Is it possible to return OSAGO after selling the car?

Refund of MTPL when selling a car

Good afternoon, dear reader.

Not all drivers know that it is possible to return part of the cost of compulsory motor insurance after selling the car.

For example, this fact is confirmed by the fact that many sellers simply give the insurance policy to the new owner, although he does not need it at all.

This article addresses the following issues:

In what cases can you terminate the MTPL agreement and return the money?

The possibility of terminating the MTPL agreement is provided for in paragraph 4 of Article 10 of the Federal Law “On compulsory insurance of civil liability of vehicle owners”:

4. In case of early termination of a compulsory insurance contract in cases provided for by the rules of compulsory insurance, the insurer returns to the policyholder part of the insurance premium in the amount of the share of the insurance premium intended for insurance compensation and falling on the unexpired term of the compulsory insurance contract or the unexpired period of seasonal use of the vehicle.

Please note that refunds are not possible in all cases .

There is a list of situations in which you can get a refund, and it will be discussed further. However, it should immediately be noted that if the driver decides to terminate the MTPL contract for no apparent reason, then the money will definitely not be returned to him.

So, the situations in which the MTPL agreement can be terminated are discussed in detail in paragraphs 1.13 - 1.16 of the Rules for compulsory civil liability insurance of vehicle owners. These paragraphs provide both situations in which you can return money for unused policy time, and situations in which the cost of the policy is not returned.

Within the framework of this article, situations in which a refund of the cost of compulsory motor liability insurance is possible :

- death of a citizen - policyholder or owner;

- liquidation of an insurance company;

- revocation of the insurance company's license;

- destruction (loss) of a vehicle;

- changing the owner of the vehicle (sale of the car).

How to get money back for unused MTPL insurance?

Getting a refund for unused insurance when selling a car in 2019 is a no-brainer. The driver needs to contact the insurance company where the MTPL policy was purchased and fill out a refund application there.

documents will be required for return :

- Passport;

- OSAGO policy;

- Car purchase and sale agreement confirming the sale;

- Bank account details where the money will be transferred.

The return procedure usually goes smoothly. As for questions and disputes, they most often arise regarding the amount of the refund.

How to calculate the refund amount under compulsory motor liability insurance?

4. In case of early termination of a compulsory insurance contract in cases provided for by the rules of compulsory insurance, the insurer returns to the policyholder part of the insurance premium in the amount of the share of the insurance premium intended for insurance payments and falling on the unexpired term of the compulsory insurance contract or the unexpired period of seasonal use of the vehicle.

There are 2 conditions in this paragraph:

- Only the portion of the premium intended for insurance payments is returned.

- Only the amount proportional to the remaining validity period of the compulsory motor liability insurance policy is returned.

Let's look at each of them in turn.

1. Let's consider the requirements for the structure of insurance tariffs established by the Bank of Russia. 77 percent of the policy value is intended to ensure current insurance compensation under compulsory insurance contracts .

The remaining 23 percent are intended for other purposes and will not be returned in any case.

2. Calculation of the amount proportional to the remaining period of validity of the compulsory motor liability insurance policy.

First of all, you need to calculate the date of early termination of the insurance policy. It is calculated as follows:

- in case of death of a citizen - date of death;

- in case of liquidation of the insurer - the date of liquidation;

- in case of destruction (loss) of the car - the date of destruction (loss);

- when revoking the insurer's license - the date the insurer received the application;

- when selling a car - the date the insurer received the application.

Please note that the amount of refund under compulsory motor liability insurance when selling a car depends on how quickly the former owner of the car contacted the insurance company.

It is in your best interest to do this as soon as possible. Ideally, you need to go to the insurance company on the same day that you sell the car.

After the termination date of the contract is calculated, you need to calculate how many unused days are left .

