Applying for MTPL insurance for a car via the Internet

OSAGO calculator

According to the Directive of the Central Bank of the Russian Federation, the eOSAGO agreement begins to be valid no earlier than 3 days after the day of registration. We recommend planning your purchase at least 3 days in advance.

3 reasons to apply for MTPL online

- Fast . You apply for a policy without queuing or going to the office; it is immediately sent to your email.

- Comfortable . Your policy is always available in your personal account, by e-mail or Passbook/PassWallet on your smartphone.

- Reliable . More than 140 points for settling losses under MTPL in Russia are ready to provide support in case of an insured event.

- Authorization.

Vehicle

- City of owner: Moscow, St. Petersburg, Kazan, other.

- Vehicle category: A - motorcycles, B - passenger cars, BE - passenger cars, C - trucks, other.

- Car make and model.

- Year of manufacture: 2019, 2018, 2017, other.

- VIN number.

- Engine power, hp

- Period of use: 20 days - 1 year.

- Purpose of use: personal, educational, taxi, rental, other.

- Full Name.

- Age.

- Driving experience.

- Identification.

- Passport address.

- Mobile phone.

Obtaining a policy

- Apply for an eOSAGO policy and receive it by email.

- Delivery: not required, you just need to print the received file.

- Payment: only VISA, MASTERCARD, MAESTRO and MIR cards are accepted for payment.

According to the Directive of the Central Bank of the Russian Federation, the eOSAGO agreement begins to be valid no earlier than 3 days after the day of registration.

We recommend planning your purchase at least 3 days in advance. Apply online now.

PJSC IC "Rosgosstrakh", license of the Bank of Russia for the provision of insurance OS No. 0001 - 03, issued on 06/06/2018, unlimited. Central office address: 121059, Moscow, Kievskaya st., 7. When paying for your policy online, no commission is charged.

About electronic MTPL

In 2019, every driver who has reached the age of 18 can calculate and buy compulsory motor liability insurance on the insurance company’s website and receive an electronic policy. Just register in your personal account, fill out the details and pay for the order - we will send the MTPL policy to your email.

The registration process consists of only 3 steps

- Calculation

- Payment

- Seal

The policy must be printed out and taken with you. It does not need seals - it is certified with a special electronic signature, which is verified on a computer. An electronic policy is as valid as a paper one .

The tariffs applied when concluding a compulsory motor liability insurance agreement electronically do not differ from the tariffs applied when issuing paper policies at the office of an insurance company or at an agent.

Settlement online

On our website you can quickly check the status of your payment case under the MTPL policy or report the occurrence of an insured event.

Advantages of electronic MTPL

- No office visit, no queues . All you need is a computer and half an hour of time.

- Faster than courier delivery . We send the policy to your email immediately after payment.

- The policy is always with you . It is stored in your mailbox and saved in your personal account. It can be printed and/or saved to Passbook/PassWallet on your smartphone.

- Convenient mobile application . Personal account in your smartphone.

What is needed to calculate the cost and purchase of MTPL

- Passports of the policyholder and the owner of the car.

- Driver's licenses of all approved drivers.

- Vehicle registration certificate.

- Vehicle passport.

- Valid diagnostic card.

- Bank card Visa, MasterCard or Mir.

- Half an hour of free time.

Please note that if, as a result of the check, some data does not match the PCA, you can send us scans of your documents and we will check them manually.

Beware of scammers!

Be careful, apply for electronic MTPL only on the official website www.rgs.ru. Do not resort to the help of intermediaries - it is illegal ! You risk purchasing an invalid or fake MTPL policy. You can check the authenticity of any MTPL policy on the RSA website.

We are always there

Also at your service is one of the widest networks of insurance offices in Russia - more than 2,000 Rosgosstrakh sales points where you can buy compulsory motor liability insurance.

We will be happy to answer all your questions and insure you. Find your nearest sales office

Other insurance products of Rosgosstrakh:

- CASCO calculator

- Green Card Calculator

- Travel insurance abroad

- Apartment insurance

- Tick bite insurance

- Other types of online insurance

Questions and answers on registration of compulsory motor liability insurance on the website

Design rules

If you are already a client of Rosgosstrakh, have access to your personal account and want to renew your MTPL policy, you need to go through 5 simple steps:

- Log in to your personal account.

- Go to the OSAGO online calculator - all the necessary data will already be filled in.

- Get an estimate of the cost of renewal.

- Pay for compulsory motor liability insurance on the website with a bank card.

