Class at the beginning of the previous MTPL policy

Class at the beginning of the annual insurance period

MTPL insurance is mandatory for every car owner, in accordance with Federal Law No. 40 “On compulsory civil liability insurance of vehicle owners.” But the cost of the “automobile license” is calculated individually. For your friend or neighbor, it may be significantly higher or lower than yours, it depends on many factors. A particularly important one is the class at the beginning of the annual insurance period. What is it and what does it depend on? Is it possible to determine it yourself? You will find answers to these and other questions in the article.

What is the class at the beginning of the insurance year?

The class at the beginning of the insurance year is a certain category that is assigned to the car owner based on the results of the past year and depends on the accident-free driving history. Depending on the class, the insurance company provides the car owner with an incentive in the form of a discount on the purchase of a policy, or, conversely, a penalty in the form of an increased cost of insurance.

The cost of an insurance policy is calculated taking into account many factors (make and model of car, locality, age and experience of the driver, and others). The driver's insurance class is the only calculation criterion that the car owner can influence independently using his driving style.

OSAGO insurance class: what is it?

The insurance class in OSAGO is an indicator of the driver’s driving quality. If a person re-applies for a “motor citizenship”, and in the previous year he did not get into accidents or traffic accidents, i.e. the insurance company did not have to intervene and pay out funds, then the policy will cost 5% less. Conversely, for a driver who was involved in an accident on the road in the previous year with the involvement of the insurance company, the cost of the policy for the next year will be higher.

The MTPL insurance class is a criterion that can become both an incentive and a punishment for the driver. The insurance company, also pursuing its own interests, competently motivates drivers to drive carefully and without accidents, which reduces the number of accidents on the roads.

How can you determine the class of vehicle owner?

The cost of a car license changes annually. Software failures happen quite often, and the human factor has not been canceled. Therefore, in order not to overpay for an insurance policy due to an accidental error, it is recommended to independently check the class of the owner of the vehicle. To do this, you first need to correctly determine its value. This is not difficult to do; let’s look at specific examples.

Let's say a car owner takes out a second policy, but over the previous year he did not get into an accident with the involvement of an insurance company. His insurance class was 3, but for exemplary driving it increases by one point and becomes 4, and the cost of insurance is reduced by 5%. In another year, under the same conditions, the insurance class will increase to 5, and the discount will be 10%. Drivers with 10 years of exemplary driving experience receive a maximum discount of 50% when taking out an insurance policy.

Another situation. The MTPL policy is issued by the owner of the vehicle, who was involved in an accident last year, with the involvement of an insurance company to pay funds to the victims. Previously, its class was equal to 3, but due to an accident it will decrease, and immediately by 2 points and will be equal to 1, and the cost of insurance will increase by 55%. If there were more than 2 payments, then the class will decrease by another 2 points and become minimal (M), and the price of insurance will increase by 145%.

How can you check the class of MTPL insurance?

Every driver can find out his insurance class on the official website of the Russian Union of Auto Insurers (RUA). Information is freely available at any time of the day for all citizens of the Russian Federation.

There are various Internet services that allow you to quickly obtain information about the class of insurance (for example, OsagoOnline.info). They all work with a single RSA database.

To receive information, you will need to fill out a simple form, indicating:

- Driver’s personal information (full name, date of birth).

- Driver's license series and number.

- Date of conclusion of the insurance contract.

When filling out the form, it is important to enter data without errors, otherwise the report will be incorrect.

Why is it so important to check OSAGO classes?

If you are taking out insurance for the first time, then it is not necessary to check the insurance class; in the first year it will be “neutral”, i.e. will not affect the cost of the pole. But in the future, it will not be superfluous to check the class assigned to you. There are many cases when the driver's insurance class is underestimated. The main reasons for this are as follows:

- a banal mistake by a company employee, a typo;

- deliberate deception of insurance clients.

You can check your class and the KBM applied to it at any time using the unified RSA database.

What to do if you find an error?

If you discover that you have been incorrectly assigned an insurance class, then in this situation you can take the following measures:

- Try to restore justice to the insurance company itself. To do this, you need to write a statement asking to correct the error.

