Tax on old cars in Russia

Which cars are not subject to transport tax?

Your car may not be taxable and you don't have to pay for it.

The full list of vehicles not subject to transport tax is indicated in paragraph 2 of Art. 358 Tax Code of the Russian Federation.

Passenger transport. Cars equipped for use by disabled people, as well as cars with an engine up to 100 horsepower, received or purchased through social security authorities.

Government transport. Transport used by executive authorities: these include the Government of the Russian Federation, all ministries, agencies, services and supervisions subordinate to them.

Manufacturing and Agriculture. Tractors, self-propelled combines, milk tankers, livestock trucks, special machines for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance. Transport must be registered in the name of agricultural producers and used for its intended purpose.

Services and organizations. Passenger and cargo sea, river and aircraft owned by organizations and individual entrepreneurs whose main activity is passenger and cargo transportation. Air ambulance and medical service planes and helicopters.

Water transport. Rowing and motor boats with an engine of no more than 5 horsepower. Fishing sea and river vessels. Vessels registered in the Russian International Register of Ships. Offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

Military equipment. All vehicles used by government agencies that provide for military and equivalent service. These are all units of the Ministry of Defense, the National Guard, the Ministry of Emergency Situations, the Foreign Intelligence Service, the FSB, the FSO, the Military Prosecutor's Office, the Investigative Committee, the Federal Fire Service, the mobilization training units of state authorities of the Russian Federation and special formations created for wartime.

In addition to the above, tax is not charged on vehicles that are reported stolen.

Who can avoid paying transport tax?

Legal entities. Until December 31, 2020, football organizations that participate in the preparation and holding of the 2020 European Football Championship in Russia do not pay tax. These organizations include UEFA and FIFA, their subsidiaries, the Russian Football Union, UEFA commercial partners and broadcasters, suppliers of UEFA and FIFA products, confederations and national football associations.

Individuals. There are no federal benefits for individuals. But regional authorities have the right to establish benefits. We'll talk about this in the next section.

Regional benefits for individuals

Regional authorities can fully or partially exempt a certain category of citizens from transport tax or reduce their tax rate.

For example, in Moscow and St. Petersburg, heroes of Russia and the USSR, veterans and disabled people of war and combat, one of the parents in a large family, and owners of cars with a capacity of up to 70 hp are completely exempt from tax. With. in Moscow and up to 80 l. With. in St. Petersburg. This is an incomplete list; all preferential categories are listed in the transport tax laws of the corresponding region.

In the Trans-Baikal Territory, in addition to complete tax exemption, there are partial benefits:

- Old age pensioners, pensioners who have reached the age of 55 years for women and 60 years for men, and disabled people of groups 1 and 2 pay 33% less;

- Owners of vehicles using natural gas as fuel pay 50% less.

In the Belgorod region, the transport tax rate is 10 rubles less for honorary citizens of the region, pensioners, disabled people and parents of large families.

Regions in which a 100% benefit applies to certain categories of citizens : The Republics of Ingushetia, Kabardino-Balkaria, Kalmykia, Crimea, Sakha (Yakutia), North Ossetia, Tyva, Khakassia, Chechnya, Altai, Kamchatka and Primorsky Territories, Amur, Astrakhan, Vologda, Voronezh, Kursk, Magadan, Omsk, Penza, Rostov, Ryazan, Saratov, Tomsk, Tyumen regions, Moscow and St. Petersburg, Nenets and Yamalo-Nenets Autonomous Okrug.

You can check the benefits in your region on the tax website.

How to apply for benefits

To apply for a benefit, you need to contact the tax office. This can be done in three ways: come in person, send a letter by mail, or send documents through the taxpayer’s personal account.

To receive a benefit, you must write an application indicating the circumstance for which you are entitled to a benefit. The application form contains a field for a document confirming the benefits, but it is not necessary to fill it out: since 2018, the tax office itself verifies the right to benefits.

Formula for calculating transport tax

Individuals do not need to calculate the tax themselves - the tax office does this. But it may be useful to check the calculations and challenge the tax if necessary. You can do this using a tax calculator or yourself using the formula:

Tax = Number of horsepower × Regional rate × Usage factor × Increasing factor.