- Receive the policy and accompanying documents by email.

When is it time to renew OSAGO?

It is better to renew OSAGO before the expiration of the current policy, so that there are no interruptions in insurance. According to Directive of the Central Bank of the Russian Federation No. 4723-U, at least 3 days must pass between the date of filing the application and the start of the contract . For example, if a new policy is to be valid from September 24, then it must be issued no later than September 20.

According to the legislation in force in 2017, a car insurance policy can be renewed no earlier than 2 months (60 days) before the expiration of the previous compulsory motor liability insurance policy.

We remind you that there is a fine for expired insurance and for driving without compulsory motor liability insurance.

How to check your MTPL policy?

The authenticity of the MTPL policy can be checked on the website of the RSA (Russian Union of Insurers).

What documents are needed to purchase MTPL online?

To obtain an insurance policy you will need the following documents:

- Passport of the policyholder and the owner of the car.

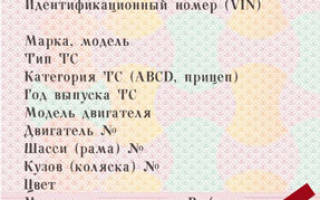

- Vehicle Registration Certificate (VRC).

- Vehicle Passport (PVC).

- Driver's licenses of all authorized drivers.

- A valid diagnostic card for the car, if the car has undergone technical inspection in accordance with the legislation of the Russian Federation.

Data from all documents is required for accurate calculation of the KBM through the automated information system RSA.

How to pay for electronic MTPL?

You can safely pay for your policy using a Visa, MasterCard, Maestro bank card or the Mir national payment card.

Before paying, make sure that the 3DS service is activated on your card to protect payments on the Internet. If you receive SMS codes to confirm online purchases, it means that 3D Secure is activated on your card. The principle and conditions for activating the service can be clarified with your issuing bank.

I have a new vehicle / I am a new driver

If you have a new vehicle or are applying for compulsory motor liability insurance for the first time in your life, it means that your data is not yet in the RSA system. Since everyone needs to pass this check to obtain a policy, the procedure for you will be as follows:

- You need to fill out all the steps of the calculator, in Step 4 confirm the correctness of the completed data and click the “Next” button.

- After an unsuccessful PCA verification, you will see in the same window a form for sending copies of your documents for verification. Make scanned copies or clear photographs of all specified documents, add them to the form and click the “Send documents for verification” button.

- Within 20 minutes you will receive an email with the results of the verification and a special link for calculation and payment.

Log in to your personal account, follow the link and pay for the policy. Important! The date of payment should not coincide with the start date of the policy, so if the policy is needed tomorrow, then it must be paid today.

I drove for a year without an accident, what discount will I get?

According to the tariff, for each year of accident-free driving, the discount on compulsory motor liability insurance increases by 5%.

Do I need to certify the electronic policy with a seal? Why do I need an electronic signature (sgn file)?

Electronic MTPL is the original of your policy.

- Print the electronic policy file on a printer and carry it with you in the car.

- The printed policy does NOT need to be certified with a seal or signature in the office!

- It does not need to be exchanged for a paper policy in the office.

Instead of a stamp and signature, electronic MTPL is certified by an electronic signature, which comes along with the policy to your email. The signature file (sgn) does not need to be opened or printed, it is simply stored with you. Additional information about the signature is in the cover letter that comes with the policy.

Answers to other questions.

You will find answers to other questions about MTPL (including electronic MTPL and policy price) in the Questions and Answers section.

You can also ask your question or describe the problem in detail through the Feedback form.

What to do, if.

If you do not receive a temporary password or it is not suitable, check the Spam folder in your email or try again later.

If you can’t set a permanent password , make sure that it contains at least 6 characters, must be in Latin, must contain lowercase and uppercase letters, as well as numbers.

Error: “Incorrect personal account type selected”

Make sure that when entering your Personal Account you select the correct type: if you represent a legal entity, then above the email and password entry field you need to check the box “Check if you are a legal entity.”

I don't have my PTS with me?

The number and series of your vehicle’s passport are indicated both in the PTS itself and in the vehicle registration certificate (VRC):

Notification “Confirmation not received from centralized PCA systems”

The notification was received because the data you entered about the drivers, car, owner does not completely match the data contained in the PCA system.

- Make sure you complete all insurance application details correctly (check for typos, dates, addresses).