- If there is no response from the insurance company, then you have every right to contact Rospotrebnadzor or the prosecutor’s office.

Basic information about KBM

The insurance class is the determining criterion when calculating the cost of a car title, and each criterion has its own coefficient. When determining the amount of payments, the base rate is multiplied by a certain coefficient value.

For the “insurance class” indicator, the “bonus-malus” coefficient (BCM) is applied. There are 15 classes in total, each of which has its own BMC value: from 0.5 to 2.45. The lower the insurance class, the higher the value of the BMR, which means the cost of insurance will be higher. Drivers who follow traffic rules and drive without accidents increase their insurance class and, accordingly, lower their BMI; insurance costs them less.

A driver who applies for compulsory motor liability insurance for the first time receives class 3 by default, the BMI of which is equal to 1 and does not affect the amount of insurance. A year later, when applying for a new policy (or renewing an old one), the insurance company, having assessed the driving history over the past period, increases or downgrades the driver’s class.

On April 1, 2019, a new procedure for assigning KBM came into force. The main changes are as follows:

- The KBM will be assigned to each driver without reference to a specific insurance policy;

- the bonus-malus coefficient will not be reset after a long break in driving;

- The MSC will be reviewed once a year as of April 1. For example, a driver was assigned insurance class 4 on the first of April, and on the first of May he was involved in an accident, and the insurance company compensated for the damage. If the driver buys an insurance policy in June of the same year, he will still have class 4 insurance, and it will decrease only on April 1 of the next year.

The adopted changes should reduce the number of cases of erroneous determination of KBM when calculating insurance.

Bonuses for driving without accidents

The bonus system of rewards for accident-free driving provides incentives for careful drivers and motivates all car owners to comply with road safety rules.

When using insurance in the first year, the driver does not have any additional bonuses , but when re-issuing a policy, his driving history will be carefully checked by the insurance company and, if he deserves an incentive, it will be provided in the form of a discount.

If you need to change insurance

There are situations when a car owner needs to change insurance company (the old one went bankrupt, the service is not satisfactory, or for any other reason), but he does not want to lose the accumulated discount for accident-free driving. Thanks to the unified RSA database, you won’t have to do this. When applying to a new insurance company, you will need to confirm your class. To do this, you do not need to provide the old contract, because all the information is already contained in the database.

Thanks to the “insurance class” indicator, each driver has the opportunity to save money when purchasing a policy. Even a young driver with little experience but a careful driving style can get a decent discount, unlike his experienced colleague who often gets into accidents and tends to violate road safety rules. When purchasing a policy, you should be careful and check the coefficient applied to you, because the insurance company employs people who sometimes also make mistakes.

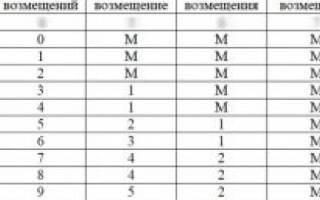

Table KBM OSAGO 2019

BMC or Bonus-Malus coefficient is a coefficient that is used by insurance companies when calculating the insurance premium under a contract. Depending on the presence or absence of accidents, Bonus-Malus can be downward or upward. For the convenience of determining this coefficient, a special KBM table for compulsory motor liability insurance has been created.

Check KBM

What do the rows in the table mean?

The cost of the contract directly depends on what class of KBM will be applied under OSAGO.

The entire table is divided into several sections. The first column indicates the driver's class at the time of insurance. A driver who contacts a company representative for the first time to sign up for a policy automatically receives the initial 3rd class. It is from him that the calculation will occur, up or down.

The second line shows the discount, bonus-malus coefficient, as a percentage.

The last column indicates the presence or absence of claims during the insurance year.

How to use the table

The table is very easy to use. To determine the coefficient, you only need to know: what class was at the time of insurance and how many accidents occurred during the validity of this contract. The second meaning is simple, since every driver knows whether an accident has occurred or not. The first value can be found from the insurance company or on the KBM verification page.

To verify, you must enter: full name, date of birth, series and driver's license number. After entering personal information, verification will occur automatically.