For example, if OSAGO is concluded for a year and 100 days remain unused, the driver will be able to receive 100 / 365 = 27.3% of the original policy amount. In addition, do not forget that the 23% discussed above is also non-refundable. Those. as a result, the driver will receive 0.273 * 0.77 = 0.21, i.e. 21% of the policy cost.

It should be borne in mind that if the policy was not concluded for a whole year, then the cost will be calculated taking this into account.

For example, if 100 days remained unused, and the policy was concluded for 4 months (from May to August), then the driver will be refunded 100 / (31 + 30 + 31 + 31) = 81.3% of the amount. Taking into account the 23% discussed above, the final payment will be 62.6% of the policy value.

I recommend that you independently calculate the refund amount before contacting the insurance company. If you are returned less and the amount turns out to be significant, then the arrears can be recovered through the court. Naturally, it doesn’t make much sense to engage in legal proceedings for 100 rubles.

In conclusion, I would like to note that the return of compulsory motor liability insurance when selling a car is a fairly simple procedure and I recommend using it.

How to get money back for compulsory motor liability insurance when selling a car

Many drivers are not aware that by selling a car, they can get back part of the money for insurance under compulsory motor liability insurance. There are also those who neglect the procedure, fearing paperwork. Autocode will tell you how to get your insurance back when selling a car without wasting a lot of time.

When can you terminate your relationship with an insurance company early?

According to the rules of compulsory motor liability insurance, the policyholder has the right to terminate the contract with the insurance company in the following situations:

- The car was in a serious accident and cannot be repaired;

- The owner of the vehicle is no longer alive (the heir receives the money for unused compulsory motor liability insurance);

- The company where the owner of the car is insured has had its license revoked (we recommend contacting the Russian Union of Auto Insurers (RUA);

Let's consider the last point in more detail, since the return of insurance when selling a car is the most common reason why a compulsory insurance contract is terminated early.

Please note that you can sell your car profitably using the Autocode service. In a couple of minutes, the service will tell you everything about the car: mileage, traffic police restrictions, fines, deposits, technical inspections, insurance and much more. A car checked in this way will inspire more confidence in a potential buyer. And the visit of a specialist will convince you of the seller’s honesty and the serviceability of the car.

Refund of the amount for compulsory motor liability insurance when selling a car

If OSAGO is not used, the money will be refunded to you. But only if the new owner is registered with the traffic police. Cases where vehicles are sold under a general power of attorney have nothing to do with them.

So, to terminate the MTPL agreement when registering the sale of a car, you will need:

- Passport of the owner for whom the insurance is issued;

- OSAGO policy;

- A copy of the car purchase and sale agreement;

- Account (debit card) details for transferring money.

With this list, go to the insurance office where you issued the policy.

How much money will be charged?

Termination of compulsory motor liability insurance when selling a car is a simple procedure, but it has some nuances. Thus, the calculation of unused days under insurance is made not from the date noted in the policy, but from the day when the policyholder wrote an application for early termination of the compulsory motor liability insurance policy. That is why we do not recommend delaying this procedure.

After a visit to the insurance company within 14 days, the company will credit you with 77% of the amount calculated in proportion to the unused days under insurance. Sometimes money is given in cash immediately after application.

As you can see, it’s easy to calculate the amount due yourself.

Why is 77% of the amount charged?

In 2014, the Central Bank established guidelines according to which insurers withhold 23% of the amount remaining until the end of the compulsory motor liability insurance contract. Ten percent of this amount is the agent's commission. Another 10% goes to the needs of the insurance company: opening offices, purchasing policies, paying employees, and the remaining 3% goes to contributions to the RSA.

Some car owners consider these deductions illegal and go to court. There were times when he took their side. Also, in 2016, insurance when selling a car became the reason for contacting the Prosecutor General’s Office. Social activist Viktor Travin asked to check the legality of the initiative. But the supervisory agency sided with the Central Bank.

If the insurance company refuses to terminate

Sometimes insurers refuse to terminate the contract until the owner shows them the title with the new owner of the car, or they require some other documents. Please be aware that this is illegal.