- If all the necessary conditions for obtaining insurance are met, but you still see the notification “Confirmation has not been received from centralized PCA systems,” use the special form under the calculation and attach scanned copies (clear photographs) of documents confirming the information you entered. The data will be checked by an employee of PJSC IC Rosgosstrakh within 20 minutes, and you will be able to issue an agreement on the website on the same day.

The error “DK required” appears.

The presence of a valid DC is checked automatically based on the entered information about the vehicle.

If you have a diagnostic card, but the error still appears, use the special Personal Account form and attach a scanned copy of the current diagnostic card. After verification, you can draw up an agreement on the website.

What to do in case of technical failure?

Write to us via Feedback. In order for the problem to be resolved as quickly as possible, indicate the calculation number, describe the problem in detail and, if possible, attach a screenshot of the screen.

The calculation data is saved in the browser. Can this be disabled?

The data you enter is saved in the browser to prevent it from being lost. If you are using someone else's computer or the computer is infected with malware, personal data could fall into the hands of criminals.

Do you want to disable the feature or just clear the fields?

Check if you want to disable the function of saving entered data in the browser.

If you do not find your brand (none of the spellings presented matches the name of the vehicle brand in your registration documents), write to the online support service (the “Help” button at the bottom of the screen > “Ask your question” > select the topic of the request “I don’t find the make of my vehicle in the list” - we will add the make of your vehicle to the list).

If you have not found your model , enter the name of the model in accordance with the data of the registration documents in the “Display in policy” field.

What should I do if I am stopped by the traffic police?

Print the electronic policy file in advance and take it with you. This paper does NOT need to be certified with a seal or signature - it is already certified with an electronic signature and is the original of the policy.

It is legal to drive with a printed policy! The traffic police checks the validity of your policy using the RSA database. You yourself can always check the validity of your policy on the RSA website.

If you are worried about traffic police checks, then in this case, together with the policy, we will send an email with links to legislation in the field of electronic compulsory motor liability insurance. Just show it to the police officer.

How to apply for compulsory motor liability insurance via the Internet?

Until recently, to purchase a compulsory motor liability insurance policy, drivers had to go to the insurance company’s office and waste time standing in queues. Today, every car owner can take out MTPL insurance online, without leaving his own home or office, which is a significant advantage. The document is sent to you by e-mail in electronic form. It can be printed or saved on a convenient medium. This significantly reduces the risk of loss or damage to the policy. You can buy electronic MTPL on the website of the AlfaStrakhovanie company.

How to calculate/buy a policy online. Step-by-step instruction

Step 1: provide vehicle details:

- select the category and type of vehicle from the list;

-

indicate the make and model of the car - to do this, enter the first characters and select an option from the proposed list;

- the date when car insurance comes into effect - you can specify an annual insurance period or take out a policy for the duration of transit;

- information about the driver(s), a correct phone number (it is necessary to apply for compulsory motor liability insurance online, since it will receive an SMS confirmation code) and email address. You can log in to the site through the “State Services” portal, then the basic information for issuing a policy will appear in the fields automatically;

- FULL NAME.;

- date of birth;

- passport data in the “series and number” format;

- residence address.

- name of the document confirming the registration of the car;

- series and document number;

- the date of its issue.

- select one of the proposed payment methods for the policy: using AlfaClick Internet banking, VISA or MasterCard bank card;

- speed and convenience. The procedure takes only a few minutes, and there is no need to stand in line or wait for an employee to be released;

- the ability to access the insurer’s website at any time convenient for the client. In most cases, Internet services operate around the clock;

- Availability of information on current prices and tariffs for services provided.

- car make and model;

- engine power and volume;

- region and planned duration of the contract:

- Full name, age, existing driving experience of the policyholder.

- age of the car owner, driving experience;

- the presence/number of accidents the driver has previously been involved in;

- category of the vehicle, power of the engine installed on it;

- insurance period;

- number of persons admitted to management.

- for damage to life and health - four hundred thousand rubles;

- for property damage - five hundred thousand rubles.

- if the driver does not have car insurance with him - five hundred rubles;

- driving during a period not provided for by the contract - five hundred rubles;

- driving a vehicle by a driver who is not included in the insurance – five hundred rubles;

- absence of a valid insurance policy for the vehicle – eight hundred rubles.

- territory of use of the car or region of registration of the owner of the vehicle;

- presence/absence of accidents in history;

- presence/absence of restrictions;

- the number of complete years and experience of driving a car;

- number of horsepower;

- using a vehicle with a trailer;

- period of operation of the vehicle;

- contract time.