In order to personally find out the coefficient for the start of insurance, you must contact the office of the company where the contract was drawn up. You must have a passport, a signed contract and a driver’s license with you. The bonus-malus check takes no more than 10 minutes.

After you find out your class, you need the 2019 KBM OSAGO table to determine the value. In the first column of the table you need to find your class. The second column will reflect the discount, or increasing factor, that was used when calculating the premium under the contract. Next, the bonus malus for the next year is determined. If there are no payments, he moves down one line in the table. If there were accidents, he moves up the table, depending on the accidents.

An example of calculating the KBM from the table

Here are two examples for your attention. In the first case, the driver drove for a year without any losses, in the second the driver had accidents. Let's look at how the driver class KBM table works in the absence and presence of insured events.

Sergey Petrovich Ivanov contacted the insurer on November 11, 2015. At the time of execution of the contract, the driver was assigned class 9 of the KBM, namely a 30% discount on the base tariff under the policy. It turns out that the client has already used the services of the insurance company more than once and each received 5% for an accident-free ride.

Example #1: No accidents

A year later, Sergei Petrovich again turned to the insurance organization to obtain a new contract. As before, the client had no accidents, and the employee provided a reduction bonus for an accident-free year. To determine this, she used the “Bonus-Malus” table according to OSAGO.

Sergei Petrovich was in 9th grade, moving along this line to the right, in the table, the insurance agent looked at the new class, with the number of insured events “0”. After 9 comes 10, which corresponds to a discount of 0.65 or 35% to the final cost of the insurance contract. It turns out that under the new contract he will receive a discount of 35%.

Example No. 2: There are three accidents

A year later, Sergei Petrovich again turned to a representative of the insurance company to draw up a new contract. Unfortunately, over the past year the client had 3 accidents that were his fault. In this regard, the client did not expect a good discount.

Sergei Petrovich was in 9th grade. Moving along the line, you need to look at the new coefficient, which is assigned to the driver who has had 3 accidents. The new class that an emergency driver receives is 1 or an increasing factor of 1.55. It turns out that the client must pay an increased insurance premium.

KBM with unlimited insurance

If a policy has been issued that provides for an unlimited number of persons allowed to drive a vehicle, then the question arises: bonus-malus class, how to find out? In this case, the bonus is calculated according to the owner of the car.

The coefficient for the owner is determined in the same way as for the driver. The only thing worth taking into account is that the discount on a car by owner is assigned to a specific car and does not apply to others.

For example, you have signed a contract for a VAZ 2110 car for several years in a row, without accidents, and have earned the maximum class of 50%. When purchasing a new car, Kia Ria, subject to an unlimited number of persons, according to OSAGO, you will be assigned an initial indicator of 3. It turns out that a new car means a new system of discounts.

No related posts.

Table KBM OSAGO 2019: 34 comments

Fear, the ZHASO company, was closed, all insurance documents were transferred to the SOGAZ insurance company.

I was insured with ZHASO for five years, but SOGAZ refused to renew my MTPL insurance, explaining that according to the PTS number, I should be insured with NSG ROSENERGO LLC, and since my old policy was running out, I had to look for this one all day The only branch in the whole city, but the insurance was without discounts; they didn’t find KBM. TELL ME where to go.

Thanks a lot ! They returned me KBM -0.55. Here's how to legitimize it for an insurance company?

I have 17 years of driving experience and, thank God, I have never been in an accident. Today I have a KBM 085, that is, 6th grade. Why am I still in the 6th grade all this time?

Thank you very much ! After considering my application for recalculation of the KBM coefficient, I was returned 1811 rubles.

I took out insurance without restrictions for two years, did not change the car, bonus-malus class 3 for the third year, subject to accident-free driving. The agents explain that there is no information about me as a driver... Is this correct? And one more question: if I got into an accident due to the fault of another driver, and filed an insurance claim, will this affect my KBM?

Hello, tell me how to return the kbm I have 10 years of experience, there have been no accidents in my vein, and for some reason I have a class of 11 (kbm 0.6)

Vladimir, that's right.