Maxim Sedov, Insurance Disputes Agency:

“The first thing that needs to be done when disputes arise with the insurance company is to put them in writing. Write your demands to the insurer; your copy must be marked with a date, signature with a transcript and the position of the person who accepted the document. The form is arbitrary: “Due to the fact that I, Ivan Ivanovich Ivanov, sold a car that belongs to me on March 06, 2018, I ask that the compulsory MTPL insurance contract (policy SSS No.) be terminated from the date of sale of the car and return the unused part of the insurance premium. I am attaching the details for enrollment."

Attach a copy of the DCP to the application, include the date, signature and current address for correspondence. Practice shows that just one such action sobers up insurers. If this measure does not help, file a complaint with the Central Bank, which supervises insurance companies, as well as with the regional branch of the RSA. Send there your complaint in any form and a copy of the application submitted to the insurance company.

A favorite trick of insurers is refusal to accept documents. This is not a problem, because the application can be sent by mail. To reduce mailing time, hand in the letter to the branch where the insurance company is located. It is better to send documents by a valuable letter with a detailed list of the attachments.”

How to get money back for MTPL insurance

It is the right of the vehicle owner to return money for liability insurance However, insurance companies do not always cooperate. At the same time, there are situations in which receiving a refusal is equivalent to a violation of current legislation. For the insurer, this is fraught with fines.

When you can return the money spent on the policy, how to do it and what laws motivate you, we will tell you in the article.

Is it possible to return money for compulsory motor liability insurance?

In the process of signing an insurance contract, companies are guided by general rules. They are being developed by the Bank of Russia on the basis of Federal Law No. 40.

In accordance with clauses 33 and 33.1, money can be returned if the following situations occur:

- Change of owner;

- Disposal or impossibility of complete recovery;

- Death of the owner or insured person

If the owner sells the car, he has the right to return part of the money spent back. An exception is the execution of a general power of attorney.

In addition to Federal Law No. 40, the Civil Code of the Russian Federation protects the rights of the insured person. Article 451 allows you to terminate a contract with an insurance company if certain circumstances occur. And article No. 958 states that upon termination of an insurance contract, the organization retains an insurance premium equal to the period of validity of the document.

If the car gets into an accident and cannot be restored, you can also issue a return. However, the vehicle itself is allowed to be disposed of. It won't play any role.

According to clause 33, the insurance company is also obliged to return money for unused compulsory motor liability insurance in the event of bankruptcy. In practice, this is almost impossible. However, the owner has the right to file a claim in court. What the final decision will be depends only on individual circumstances.

It will not be possible to return the money if the reason is not included in the above list. For example, the owner of a car decided to change the insurer for his own personal reasons, or he simply does not use the vehicle, which is idle in the garage.

Who has the right to return money for compulsory motor liability insurance?

Clause 34 of the OSAGO rules specifies the circle of persons who have the right to return unused funds for the policy.

These include:

- Owner;

- Heirs;

- Confidant

The owner of the car has the right to transfer the right to receive funds to a third party, subject to the execution of a power of attorney. For this purpose, you will need to visit a notary. The service is paid. Quite often its cost exceeds the amount of compensation received.

By transferring ownership of a car under a general power of attorney, the former owner remains the official owner. Having taken out full insurance, the new owner simply will not be able to return the money for the policy. A solution may be to include the old owner's name in the insurance.

How to get your money back and when?

You can get your money back by contacting the insurance company where you purchased the policy. Employees of the organization should tell you in detail how to terminate compulsory motor liability insurance. The actions of the owner in this case are simple. He will be required to write an application and provide the necessary list of documents.

Particular attention should be paid to the timing of the application. After selling the car or disposing of it, it is recommended to immediately contact the insurer. The fact is that the refund in these cases is calculated based on the date of receipt of the documents. No one will pay for the missed months.