- identification document of the policyholder;

- PTS or STS;

- registration of all those admitted to driving (if the contract is drawn up with a list of drivers by name);

- a valid diagnostic card (if technical inspection is required by law).

- Simplicity in design. To apply for a policy, you do not need to visit the insurance office - just fill out the form provided. The data specified in the application will be sent to the RSA database for verification, and after verification it will be generated automatically.

- Delivery. You won't need to adjust your schedule to meet with the courier or insurance agent. The agreement will be sent to you electronically by email. It will be enough to print it out and always have it with you.

- Less risk of fraud. One of the main problems with paper policies is the likelihood that an unscrupulous seller will issue you insurance on a fake form. Unlike a regular form, you buy an electronic policy through the website, and it almost immediately appears in the RCA database.

- The policy is always at hand. In case of loss or damage, you will only need to re-print it.

- Opportunity to find out the cost of the largest companies at competitive prices. You can save a lot.

- To purchase insurance, you do not need to go anywhere - just fill out an application for the selected offer. Delivery is free in some regions.

- On our website you can purchase an electronic policy. At the same time, you will not have to fill out the same type of forms several times on the websites of different insurers. The application filled out on our website will be sent simultaneously to several companies, all you have to do is choose the offer you like.

- We guarantee the authenticity of insurance purchased through our service.

- make, model, year of manufacture and modification of the vehicle;

- period and start date of insurance;

- region of registration and actual residence of the owner;

- information about the owners.

- A

- Adygea

- Altai

- Altai region

- Amur region

- Arkhangelsk region

- Astrakhan region

- B

- Bashkortostan

- Belgorod region

- Bryansk region

- Buryatia

- IN

- Vladimir region

- Volgograd region

- Vologda region

- Voronezh region

- D

- Dagestan

- E

- Jewish Autonomous Region

- Z

- Transbaikal region

- AND

- Ivanovo region

- Ingushetia

- Irkutsk region

- TO

- Kabardino-Balkaria

- Kaliningrad region

- Kalmykia

- Kaluga region

- Kamchatka Krai

- Karachay-Cherkessia

- Karelia

- Kemerovo region.

- Kirov region

- Komi

- Kostroma region

- Krasnodar region

- Krasnoyarsk region

- Crimea

- Kurgan region

- Kursk region

- L

- Leningrad region.

- Lipetsk region

- M

- Magadan region

- Mari El

- Mordovia

- Moscow region

- Murmansk region

- N

- Nenets Autonomous Okrug

- Nizhny Novgorod region.

- Novgorod region

- Novosibirsk region

- ABOUT

- Omsk region

- Orenburg region

- Oryol region

- P

- Penza region

- Perm region

- Primorsky Krai

- Pskov region

- R

- Rostov region

- Ryazan region

- WITH

- Samara region

- Saratov region

- Sakha (Yakutia)

- Sakhalin region

- Sverdlovsk region.

- North Ossetia

- Smolensk region

- Stavropol region

- T

- Tambov region

- Tatarstan

- Tver region

- Tomsk region

- Tula region

- Tyva

- Tyumen region

- U

- Udmurtia

- Ulyanovsk region

- X

- Khabarovsk region

- Khakassia

- Khanty-Mansi Autonomous Okrug

- H

- Chelyabinsk region

- Chechen Republic

- Chuvashia

- Chukotka Autonomous Okrug

- I

- Yamalo-Nenets Autonomous Okrug

- Yaroslavl region

- Car insurance

- own passport and license;

- vehicle diagnostic card;

- vehicle registration certificate.

- inspection certificate;

- confirmation of vehicle registration;

- approved internal charter;

- extract from the Unified State Register of Legal Entities and tax authorities;

- current seal of your organization.

enter the year of manufacture and modification of the vehicle, the power will be determined automatically;

select the purposes of use from the drop-down list;

indicate the license plate number of the vehicle;

indicate the VIN of the car, which is registered in the vehicle passport (PTS), or, if there is no VIN, enter the body number or chassis number.

Step 2: fill out the basic insurance parameters:

Step 3: Provide the following information:

Step 4: click the “Calculate E-OSAGO” button, and the system will automatically send the information for verification using the RSA database.

Step 5: after calculating the cost, provide information about the vehicle:

Step 6: Payment:

Frequently asked questions about E-OSAGO

The electronic policy form contains the same fields and information as the paper policy. The information in the documents is identical and complies with the requirements of the law. The electronic insurance contains the details of the owner, policyholder, insurance period, characteristics of the vehicle, etc.