There are 13 KBM classes in total. For every year of accident-free driving, 1 class is added.

Good afternoon ! I can’t understand why they assigned class 5 and the discount is only 10 percent, if there is limited insurance and no accidents for 3 years

Good afternoon I have been insured for more than 10 years, at the moment I have the maximum discount when checking on the website, but for the last 4 years I have included my wife in the insurance and for the last 4 years they have been counting me according to the 3rd class, it turns out that my wife’s coefficient does not change. Is this really true or is the insurance company not fulfilling its responsibilities properly?

Good day! I have driving experience since 1993, and the discount is 20%, my wife has it for more than 10 years, the State Insurance has completely lost her discount, how can I get the points back? But I don’t intend to pay as a newbie, it’s not our fault and there was no accident.

And if there was an accident, but not through the driver’s fault.

What then?

Which KBM? Let's say KBM = 0.5.

The accident was not the fault of the driver. What is his MBM for next year?

In simple terms, what is a driver class in OSAGO. Why is it needed and how to find out yours?

Guided by these rules of compulsory motor vehicle insurance, each driver receives a class in the MTPL insurance. This class affects the final cost of services provided by insurance companies.

It is important to emphasize that the total cost of insurance depends on several components. One of them is the driver’s insurance class under MTPL. Unfortunately, most car owners have no idea how to correctly determine their insurance class. In this regard, the cost of an insurance policy remains a big mystery for them.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 703-38-65. It's fast and free! . It's fast and free!

What does this mean in insurance?

Let's take a closer look at what this means in insurance and how, for example, class M differs from 1, 4, 6 or others.

The driver's class is a value denoted by the letter M or any value from 1 to 13. Thus, the smallest class in compulsory motor liability insurance is M. The variable “13” is the highest class, respectively. Please note that the driving class does not in any way affect the overall price of insurance. However, it is involved in the calculation of the BMR, thanks to which the insurer can reduce the price of an insurance report by a maximum of 50% or, on the contrary, increase it several times compared to the current one.

The term “MTPL class” is directly related to the bonus-malus coefficient. A driver who applied for a policy for the first time, according to the established standard adopted in 2003, receives third class with a minimum value of “1”. Next, the insurance history is recorded.

The MTPL insurance class indicates the discount coefficient used by the insurance company and calculates the cost of a civilian car. The final discount directly depends on the class: the larger it is, the higher the discount, respectively. The insurance class can be either a decreasing or increasing coefficient for calculating compulsory motor liability insurance. We remind you that the class directly depends on the number of road accidents due to the fault of the insured person (you will learn about how the driver class for compulsory motor liability insurance is established and whether it can help you save on insurance, you will learn from our article)

It is worth noting that with each year that passes without traffic accidents, this coefficient decreases. In other words, when the policy is renewed, the default third class will change to the fourth, respectively. The bonus-malus will be 0.95, and the discount will be as much as 5%. If at least one emergency situation was recorded during the year, the class is lowered, and the cost, on the contrary, increases due to accidents. The further situation is similar.

It is important to emphasize that for each conventional unit of upgrade, the discount increases by 5%. The maximum permissible class is thirteen, the lucky owners of which receive a 50% discount on car insurance.

Since 2007, the MTPL class has been assigned not to a car, but to a specific person. Therefore, the KBM remains the same, even if the car owner changes the vehicle at any time.

What does this indicator give to the owner of the insurance policy?

Having a clean insurance history under MTPL is an important advantage for every driver. Having no recorded traffic accidents, he receives favorable discounts and bonuses, thanks to which he can save a large amount of money on vehicle insurance.

An insured who has received the fifth class under OSAGO for accident-free driving has every right to reduce the key coefficient in the formula for calculating the cost of a “motor vehicle insurance policy.” Thus, for such a driver this variable will be 0.9. This indicator suggests that insurance will be rated 10% lower than for a novice driver who is taking out an insurance document for the first time.

Since car insurance under MTPL is a mandatory procedure, which is stipulated by the current legislation of the Russian Federation, motorists need discounts on this type of service. Thus, the higher the class, the larger the discount on further insurance services in any company.