Another thing is the death of the insured person or the owner of the car. In this case, the date of application does not matter. The funds are returned to close relatives. The calculation is carried out from the actual date of death based on the provided documentary evidence.

How to calculate the amount for a refund - formula

The amount of refund for the MTPL policy is determined individually for each applicant. Calculation begins on the first day after receipt of documents. At the same time, 23% is deducted from the total amount - the insurance company's premium. This cannot be avoided; the insurer must not miss out on its benefits from the transaction.

The refund is calculated as follows:

- 23% is deducted from the total cost of the policy;

- The special insurance coefficient is calculated as the ratio of days of use of the policy to unused ones;

- The total amount, minus 23%, is multiplied by the factor

An online calculator will help you calculate the approximate refund amount. It is recommended to resort to his help in order to avoid errors in independent calculations.

The best option, allowing you to make calculations accurate to the penny, is to contact the insurance company employees.

You can find a calculator on the official websites of most insurance companies, in particular:

- RESO;

- Rosgosstrakh;

- Alpha Insurance;

- Ingosstrakh;

- Tinkoff

You will need to enter a minimum amount of data into the calculator. In addition to the designated sites, it is possible to find a suitable payment system on third-party electronic platforms.

How to return money for an electronic policy

By applying for compulsory motor liability insurance online, the car owner also has the right to return the money spent. The return procedure is standard. The owner has the right to visit one of the insurer's offices, or send an application by registered mail.

When sending an order to the insurer’s website, you must attach a standard list of documents to it.

Refunds via electronic compulsory motor liability insurance are carried out within standard terms. The policy form cannot be the reason for refusal.

Necessary documents for terminating the MTPL agreement

The contract can be terminated provided that the required list of documents is provided.

- OSAGO policy;

- Receipt for payment of insurance;

- A copy of the passport of the insured person or his heirs;

- A copy of the purchase and sale agreement (if there is a change of owner);

- A copy of the death certificate (if the cause was the death of the car owner);

- The original recycling certificate (if it is impossible to restore the vehicle);

- Certificate of inheritance, or a certificate from a notary office proving the filing of documents (relevant in the event of the death of the insured person)

Additionally, the company has the right to request a copy of the title with the name of the new owner of the car, and bank details for transferring funds.

Terms of payment of money for compulsory motor liability insurance

In case of disposal or sale of the car, money is paid no later than 14 days from the date of cancellation of the policy. If the insurer does not fulfill its obligation within the prescribed period, it will have to pay a 1% penalty for each day of delay.

Other deadlines are provided for when entering into inheritance . According to the law, heirs receive the right to use the property of the deceased after 6 months from the date of death. Therefore, you should not expect a quick payment of funds for the policy.

All legal successors of the deceased who have submitted inheritance documents to a notary office have the right to expect a refund. This means that if there are 2-3 of them, the amount will be divided into equal parts. You will have to contact the insurer together.

Why is 23% of the refund amount withheld?

The actions of the insurance company to withhold 23% of the policy cost are completely legal. They are justified by incurring expenses for which it is simply impossible to return payment.

The total cost of the policy consists of:

- 3% - mandatory contributions to the union of insurers. They are summed up and create a target compensation fund;

- 20% — the company’s own costs for obtaining insurance;

- 77% - the amount from which payments will be made in the future in the event of an insured event

Thus, the refund is calculated on 77% of the total amount spent. The insurer only deducts the amount of basic expenses.

Is it possible to get a refund if payments have been made?

The occurrence of an insured event cannot in any way affect the receipt of compensation for an unused policy. It does not depend on the amount of damage caused; it is paid according to the standard scheme.

Thus, having had an accident and received insurance compensation, having decided to sell the car before the policy expires, the owner has every right to apply for compensation. Insurance company employees will not be able to refuse to implement it.

Do you have any clarifying questions about the text of the article? Ask them in the comments! ASK A QUESTION TO AN SPECIALIST>>

Is it possible to issue a refund under compulsory motor liability insurance without providing a PTS?