How to check E-OSAGO?

The authenticity of the policy can be checked on the official website of RSA.

What is more expensive – E-OSAGO or regular paper insurance?

The price of electronic and paper policies is calculated at the same rates. Under the same conditions for concluding a contract, the cost of compulsory motor liability insurance will be the same both when purchased in the office and when issued via the Internet.

How to terminate an E-MTPL issued electronically?

To terminate a car insurance contract, you need to contact the nearest office of our company.

Do I need to print out E-OSAGO?

We recommend printing out the policy and attaching it to the rest of the documents for the car. Having insurance in paper form will help avoid misunderstandings when communicating with traffic police officers.

What should I do if I lost my electronic policy?

The paid insurance is saved in your email inbox and in your “Personal Account” on the insurer’s website. You can print the policy again at any time.

Is it possible to convert purchased paper insurance into electronic form?

This option is not provided. Upon expiration of your current insurance, you can issue an electronic MTPL policy.

Apply for MTPL online

Enter the car number for the service to fill in modification data

Electronic MTPL

The ability to issue an electronic MTPL policy was approved by regulatory documents from 10/01/2015. The amendments introduced to the laws oblige all insurance companies to introduce the ability to online issue an E MTPL policy from 01/01/2017.

Electronic registration of car insurance has a number of advantages:

The whole procedure will take no more than 5-6 minutes, and there is no need to make copies of any documents, the main thing is to accurately enter the available personal data.

To buy an MTPL policy online, the car owner must enter the following data:

Some organizations provide discounts for regular customers; in this case, the calculator requires you to indicate information about already concluded insurance contracts.

The cost of an electronic OSAGO policy

Each insurance company develops its own rules according to which it calculates the cost of compulsory motor liability insurance. Despite the fact that they are based on uniform tariffs and base rates for all, established by insurance regulatory authorities, insurers are given the right to use various adjustment factors. Due to this, calculations of the cost of a policy from different insurers can differ quite significantly.

In general, the price of E OSAGO depends on the following main factors:

OSAGO calculator online

A convenient way to calculate your policy

OSAGO CALCULATOR

An OSAGO policy is a compulsory motor third party liability insurance agreement that will help the car owner financially protect himself in the event of an accident due to his fault.

Compensation will be triggered when civil liability occurs as a result of causing harm to the life, health or property of third parties while driving a car. The maximum limit of liability of the insurer for each case is:

In case of an accident with three or more drivers, each victim can claim insurance compensation in the amount of the above limits. It is important to remember that this type of insurance does not cover the costs of restoring the car of the person responsible for the accident. This type of protection is provided by Casco. Insurance can be purchased on paper or electronically.

Federal Law No. 40 establishes a ban on driving a car without a contract. The penalty for failure to comply with this requirement is:

What do you need to calculate the cost of insurance?

The policy price is calculated using the base rate and additional adjustment factors. This tariff is set by each insurance company at its own discretion within the range approved by the Central Bank. Adjustment factors are also developed and approved by the Central Bank, but, unlike the basic tariff, they are the same for everyone. The parameters that influence the calculation of the cost of insurance include:

What documents are needed for registration?

To purchase this type of compensation you may need:

Today it is not necessary to go to the insurer’s office and apply on a paper form. Issuing an insurance policy electronically has a number of significant advantages:

Despite all the listed advantages, the type of policy - paper or electronic - does not in any way affect the cost of insurance.

How to insure a car cheaply?

Since the insurance company can set the base rate at its discretion, the cost of insurance in different companies may vary. Using our calculator, you can not only choose the best offer at the lowest price, but also save time - apply through our website.

Advantages of registration through our website

How to apply for a policy on our website?

First of all, you need to calculate the insurance for your car. To do this, fill in our calculator with information about the vehicle and insurance parameters, namely:

When calculating the cost, you may not fill out all the fields, but in this case the calculation will not be accurate, without taking into account the bonus-malus coefficient, which, depending on the driver’s insurance history, can range from 0.5 to 2.45. If you want to make insurance without restrictions on the number of persons allowed to drive a vehicle, then to calculate the CBM you must indicate the passport details of the owner and the VIN of the car.

We work only with trusted partners, so no matter which company you choose, we guarantee its authenticity.

Car insurance

Place of registration of the vehicle owner:

Questions - Answers

Is the OSAGO policy genuine?

We work under a direct agreement with insurance companies, and we guarantee the authenticity of the MTPL policy and its availability in the database of the Russian Union of Insurers (RUA).

