has been talking about abolishing TN for about 10 years, the initiatives do not find support. Therefore, you should not expect that the car tax will be abolished in 2019.

In the future, it is proposed to replace the road tax with:

Environmental fee or;

Increased excise tax on fuel.

We will reveal the pros and cons of the proposals below.

How does the environmental fee differ from TN?

The amount of the fee depends not on the power, but on the environmental class of the car. The more a car pollutes the environment, the more the car owner will have to pay for it. This idea of replacing the VT has several disadvantages:

Again, you will have to pay not for using the car, but for the very fact of owning it.

The maximum fee will be levied on owners of older cars, which most will find unfair.

No one is insured that after the introduction of the environmental tax they will not change their mind about canceling the TN.

A bill to replace the TN with an environmental fee is planned to be prepared by 2019.

How can raising the price of fuel get rid of TN?

The State Duma has repeatedly proposed replacing TN with increased excise taxes on fuel. Despite the fact that in this case gasoline prices will rise, such a change could solve several problems at once:

Car owners will start paying for using a car, not for owning it.

The car owner will be freed from liability to the tax authorities - there will be no need to wait for notification and comply with tax payment deadlines, and there will be no fines and penalties charged for anything.

Only beneficiaries will not like this proposal, because the increase in the cost of gasoline will affect them too. However, the chances of the idea coming to fruition are slim. There was talk of replacing TN with higher excise taxes back in 2010. Then excise taxes on fuel really began to rise, but the tax was never abolished.

Why hasn't the transport tax been abolished?

Cancellation of TN will lead to budget losses of more than 146 billion rubles. (car owners paid this amount of tax in 2016). The government will not cancel the car tax without developing a plan to compensate losses to local budgets. Therefore, TN can only be replaced by an environmental tax or an increase in excise taxes on gasoline.

So, in 2019 there is no reason to think that the road tax will be abolished. Let's hope the government comes up with a plan to get rid of the shortcomings of TN next year.

Cancellation of transport tax in Russia

Owning a car is an expensive business, no matter how you look at it. This includes insurance, gasoline, and taxes. And the car itself is not the cheapest pleasure. The abolition of transport tax is a delicate matter and many motorists have been waiting for it for a long time.

In addition to the direct costs of a car, there is also a transport tax, which every car owner in our country is required to pay. In this article you will learn everything about the transport tax on passenger cars and whether it will be abolished or not.

What vehicle owners pay tax?

Bicycles and scooters are also good transportation options, but they are not subject to tax. But what you will have to pay for, read the list below:

- Motorcycle or scooter;

- Bus and truck;

- Tracked and pneumatic vehicles, as well as self-propelled vehicles;

- Airplane and helicopter;

- Motor sleighs and snowmobiles;

- Yacht, boat, jet ski and special vehicles intended for towing;

- And, of course, cars.

However, in addition to bicycles and scooters, there is a whole list of vehicles that do not make their owner victims of the tax. Their list is presented below.

So, the following are not subject to transport tax:

- Motor boats with a power of up to 5 horsepower or with a complete absence of a motor (rowing boats).

- Cars with an engine power of up to 100 horsepower, provided under the social protection program.

- Special equipment involved in agricultural work.

- Cleaning machines.

- Special services vehicles.

- Drilling and fishing vessels.

Various air and water vehicles that legally carry out cargo or passenger transport.

In addition to all of the above, cars that are owned and specifically designed for people with disabilities are also not subject to tax.

How to calculate your transport tax yourself?

The formula for calculating transport tax is extremely simple. In order to calculate the rate, you first need to take the vehicle engine power in horsepower as a basis. If we are not talking about a land vehicle, then this quantitative indicator can be replaced by jet thrust, the number of units (quantity) of means, and the like.

The engine power of your vehicle is called the tax base in the formula.

The final formula looks like this: tax rate tax base (vehicle capacity) number of months you own the vehicle, divided by 12 increasing factor (not always applied).

Now we should take a closer look at some of the variables:

- Firstly, for those who have owned a car for more than 1 year, the third variable (number of months/12) does not matter at all; it does not need to be used in the calculations.

- Secondly, the coefficient that increases the transport tax does not apply to all vehicles. The size and general need to apply this coefficient depends on the cost of your funds in rubles.

- Price up to 3 million rubles. — there is no coefficient.

- Price 3 – 5 million rubles. — the coefficient is 1.1 (the car itself is no more than 3 years old). Price 5 – 10 million rubles. — coefficient size 2 (subject to using the car for up to 5 years).

- Price 10 – 15 million rubles. — coefficient size 3 (if you use the car for up to 10 years).