The list of documents required for a refund is standard for all insurers. However, as mentioned above, some organizations require the additional provision of a PTS with the name of the new owner. In fact, this is not mandatory. Obtaining a legal refusal in this case is impossible.

Insurers are required to terminate the contract upon presentation of the purchase and sale agreement, the original policy and receipt of payment. Why then do we need a PTS? The fact is that some car owners deliberately enter into a purchase and sale agreement in order to receive a refund under compulsory motor liability insurance. The insurer may not know whether the car has been re-registered, since the handwritten copy is not certified by a notary office and may simply be thrown away.

By requesting a title with the name of the new owner of the car, the insurance company is trying to protect itself from fraudulent activities. In order not to run into problems and prove that you are right, it is still worth making a copy of the document.

In addition, this will give the former owner confidence that the vehicle has been completely re-registered and he is no longer responsible for it in terms of tax payments and administrative penalties .

How to get money if you refuse OSAGO: step-by-step instructions

In conclusion, we propose to define a clear sequence of actions for the owner or heirs to receive money for unused compulsory motor liability insurance:

- We contact the insurance company that issued the policy.

- We are writing a statement to terminate the contract.

- We provide the necessary list of documents.

- We are waiting for payments to arrive.

If insurance company employees refuse to accept documentation unlawfully, you can file a complaint with the prosecutor’s office or file a claim in court.

To make a decision in your specific situation, please contact a specialist through the online consultant form or by phone:

Moscow and region: +7(499) 577-00-25 ext.

691 St. Petersburg: +7(812) 425-66-30 ext.

691 All regions of the Russian Federation: 8(800) 350-84-13 ext. 691

It's fast, free and confidential!

How to get money back for an unused OSAGO policy

A previously issued OSAGO policy may, under certain conditions, become unnecessary for the owner. It is possible to return the remainder of the fee for the unused insurance period, but not all drivers are aware of this.

The article will describe in detail the conditions and procedure for returning money for compulsory motor liability insurance.

Conditions under which you can return money for unused MTPL insurance

All information about the conditions for refunding money for insurance is specified in the “Regulations on the Rules...” No. 431-P dated 09.19.2014. It also states that compensation is provided only for the unexpired term of the compulsory insurance contract or seasonal use of the vehicle.

Is it possible to get money back for selling a car?

The money can be returned, since the sale of the car is included in the list of conditions suitable for the owner to receive a refund.

In this case, in order to receive a refund for unused insurance, in addition to the main documents, you will also need to provide a car purchase and sale agreement and a copy of the title to the insurance company to confirm the change of owner.

When selling a car, it is not necessary to terminate the MTPL agreement and demand a refund from the company. You can simply sell the car along with the existing insurance and, in order not to remain in the red, include the amount of unused insurance in the price of the vehicle.

Is it possible to return the money just because you won’t use the car?

If a citizen simply does not want to use the car for some time, then, according to the law, this is not a reason to return the money paid for compulsory motor liability insurance. After all, it is almost impossible to prove that the car was really idle during a specific period of time.

All other cases

There are several other conditions regarding refunds:

- loss of a car: theft, large-scale irreparable damage, disposal;

- death of the policyholder, in connection with which the insurer company is obliged to terminate the contract;

- death of the owner of the vehicle, entailing a change of owner, as in the case of sale;

- liquidation of a legal entity that is the owner of the insured vehicle;

- The insurance company lost its license, so the rest of the money must be returned.

If an insurer loses its license due to impending bankruptcy, you should hurry, otherwise you may not get your money back at all.

When the money is not returned: reasons

It also happens that the car owner cannot get his money back for the remaining insurance period upon termination of the contract.