Is it possible to apply for compulsory motor liability insurance without a diagnostic card?

For cars less than three years old, a diagnostic card is not required (when filling out, leave the fields with the number and expiration date blank).

If the car is more than three years old, you can issue an electronic policy, but you still need to get a diagnostic card.

Why does the MTPL policy begin only 3 days after the conclusion of the contract?

According to the Directive of the Central Bank of the Russian Federation No. 4723-U, the electronic MTPL policy begins to be valid three days after the day of registration.

Why is the BMR equal to 1 in the calculation, although the driver was not involved in an accident?

There can be many reasons for resetting the KBM. Carefully check the correctness of the driver information entered. If the data is correct, to restore the KBM, you can contact the insurance company where the previous policy was issued, or use the KBM restoration service.

How quickly does the MTPL policy arrive by e-mail?

An electronic policy is sent by email immediately after payment. If you have not received the policy by e-mail, write to us.

For which categories of vehicles can a compulsory motor liability insurance policy be issued?

At the moment, we only have compulsory motor liability insurance available for category B.

Good company

It's time to take out an insurance policy. I thought for a long time about which company to choose so that I could get a policy there quickly and without hassle. Initially, I read a bunch of reviews on the Internet. I decided to apply with Ingosstrakh. Moreover, I also recommend this company.

Good company

The Alpha Insurance company was recommended to me by guys at work. They themselves issue compulsory motor liability insurance for their cars, the prices are more than acceptable. You don’t need to go anywhere, in a calm environment from home, fill out the necessary data, pay in a convenient way, etc.

OSAGO insurance

When buying a car for my husband, on the recommendation of friends, we applied for an MTPL policy from AlfaStrakhovanie. Everything turned out to be so simple! I called the organization and they offered us to submit an application on the company’s website online without visiting the office. We have filled out the application here.

Online insurance

I have always been insured with Alfa Insurance before, I trust this company and the price makes me happy. I recently found out that I can insure my car via the Internet. But for some reason I was worried that the policy would not be valid or that I would be deceived. But mine is familiar.

great company

I have been insuring my car for several years now, I switched to this company on the recommendation of a friend, and have never regretted it! Today I took out a policy under the very convenient Formula 50+ program, you pay half, and the second half only when an insured event occurs, if.

Insurance companies

OSAGO policy may become gold

Having rejected the Ministry of Finance’s tough bill on the liberalization of compulsory motor liability insurance, State Duma deputies took up this idea, proposing in their new bill to allow insurers to set individual tariffs.

New fines will be introduced for Russian drivers

New fines for Russian car owners and drivers come into force on January 1, 2020. Now, for a GAZelle left overnight in the courtyard of a residential building, its owner will be fined.

The road bridge from Russia to China will be opened in 2021

Large-scale construction of a bridge in the Far East has been completed.

-

#OSAGO /

No motorist can say with certainty that he will not become a victim of an accident. And after an accident, the car owner not only has to repair the damaged vehicle, but sometimes also undergo treatment himself. To reduce restoration costs as much as possible, it is worth taking out a compulsory motor liability insurance policy. It will take a little time, but as a result you will receive reliable protection against unpleasant surprises.

What documents need to be prepared

By law, car insurance is issued to both legal entities and individuals. If you need to buy a policy for yourself, be prepared to provide:

If you are driving someone else's car, you will also need a power of attorney from its owner. It is interesting that for individual entrepreneurs the list of required documents will be the same as for individuals.

For a driver who does not insure his vehicle, the law provides for serious fines. That is why it is much easier to buy a policy than to be punished later for not wanting to take out one.

And it should also be noted that a small business in the form of an individual entrepreneur does not need to prepare any additional certificates. For entrepreneurs, the same list of documents is provided as for individuals. But all kinds of companies will have to provide the following papers:

But it must be said that this list changes periodically, so check the current checklist with our customer support.

How to determine the cost of a future policy in advance?

There are at least two ways to calculate the final price of online car insurance. Firstly, this is done using a unique calculator. To do this, we recommend going to the appropriate page, entering the correct information in all fields and making the final calculation.

In conclusion about our advantages

Undoubtedly, online car insurance has full legal force, but the process of purchasing it is much simpler than regular one. For example, with us all stages of its design are optimized as much as possible. This allows the client to obtain the desired document within a few days with just a couple of clicks. That is, you just need to fill out a special form, pay the cost of the policy in full and then receive an archive with the completed certificate by email.