- The car costs more than 15 million rubles. — coefficient size 3 (if the vehicle’s age does not exceed 20 years).

For what period is transport tax calculated and when to pay it?

You only need to pay transport tax once a year. It is calculated each time also for an annual period.

The Tax Code of the Russian Federation establishes the following deadlines for payment of the transport tax contribution:

- Individuals must deposit funds by December 1st.

- Legal entities are required to deposit funds before February 5.

What is the transport tax rate for your car?

Each vehicle has its own tax rate. This article will only cover rates for passenger cars. Tables for other types of transport can be found on the Internet and are freely available. The official website of the Russian Tax Service can help you with this.

For passenger cars, depending on the power of their engine, the following transport tax rates apply:

- Up to 100 horsepower - rate 12;

- 100 – 125 horsepower – rate 25;

- 125 – 150 horsepower - rate 35;

- 150 – 175 horsepower – rate 45;

- 175 – 200 horsepower – rate 50;

- 200 – 225 horsepower – rate 65;

- 225 – 250 horsepower – rate 75;

- From 250 horsepower or more - rate 150.

Depending on the power of your machine, you substitute the desired number into the formula given above.

Who can avoid paying transport tax according to the law?

Below is a list of groups of citizens whom the state exempts from the obligation to pay this tax. However, you should pay attention to the fact that such a benefit applies only to one vehicle and only with an engine power of up to 200 horsepower.

In addition, this benefit does not apply to water and air transport, snowmobiles or motor sleighs. So, under all the conditions mentioned above, you don’t have to pay tax if you:

- Veteran and disabled person of the Great Patriotic War and other military operations.

- Hero of the USSR, Russian Federation or holder of the Order of Glory, 3rd degree.

- Disabled person of 1st and 2nd groups.

- Participant in the tragedy in Chernobyl and other accidents associated with the release of radioactive waste.

- Were a minor prisoner of a ghetto or concentration camp.

- Legal representative of a child with disabilities.

- Guardian of an incapacitated person with disabilities since childhood.

- Nuclear weapons tester, accident liquidator, victim of radiation sickness.

- In addition, the restriction on car power is lifted for one parent of a large family.

- Also, vehicles with an engine power of up to 70 horsepower are not subject to tax.

Will the transport tax be abolished in 2019 or 2020?

The question of abolishing the transport tax still remains open. A federal law to amend it or completely abolish it has not yet been adopted. Thus, any information about the abolition of transport tax in 2019 is fake.

It is possible that false information has spread due to the writing off of old debts for the payment of this tax for 2015 and previous years. However, this did not happen in anticipation of the abolition of the tax, but only after the statute of limitations for these cases had expired.

However, a bill on abolishing the tax contribution for vehicles is indeed in the State Duma and it is quite possible that after significant revision the law will be adopted.

What is the essence of the federal bill to abolish the transport tax?

We need to start with the fact that deputies have been working on the bill since the beginning of June 2018 and still cannot reach agreement on all issues. Such a lengthy discussion of the law is due to the importance of transport taxes for the state budget at the regional level.

Deputies from the “A Just Russia” faction, who took the legislative initiative, believe that the vehicle tax in its modern form is not a fair fee, because the same amount has to be paid by both those who drive a car every day and those who use personal by road once a month.

In addition to the deputies of the said party, at different times the President of Russia himself and the Minister of Transport spoke about the injustice of the tax law (this was indicated in the explanatory letter to the bill).

How do deputies want to restore justice?

It is assumed that the only correct solution will be to simultaneously increase the excise tax on gasoline and abolish the tax.

If such a measure is adopted, the tax amount will be included in the cost of fuel, and it will be paid by those who directly use personal transport.

But the document never passed the lower house of parliament and a month after the bill was introduced it was sent to the Government of the Russian Federation for approval, which has not yet taken place.

Can the president personally cancel the transport tax?

No, Vladimir Putin, having issued a presidential decree, cannot influence the existence of a transport tax. This is due to the very nature of the law on this fee.

The law on vehicle tax is enshrined in the Tax Code of the Russian Federation. Individual provisions may vary slightly from subject to subject, but they do not have the right to cancel it on their own.

It turns out that no order or decree can cancel the tax. Only amendments can be made to the law on transport tax. However, to make such amendments it is necessary to issue an entire separate federal law.

Should car owners hope for the abolition of transport tax?

Definitely worth hoping.

More than one attempt has been made to promote an initiative to significantly change it or completely abolish it. But there is no need to talk about imminent cancellation yet. Back in 2012, the president himself took an active initiative to abolish this tax levy, but it did not receive the proper response.