The amount of horsepower is indicated in the vehicle passport.

The regional rate is on the tax website.

the utilization rate independently. Calculation formula: the number of months of the current year when the car was owned, divided by 12.

The increasing factor is used for expensive cars:

- 1.1 - passenger cars worth from 3 to 5 million rubles inclusive, not older than 3 years;

- 2 - passenger cars worth from 5 to 10 million rubles inclusive, not older than 5 years;

- 3 - passenger cars worth from 10 to 15 million rubles inclusive, not older than 10 years;

- 3 - passenger cars costing over 15 million rubles, not older than 20 years.

A list of expensive cars can be found on the website of the Ministry of Industry and Trade.

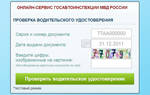

Search for tax rates on the tax website. You must select the type of tax, tax period and the region in which the vehicle is registered

Is it possible to get a refund of overpaid tax?

It's possible. In the taxpayer’s personal account, this amount will be indicated as an overpayment of tax. It can be offset against a future payment or returned to your bank account. It is enough to write a return application and indicate your bank account information.

Page with overpayment of taxes in the taxpayer’s personal account To refund the overpayment of transport tax, you must indicate your account details in your personal account. There is no need to fill out separate forms or submit a paper application.

Owners of old cars want to be exempt from transport tax

We are talking about cars older than 10 years. According to the author of the proposal, only people “with a low level of well-being” buy them and the tax hits their wallets.

From time to time, initiatives appear in the Russian Federation to abolish taxes for car owners. Another idea became known today, December 5, 2018. Owners of cars whose age exceeds ten years and whose market value is no more than one million rubles are proposed to be exempt from paying transport tax. A corresponding proposal has already been sent to the Minister of Industry and Trade of the Russian Federation Denis Manturov.

Pictured: Porsche Cayenne

The author of the initiative is State Duma deputy from the LDPR faction Vasily Vlasov, RIA Novosti reported. He believes that such cars are bought by people “with a low level of wealth.” Let us emphasize that the price threshold he defined is 1,000,000 rubles. In his opinion, low-income citizens will be able to afford to buy ten-year-old used Porsche Cayenne, Audi Q7, Mercedes-Benz S-Class, BMW X5 or Range Rover. Such cars are offered, for example, in Moscow within the specified amount. Owners of such cars, again according to him, will be burdened with paying transport tax.

In the photo: Mercedes-Benz S-Class

Let us remind you that today owners of cars worth more than 3 million rubles (regardless of the age of the car) pay more: they are charged the so-called “luxury tax”. In March of this year, we reported that the Ministry of Industry and Trade of the Russian Federation expanded the list of luxury cars. The list has increased by almost a quarter due to rising prices in the car market.

The deputy also advocates making changes to the transport tax calculation system. He considers it unfair to take into account the power of car engines (the higher the output of the engine, the more the owner pays to the state). He explained that two cars with engines of the same power, but different years of production, differ in cost. Judging by his words, it is the market value of the car that should form the basis for calculating the transport tax.

In the summer of this year, Kolesa.ru reported that most of the transport tax in the Russian Federation was paid by owners of cars with engines with power over 150 hp. At the same time, cars with less powerful engines account for 87% of the country’s total vehicle fleet. By the way, at the beginning of 2017 it consisted of about 38 million cars.

If it is now proposed to exempt owners of old cars from paying transport tax, then previously it was proposed, on the contrary, to increase it for them. The initiative was explained by concern for the environment: an increased tax threatened the owners of cars with eco-class engines lower than Euro-4. Things didn’t go further than voicing the idea.

More recently, we talked in more detail about what transport tax is, as well as about who may not pay it.

Taxes and Technical Regulations do not apply to cars over 30 years old - is this true?