The policyholder will not receive money if:

- the contract is terminated at the initiative of the insurer due to incorrect data provided by the vehicle owner himself when completing the paperwork or incomplete payment for compulsory motor liability insurance;

- the car was transferred to another person by proxy, since in fact it was sold, but according to the law the owner remained the same;

- the owner terminates the contractual relationship with the insurer only because he does not plan to use the vehicle for some time;

- his driver's license was revoked;

- the insurer is declared bankrupt;

- 2 months have passed since the sale of the car, which means it is too late to submit documents for termination of the contract and refund;

- The insurance company may refuse to return funds due to previously paid indemnities, but this is unlawful, and such a decision must be challenged in court.

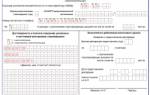

Step-by-step algorithm for terminating a contract

To terminate the MTPL agreement, you must adhere to the following procedure:

- Contact the insurance company with which you have a contractual relationship.

- Write a statement of desire to terminate the contract. It is written in free form, but you can also use a sample from the company’s stand. Be sure to indicate the bank details where the insurance company can return the money.

- Provide along with the application the following package of papers: the original insurance policy, a receipt for payment of the insurance premium, a purchase and sale agreement, pages of the owner’s passport, documents confirming the need to terminate the contract (on the liquidation of a legal entity - the owner of the vehicle, the death of the insured, etc. ).

- Wait for the insurance company's decision within 10 days.

- If the answer is yes, then take a certificate of the terminated MTPL policy for future insurance.

- In case of refusal to terminate the MTPL agreement and the corresponding payments, you can contact the judicial authorities or the Union of Auto Insurers.

You must provide original documents along with their copies.

Termination of contractual relations is regulated by Federal Law No. 40 “On Compulsory Insurance” and Regulation No. 431-P.

In what case is it possible to get a full refund?

Initially, when purchasing an MTPL policy, the car owner pays its full cost. Moreover, when the question arises of terminating the contract and returning the amount remaining for unused months, the insurance company takes 23%.

Is it possible to take away this 23% from the insurance company and thus receive a full refund?

Until 2014, it was possible through the court to regain 23% retained by the insurer. Car owners won the case without any problems and received their money. This court decision was based on the fact that this contradicts the rules of OSAGO, the Federal Law “On OSAGO”, as well as the Civil Code of the Russian Federation.

Since 2014, the rules of OSAGO and the Federal Law “On OSAGO” have stipulated that only 77% of the amount is refundable. At the same time, a record was left in the Civil Code stating that the entire amount is due for payment. But during legal proceedings in this matter, preference is given to the Federal Law “On Compulsory Motor Liability Insurance”, so recently, even through the court, it will not be possible to take away the remaining 23% from the insurance company.

In what case will the funds be partially returned? How is the payment amount calculated and what does it depend on?

According to clause 1.16 of the Rules of Compulsory Insurance and Art. 958 of the Civil Code of the Russian Federation, the owner has the right to return the unused portion of the policy amount. To do this, you just need to provide the company with documentation confirming the legal reason: a purchase and sale agreement, a death certificate of the policyholder, papers on the liquidation of a legal entity, loss of a car.

Formula for calculating the return of insurance premiums under compulsory motor liability insurance

The final amount that the policyholder can receive back depends on:

- number of remaining months;

- the initial cost of the insurance policy.

To determine specifically how many unspent months are left, you should clearly define the date of termination of the contract, which may coincide with the date of death of the owner, the date of theft, or deprivation of the license.

The calculation formula is as follows:

SV = (PSP - 23%) x (n/12), where:

- SV - refund amount;

- PSP - the total cost of the policy;

- n is the number of months remaining until the end of the insurance period.

- 3% are transferred to RSA;

- 20% goes to pay various expenses for conducting the process of termination of the contract.

Calculation example

Let's say the vehicle was insured in December and sold in mid-June, and the original policy cost RUB 4,200.

The calculation based on this data will look like this:

CB = (4200-23%) x (5/12) = 3234 x 0.42 = 1358.

The total refund amount will be 1,358 rubles.

Within what time period after termination of the contract must the money be returned? Where are they being returned?