The economic factor plays a large role in the discussion of this issue. Tax contributions from car owners are a truly powerful source of funds for regional budgets. Even the proposal to increase excise taxes did not satisfy the regional authorities.

In addition to the presidential initiative in 2012, after that three bills were rejected for 2015 and 2016, the essence of which was the same - the abolition of the single tax levy and its replacement with increased excise taxes.

Today, transport tax is a truly impressive amount of more than one hundred billion rubles, which is guaranteed to go to the regional budgets of our country. Even with an increase in gasoline prices and the abolition of the tax, the amount of funds coming to the regions from car owners will be lower.

Thus, no one is going to cancel the transport tax yet. Although this issue is in limbo throughout the entire government apparatus, parliamentarians have not yet been able to come to a compromise. And motorists will have to rely on their sense of justice and sympathy for the citizens of the Russian Federation.

Will the transport tax be abolished in 2019?

Maintaining roads in good condition requires considerable financial resources, which are mostly collected from motorists. The main requirements for the reasonable collection of a road toll or transport tax: fairness and ease of payment. In many countries (Denmark, Holland, Portugal) such a fee is paid at a time when purchasing a car. In others (USA), transport fees are included in the cost of fuel and a fair collection system is implemented - whoever uses more fuel, has more mileage, participates in proportion to their construction and repair.

And in Russia, car enthusiasts have been arguing for six months: has the transport tax been abolished or not?

When will the transport tax be abolished in Russia?

The Russian Federation has adopted an annual basic system for calculating and paying transport tax (TN). The size of the fuel pump depends on the engine power of the car and the region in which it is registered. Due to its injustice towards people who have low mileage cars, as well as the parallel payment of tolls on highways, rumors are constantly being spread and the burning question is being asked: when will the transport tax be abolished in Russia?

The activity of discussion in society increased after the appearance of Law FZ-436 on December 28, 2017. The “hot heads” did not understand its essence and disseminated information about the abolition of the transport tax in 2018. In fact, this law duplicated the obvious rules on writing off tax debt for payment of transport tax with an expired statute of limitations - 3 years. After this period, according to current legislation, tax authorities do not have the right to collect debts and impose financial sanctions. Therefore, Federal Law 436 was signed, first of all, to “clear the tax base” of unnecessary information about taxes that cannot be collected.

Thus, individual motorists may not pay transport tax for 2015 and earlier periods. It is important to know that failure to pay transport tax without a legal reason can result in a fine. .

But the tax for the previous year, in order to avoid the application of financial and administrative sanctions in accordance with the provisions of Article 363 of the Tax Code of the Russian Federation, was due to be paid until December 3, 2018.

Who can avoid paying transport tax?

The Tax Code of the Russian Federation has determined the regional system for setting car tax rates and the procedure for applying benefits. As a rule, tax benefits are provided for only one vehicle. In the capital the following benefits are available:

- disabled people of the first and second groups;

- member of a large family;

- heroes and order bearers of three degrees of Glory;

- guardian or parent of a person disabled since childhood;

- liquidators of the Chernobyl disaster and other persons injured during nuclear and space tests;

- combat veterans;

- former prisoners of concentration camps;

- owners of small cars with power up to 70 hp.

The abolition of transport tax for families with many children is relevant only for certain regions, since in others such a benefit is already in effect.

What can car enthusiasts expect in the future?

The real abolition of transport tax in the Russian Federation is possible after changing the systematic approach to its calculation and collection by including it in the cost of fuel and lubricants. You can recalculate transport tax. This summer, a resonant discussion of the topic “will the transport tax be abolished or not in 2018” intensified after the State Duma was introduced on June 5, 2018 by deputies of the “A Just Russia” faction of Bill 480908-7, which provides for the abolition of the transport tax (TN) a month after the publication of the relevant Law . Unfortunately, the State Duma did not consider the project and sent it to the archives. According to experts, the preparation of a bill to abolish the transport tax in 2019 would be advisable with the introduction of possible ways to compensate local budgets for losses after the abolition of TN. We need appendices to the bill in the form of a specific comparative calculation: how much will go into the budgets for road construction and repair after its inclusion in the cost of fuel.

In the meantime, the Russian government is showing a serious initiative to abolish the technical requirements for electric vehicles in order to improve the environmental situation.

Cancellation of transport tax in Russia in 2020

A law has been signed that makes very good changes to the payment of transport tax. We'll tell you about the latest news on tax abolition in 2020 in this article.