It must be emphasized that the driver can count on various bonuses for accident-free driving over a certain period of time. To do this, it is enough not to get into traffic accidents due to personal fault. Since absolutely every driver’s appeal to the insurance company to receive monetary compensation for insurance is recorded in a single system, which, in turn, spoils the story.

What is the division?

There are 15 classes in MTPL insurance.

- First class – M. The bonus-malus coefficient in this class is 2.45. Increase in price - 145% discount.

- Second class – 0. The BMR in it will be 2.3. Increase in price – 130% discount.

- The third class is 1. The BMF in it is 1.55. 55% – price increase-discount.

- The fourth class is 2. The KBM in this class is 1.4, and the increase in price is a 40% discount.

- Fifth class - 3. Bonus-malus coefficient 1. There is no increase in price discount, since this class is assigned to novice drivers.

- Sixth grade – 4. KBM is 0.95, and the increase in price is a 5% discount.

- Seventh grade – 5. The bonus-malus coefficient is 0.9. 10% is a price increase-discount.

- Eighth grade – 6. The MMB will be 0.85, and the increase in price will be a 15% discount.

- Ninth grade – 7. KMB – 0.8. Increase in price - 20% discount.

- Tenth grade – 8. The bonus-malus coefficient is 0.75. 25% is a price increase-discount.

- Eleventh grade – 9. The BMR is 0.7, and the price increase-discount will be 30%.

- Twelfth grade – 10. The bonus-malus coefficient is 0.65. The price increase-discount will be exactly 35%.

- Thirteenth grade – 11. What does grade 13 mean? With it, the BMR is 0.6. 40% is a price increase-discount.

- Fourteenth grade – 12. The bonus-malus coefficient is 0.55, and the increase in price-discount, in turn, will be 45%.

- And the last, extreme, Fifteenth grade is 13. The BMR is 0.5. Price increase-discount is equal to 50%.

You will find a detailed table of MTPL classes with coefficients in a separate article.

How to find out yours?

Many drivers often wonder how to find out their MTPL class? The answer is very simple - we will tell you how to do it. You can find out all this information on the official website of the Russian Union of Auto Insurers (RUA). To check, you need to open the database and enter the following in the appropriate fields:

- Last name, first name, patronymic.

- Date of Birth.

- Driver's license number.

After completing these steps, you will receive all the information regarding the insurance history of a particular driver. We conclude that we can obtain the information we are interested in, regardless of the date of registration of insurance. This entire system has great priority over both ordinary drivers and insurance company employees.

Many motorists can take this information even if they need to renew their insurance. And if they need a new MTPL policy, then the information that the previous insurance company had is not lost on the car.

Exclusively all insurers and their companies that issue policies have a common information base on drivers. They are the ones who fill out this data in the database.

The process goes like this:

- All data that the driver has is entered into the database of the Russian Union of Auto Insurers upon initial receipt of the MTPL policy.

- When a motorist applies to the insurance service for any compensation, all amendments are made to the database with the indicated payment amounts, as well as the approximate nature of the damage to the car.

- If the client contacts a new company to create insurance, then its representatives can check and obtain all the information about the previous insurance history using the driver’s license number.

So, we conclude that in order to find out your MTPL insurance class, you just need to go to the database of the official website of the Russian Union of Auto Insurers and enter information about the driver’s identity.

In addition, in order not to be left with nothing, the driver should regularly (at least once a month) check the OSAGO classes with the official database. This must be done even if the insurance company provides this check without the participation of the driver’s client. There are the following subjective reasons for this:

- When concluding a contract, the driver, without knowing it, may stumble upon fraudulent companies. Thus, when calculating the bonus-malus coefficient, various types of inaccuracies may arise. They are easily eliminated through high-quality verification and compliance with official data.

- When concluding a contract, the insurance company may make a mistake when checking the driver’s data. As a result, an extremely low result may be presented. Therefore, regular and timely verification of information will help to avoid inconsistencies in the insurance history.