Benefits for cars over 30 years old

There are a number of vehicles that are exempt from some technical condition monitoring obligations, as well as from the tax burden. In recent years, information has increasingly spread online that these include old cars. Allegedly, cars older than 30 years are not subject to transport tax, and they are also not subject to the Technical Regulations of the Customs Union. Is all this true as of 2019, let's find out. We will also explain how the legislation works in this regard!

Cars over 30 years old are not subject to tax – right?

Not really. The fact is that car taxation is regulated by 2 types of regulations:

- The Tax Code of the Russian Federation establishes general tax rules for cars,

- regional tax legal acts regulate tax rates, as well as types of vehicles that are completely exempt from it.

The Tax Code of the Russian Federation takes precedence over regional documents, and therefore, if there is a contradiction, one must be guided by the former. And it is he who does not establish any benefits for cars over 30 years old. “Proof” is found in Article 358 of the code - it lists vehicles whose owners are exempt from paying transport tax.

But all this only means that benefits for old cars are not regulated by federal legislation. But regional codes establish the possibility of tax exemption for old cars, but only under certain conditions. And we are talking about age not at all 30 years, but depending on the specific region - up to a certain year of manufacture of the car.

Let's look at the regions and cities in which such subsidies apply in 2019.

In these 5 regions of Russia there are benefits for paying transport tax. There are none of these in Moscow and other big cities as of 2019.

Please note that we are talking specifically about a tax subsidy. This means that in order to be exempt from paying the fee, you need to take certain actions depending on the specific region - submit an application to the tax office to receive it with the attached documents (most often this includes documents for the car).

Are old cars not covered by the Technical Regulations?

But this is already true! But this is unlikely to make it any easier for you. Why?

Let's start with the same “proofs”. According to the provisions of the Technical Regulations of the Customs Union “On the safety of wheeled vehicles”:

3. This technical regulation does not apply to vehicles :

.

3) categories L and M1, from the date of production of which 30 or more years have passed , as well as categories M2, M3 and N, not intended for commercial transportation of passengers and cargo, from the date of production of which 50 or more years have passed, with the original engine, body and, if available, framed, preserved or restored to original condition;

As you can see, the fact that the Technical Regulations do not apply to cars over 30 years old applies only to categories L and M 1 . What are these categories? Everything is very simple:

- L – these are motorcycles, including scooters, mopeds, three-wheelers,

- M 1 are vehicles that are designed to transport people, and the number of seats in which is no more than 8 - that is, almost all cars, crossovers and SUVs over 30 years old are standard.

But there is also a condition that the regulations do not apply to categories M 2 , M 3 and N. These are, respectively, buses with more than 8 seats (up to 5 tons or more, according to category designations) and trucks (intended for transporting goods). And for them, an important condition is that they must be over 50 years old inclusive, as well as a number of other obligations listed in the quotation.

Please note: we indicated above that there is no practical benefit from this. This is true, because the traffic regulations in force in 2019 indicate that changes cannot be made to the design of cars without the permission of the traffic police. And this is without any reference to the Technical Regulations. Traffic rules, being a government decree, take precedence over the Technical Regulations, which, in turn, are a type of GOST.

Transport tax on old cars in Russia in 2019

Last update 2019-03-10 at 13:27

In this article we will tell you the rules by which the tax on old cars is levied in 2019, and in what cases benefits and increasing coefficients are applied. We remind you that this year physical. individuals pay tax for the previous year 2018.

How is transport tax calculated for a car over 10 years old?

The general rules for calculating tax are enshrined in the Tax Code (Chapter 28). According to paragraph 1 of paragraph 1 of Article 359 of the Tax Code, the tax base is determined by the power of the car engine (in hp). The specific rate is set per 1 hp. (Clause 1 of Article 361 of the Tax Code). The general calculation formula is as follows: rate × number of hp. × number of months of ownership per year/12.

In certain cases, increasing factors are added to this formula. They apply to passenger cars costing more than 3 million rubles, a list of which is compiled and updated annually by the Ministry of Industry and Trade. Lists for the current and previous years can be found on the ministry’s website or downloaded from our website (links to 2018 and 2019 ).

Important!

The size of the coefficient depends not only on the car model and its cost, but also on the year of manufacture. Determine the age of the car, counting from the year of manufacture.