Cancellation of transport tax in Russia

In Russia, everyone who owns a car is a tax payer.

Moreover, it does not matter whether the car is used for its intended purpose, whether it is in good working order, how old the car is and what its power is - tax is required for any registered car.

Organizations calculate the tax themselves and submit a declaration . By the way, companies pay tax not only by year, but also by quarter. We have prepared a payment table for all 85 regions of the Russian Federation .

For individual entrepreneurs and citizens, payments are made to the Federal Tax Service. In the summer, the inspection sends the payment for the previous year. And the tax must be paid no later than December 1 of the following year. For example, the tax for 2018 for individual entrepreneurs and citizens must be paid no later than December 1, 2019.

For cars whose cost exceeds 3,000,000 rubles, there is an additional luxury fee . Below you can see the official lists of cars by brand that are subject to the luxury tax. Please note that the list has been updated and brought to the attention of the Federal Tax Service of Russia! Do not download old lists from the Internet; there is a current list in the Simplified magazine.

Neva LLC owns a Range Rover sport car with an engine power of 251 hp. With. The car was purchased in December 2018 for RUB 4,809,000. at a car showroom. The vehicle is registered in Moscow.

Tax rate for passenger cars with a capacity of 250 hp or more. With. in Moscow it is 150 rubles.

The increasing coefficient for cars worth from 3 to 5 million rubles, from the year of manufacture of which 1 to 2 years have passed - 1, 3.

The tax for 2018 will be: RUB 48,945. (150 x 251 x 1.3).

Cancellation of tax in 2020

There have been discussions about the abolition of transport tax in Russia for a long time, because the injustice of the principle of its payment is obvious.

Tax payers are everyone to whom a car is registered, regardless of whether they use it or not.

It turns out that the owner of a car who drives it every day and the owner who uses the car once a month will pay the same tax.

Deputies of the State Duma, who prepared a bill to abolish the tax, spoke out against such injustice. Instead, they proposed increasing the excise tax on fuel. Thus, the car owner’s expenses will directly depend on the frequency of use of his car.

For what periods did the President abolish the transport tax?

Since 2018, employees and individual entrepreneurs no longer owe the state transport tax for periods before January 1, 2015. This follows from Law No. 436-FZ, which Putin signed on December 28, 2017.

Tax debts of citizens and entrepreneurs will be written off automatically. The state will forget about unpaid payments for transport tax, personal property tax, and land tax.

Debts that were incurred as of a date before January 1, 2015 will be written off. If you accrued any penalties, they will also be forgiven.

There is no need to submit any documents to the tax office. The tax authorities will write off everything themselves and cover the debts. There is no need to attend the inspection in person.

An example of how debts are written off

Let’s say an individual entrepreneur has a tax debt for 2014. And by 2018, penalties for non-payment also accrued.

Starting from 2018, both the tax debt and all penalties will be written off. Everything will be written off automatically; you won’t have to write any statements.

Who should not pay transport tax in 2020: changes

Change No. 1. The Federal Law clarifies the grounds for exemption from taxation of vehicles that are wanted in connection with their theft (theft).

As the tax service commented, starting from the tax period of 2018, vehicles that are on the wanted list, as well as vehicles for which the search has been terminated, are not subject to taxation (clause 7, clause 2, article 358 of the Tax Code of the Russian Federation).

The exemption is valid from the month the search for the car began until the month it was returned to the person in whose name it was registered. Facts of theft (theft), return of a vehicle are confirmed by a document issued by an authorized body, or information received by tax authorities from the Ministry of Internal Affairs.

As a result, the end of the search for a vehicle that has not led to its return to the person to whom such a vehicle was registered will not entail the resumption of taxation.

Change No. 2. Starting from the 2020 tax period, the obligation to submit tax returns for transport tax has been cancelled. This measure is aimed at increasing the efficiency of control over the completeness of tax payment, and is also intended to reduce the administrative burden in the form of redundant reporting for payers.

To solve these problems, the law regulates the mechanism of interaction between tax authorities and taxpayers. Tax authorities send messages to taxpayer organizations and their separate divisions at the location of their vehicles about the amounts of tax calculated by tax authorities within the following periods:

- within 10 days after the Federal Tax Service draws up a report on the calculated tax for the past year, but no later than 6 months from the date of expiration of the tax payment deadline

- no later than 2 months from the date of receipt by the Federal Tax Service of documents and other information for calculating tax for previous tax periods

- no later than 1 month from the date the Federal Tax Service receives information from the Unified State Register that the organization is in the process of liquidation

Messages are transmitted to the taxpayer via TCS, personal account or by mail.