- There may be incorrect entry of information about driver insurance under previously signed contracts. For example, an insurance company employee may incorrectly indicate the start and end dates of the insurance policy.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Insurance class OSAGO

Now it’s no secret that accident-free driving helps the driver reduce costs when concluding an agreement on compulsory motor third party liability insurance (MTPL).

Each accident-free year brings the driver a 5% discount and an increase in insurance class. Drivers with ten years or more of experience and no accidents can receive a maximum discount of 50% of the policy cost.

What is the MTPL insurance class?

An insurance class, or, as it is also called, an insured class, is assigned to each driver. For beginners, class 3 is determined at the beginning of the insurance period. If during the year (the period of validity of the MTPL policy) insurance payments were not made, then the “class” of the driver, and with it the discount on the cost of the policy at the end of the insurance period, increases. Accordingly, from the second year, when concluding an OSAGO contract, class 4 will be established, and so on. And vice versa, depending on the number of accidents that occurred due to the driver’s fault, his class is lowered; instead of discounts, he receives bonuses for careless driving (up to 145%). If previously the policyholder's class was tied to the vehicle and the driver lost earned discounts when purchasing a new car, then starting in 2008, the class began to be assigned specifically to the driver. With the advent of the automated compulsory insurance information system (AIS) in 2013, where insurers send the information necessary to determine the driver’s class, changing insurance companies is no longer an obstacle to receiving honestly earned discounts. To determine the class when calculating the cost of compulsory motor liability insurance, the insurer must be guided by AIS data.

KBM Table

KBM or bonus-malus coefficient is an indicator that determines the discount on the cost of an MTPL policy. People call it a discount for accident-free driving. The indicator may increase or decrease the cost of compulsory motor liability insurance depending on how accident-free the car was driven during the previous year of insurance.

How to use the table to calculate KBM?

The table for KBM calculations includes information about the MTPL class, the value of the coefficient that corresponds to a certain class, as well as information on how the number of accidents during the annual insurance period affects the MTPL class.

Using the KBM table is very simple. First you need to know the KBM. This information is available on the website of the Russian Union of Auto Insurers (RUA), you can contact the insurance company or look at the KBM in the current policy (some companies indicate the class directly in the insurance). All other sources are considered unreliable.

If a citizen enters into a MTPL agreement for the first time, he is assigned class 3, for which the BMR is 1.00. Therefore, no discounts or surcharges apply.

Driver classes in the KBM table

The driver's class depends on the number of insurance payments made for the previous year of insurance due to his fault. If the accident was not registered by the State Traffic Safety Inspectorate, this will not affect the driver’s class in the KBM table, since the insurance company is interested in liability, not property.

Each insured event resulting in insurance payments lowers the driver’s class by 2-6 positions. For example, the driver’s initial KBM corresponds to the value 8. If one accident occurs, resulting in an insurance payment, the class will be reduced to 5, two accidents will lower the class to 2, and three or more will drop it to the lowest level. Class M means that the client is especially dangerous for the insurance company. In this case, the cost of the policy increases by 2.45 times.

How does the OSAGO class affect the discount?

The amount of discount on the cost of the policy depends on the MTPL class. Each year of accident-free driving entitles you to a 5% discount.

To determine what discount the driver receives, you need to do some simple calculations. You must subtract one from the coefficient value and multiply the resulting number by 100%.

For example, the driver’s class at the beginning of the annual insurance period is 11. It corresponds to a coefficient of 0.6. Thus,

Renewing insurance will cost 40% less.

An example of calculating the KBM from the table

We propose to consider an example of calculating the KBM using the table. Initial data: the driver enters into a MTPL contract for the first time and has committed 2 accidents in a year that resulted in insurance payments.

Since the driver has no history, he is assigned class 3, which corresponds to a value of 1. Having committed 2 accidents, the class is downgraded to M. When the contract is extended, the cost of insurance will increase by 2.45 times.

The desire to reduce the cost of insurance pushes some drivers to distort information. However, this is not recommended. If an insured event occurs, the fact of participation in an accident will certainly be revealed, and the insurance company will refuse to pay. You will have to eliminate the consequences of the accident at your own expense.