According to the rules of MTPL insurance, a refund must be made no later than 14 days from the date of filing the application.

Sometimes money is returned through the cash desk in cash almost immediately after the application.

When transferring to the bank account indicated in the application, you will have to wait, but not longer than the specified time.

What to do if money is not transferred on time

If more than 14 days have passed and the money has still not been paid, you need to do the following:

- Contact the insurance company and find out the reason.

- If they claim that they have transferred everything, then you need to take the transfer number and go to the bank, where they can easily check the availability of money.

- If the insurer violates the terms, transferred the wrong amount or refuses compensation altogether, it is worth going to the company management and the RSA, providing a copy of the policy and a statement of termination.

- If the issue is not resolved, go to court.

For each day of delay, a 1% penalty is added to the refund amount.

Conclusion

Every car owner who demands a refund for unused insurance has every right to receive it, even if there have been insurance payments in the past period. If the insurance company prevents this, you should not retreat immediately, you need to resolve the issue to the end.

How to get money back for compulsory motor liability insurance when selling a car. 3 simple ways.

You successfully sold your car, but the MTPL policy has not expired; you have, for example, at least 3 months left until expiration.

What to do with the MTPL policy when selling a car?

The situation suggests several options for resolving the issue.

OSAGO when selling a car - what to do with unused insurance?

Changing a car or selling it due to urgent need, regardless of the amount of money, is carried out with the preparation of a purchase and sale agreement in writing.

You can get your money back for compulsory motor liability insurance when selling a car in the following ways:

renew your MTPL policy for a new car.

We are writing an application to the insurance company for a refund of money for compulsory motor liability insurance when selling the car.

In case of selling a car under a general power of attorney, we enter the buyer’s name on the insurance policy.

Changing the owner of a car and the option of re-issuing insurance to another owner involves visiting the offices of insurance companies to write an application for changing the insured.

You need to have the following documents with you:

- vehicle passport with the name of the new owner (copy);

- car purchase and sale agreement;

- driver's license of the person for whom the insurance will be reissued.

When re-registering, you need to take into account documentary subtleties - the owner and the insured may be different people. But an insurance policy makes it possible to change both the policyholders and the owners in the document. If the seller has not changed his name on the insurance, then he must be prepared to participate in all processes related to insurance compensation for the owner of the damaged car.

Terminating the MTPL agreement will help you avoid unnecessary worries.

How to return the remaining insurance amount?

The option to return money for compulsory motor liability insurance when selling a car does not have any obstacles for the insured of the sold car. You will have to visit the office of the insurance company to write an application (but you should not hesitate with this, since the amount that will be returned to you will be calculated from the day you submit your application). The less time remains until the end of the policy, the less money you will receive.

The amount that will be returned to you is calculated using the formula:

Refund amount = Policy price x number of remaining days of insurance/365 – 23%

23% are expenses (3% in RSA, and 20% in the insurance fund).

These numbers are not stated anywhere at the legislative level, so there are doubts about the legality of their use.

Renew insurance for a new car

Instead of returning money for compulsory motor liability insurance when selling a car, it is possible to renew the insurance for a newly purchased car.

This is very convenient for a planned car change, when an old car is sold and a new car is purchased at the same time. If the engine power in a new car is higher, you need to be prepared to recalculate the cost. The owner must have with him a purchase and sale agreement for the sold car and all the documentation for the new car.

If you gave it to a close relative?

They not only sell the car, but also give it to their relatives or give the opportunity to legally drive the car to their children or wife. In addition to the joy of what happened, there are also problems with the correct execution of documents.

In this case, you can use a general power of attorney for the right to drive the car to another person. In this case, renewal of the MTPL policy is not required. You remain the official owner of the car, and the power of attorney allows another driver to legally operate the car.

As for the insurance side of the issue, it is enough to enter the name of the driver for whom the power of attorney is written in the compulsory civil liability insurance policy.