As can be seen from the table data, the increasing coefficient for transport tax on cars older than 10 or 15 years is applied only if the average cost of this car exceeds 15 million rubles. and it is included in the list of the Ministry of Industry and Trade. In practice, according to the current lists, coefficients are used only for cars no older than 5 years.

Conclusion!

In the reporting periods 2018 and 2019. When calculating tax on a car older than 5 years, the increasing factor is not applied.

How to check rates and benefits

According to the Tax Code, transport tax is a regional tax. This gives the authorities of the constituent entities of the Russian Federation the right to independently introduce regional benefits and set rates. Their size may depend on various factors, including:

- vehicle categories;

- car age;

- environmental class, etc.

The Federal Tax Service website contains a special reference book that contains the conditions for applying transport tax in a specific region.

How to use it:

- Select the type of tax, reporting period and region.

- Reveal the details of the new law. If there are two acts, you need to check both.

- In the table that opens, see the rates valid for vehicles with the required category and engine power.

- In a deposit with regional benefits, check whether there are benefits in the region when calculating tax on a car over 10 years and what are the conditions for their provision.

So, in the Voronezh region. Transport tax is not paid if the car is more than 25 years old and its engine power does not exceed 100 hp.

According to the online directory, regions introduce benefits for used cars based on various criteria. Among them:

- vehicle age;

- year of issue;

- Country of Origin;

- brand;

- owner category;

- engine power, etc.

Some regional benefits (for the reporting period 2018):

- In the Tula region. There is no tax on vintage cars 50 years or older.

- In the Novgorod region. For disabled taxpayers, the tax on trucks made in 1994 and older with a capacity of up to 100 hp has been abolished, if they are manufactured on the basis of domestic passenger cars (GAZ, UAZ, VAZ, IZH, Moskvich).

- Residents of the Murmansk region. do not pay tax on passenger cars older than 30 years with a power of no more than 100 hp.

Important!

You can calculate the tax amount for a specific year, taking into account regional benefits, using the Federal Tax Service tax calculator.

Example 1

Example 2

Example 3

In 2019, Sergey will pay tax on a 2005 car at a reduced rate (6.5 rubles/hp)

- The Tax Code does not provide for an increase in the tax on old cars. It is calculated using the same formula as for new vehicles.

- Regional authorities have the right to introduce differentiated rates depending on the age of the car, as well as establish their own benefits.

- When calculating the tax on expensive passenger vehicles, the production of which has passed no more than 20 years, increasing coefficients may be applied. A closed list of such vehicles is established by the Ministry of Industry and Trade. There are no vehicles older than 5 years in the current list.

If you find an error, please select a piece of text and press Ctrl+Enter .

I tried very hard when writing this article, please appreciate my efforts, it is very important to me, thank you!

(5 ratings, average: 4,80)

Nuances and subtleties of paying transport tax on old cars in Russia

The transport tax applies to owners of almost all types of vehicles - cars, motorcycles, scooters, snowmobiles and water transport. It doesn’t matter whether the car is new or old, whether it is being used or the car has been in the garage for ten years: the owner is obliged to pay transport tax.

In the winter of 2018, it was proposed to abolish the duty on old cars in Russia. In April 2019, the Ministry of Finance took the initiative to add new fees for transport owners. We will tell you in the article whether the proposals will become legislative and how much Russians pay for old vehicles today.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, just call, it’s fast and free!

New state duty on cars in 2019

Almost half of all passenger cars registered in the country are cars older than 10 years. And this situation has not changed for almost twenty years (https://www.kommersant.ru/doc/3752955). If the car is also expensive, the car owner pays an increased transport fee.

- For individuals, the increasing coefficients are different and depend on the age and cost of the car.

- For legal entities , according to Article No. 362 of the Tax Code of the Russian Federation for cars older than 10 years worth more than 10 million rubles. the coefficient is the same - 3.

They want to reduce the payment

In December 2018, State Duma deputy from the LDPR faction Vasily Vlasov proposed abolishing the transport tax on cars older than 10 years if their cost is below 1 million rubles.

As RIA Novosti reported (https://ria.ru/20181205/1543479059.html), an initiative letter was sent to the Ministry of Industrial Trade. According to the deputy, calculating transport tax based on engine power is “not entirely fair”, since the cost of two cars with the same power, but different years of production, differs greatly.

“ Due to the low level of well-being, most citizens have to purchase used cars, while the average age of a used car sold exceeds ten years. In this case, he needs the car so that he can use it occasionally in exceptional cases. By imposing such a tax on cars, the state worsens the situation of the population with a low standard of living, ” Vlasov explained.

There are no official confirmed decisions on this issue from the Ministry of Industry and Trade yet.

Can raise

On April 1, 2019, the Ministry of Finance of the Russian Federation developed a bill to include six non-tax payments in the Tax Code. Two of them – environmental and recycling – concern motorists:

- Environmental fee - for environmental damage from old cars (https://regulation.gov.ru/projects#npa=84496).

- the recycling fee is optional - if the car owner does not pay it, he has the right to dispose of the old car himself and save money. According to the new bill, it is assumed that the recycling tax will be paid by businessmen who import foreign cars into the country. But how this will actually happen is unknown.

It is planned that the law will come into effect in 2021 (https://www.interfax.ru/business/656940).

Contributions to the Russian treasury for cars that are 20 and 25 years old?

Tax fees for owners of old expensive cars depend on the age of the vehicle:

- Over 10-15 years old - coefficient 2. If the car costs more than 15 million rubles. – the coefficient increases to 3.

- For cars that are more than 20-25 years old - coefficient 3.

What does the multiplying factor mean? You need to multiply the transport tax rate by it.

The age of a car is calculated not from the date of purchase, but from the date of manufacture.

The amount of transport tax depends on the price of horsepower in the region where the car is registered. Rates by region are published on the portal of the Federal Tax Service - https://www.nalog.ru/rn77/service/tax/d814314/.

Using an example, let's calculate the tax on the Mercedes-Benz E-200 coupe:

- This foreign car is included in the list of expensive cars of the Ministry of Industry and Trade.

- Power – 184 hp.

- Registered in St. Petersburg.

- Year of manufacture – 2008.

The rate in St. Petersburg for a car with such power is 50 rubles, the increasing coefficient for a car that is 11 years old is 3 calculation formula: 184 hp. × 50 × 3 = 27,600 rub.

There are categories of citizens who can take advantage of transport tax benefits for cars older than 10 years. Pensioners, disabled people, WWII and military veterans, Chernobyl liquidators and members of large families pay reduced vehicle fees.

Current subsidy amounts must be requested from the Federal Tax Service office in the region of residence of the car owner. In some regions, car owners do not pay taxes at all if the car falls under certain conditions. These are the residents:

- St. Petersburg (vehicles before 1990, no more than 80 hp).

- Voronezh (vehicles up to 100 hp).

- Khabarovsk (TS until 1991).

- Ingushetia (vehicles until 1994, up to 90 hp).

- Tver (TS until 1970).

Are cars over 30 years old subject to tax?

Federal legislation does not stipulate the abolition of transport taxes for cars over 30 years old, but in Murmansk, the only region, owners of such cars are not subject to tax.

Advantages and disadvantages

In Russia, for car owners there are no advantages from the tax on old cars ; in this case, only the state benefits. The federal budget is significantly replenished from organizations that have expensive vintage cars on their balance sheets or from wealthy Russians who can afford to have an expensive used car in their garage and pay higher taxes for it.

For the average population - pensioners and low-income people - there are only disadvantages from a tax on old cars. People drive such cars because they cannot afford to buy and maintain a new car.

Before increasing the transport tax for this category of people and introducing an environmental tax, you need to study the real economic situation and carefully study the tax conditions.

Remember, the age of a car is calculated from the date of its manufacture, not its purchase . Only owners of expensive foreign cars pay an increased coefficient for the age of the vehicle, but changes in legislation are possible. In six regions of Russia, owners do not pay transport tax on old cars.