Limitation period for compulsory motor liability insurance

How to calculate the limitation period for compulsory motor liability insurance for road accidents?

Drivers whose car was damaged in an accident are not always able to negotiate decent compensation. Insurance companies may underestimate the amount of damage, which leads to disputes and litigation. The law establishes a period during which you can apply for payment under compulsory motor liability insurance.

Deadline for receiving compensation under compulsory motor liability insurance

Car owners turn to the insurance company for payments when a package of documents is collected. For example, a resolution may be required indicating the culprit of the accident.

The Law on Compulsory Motor Liability Insurance (FZ-40 of April 25, 2002) does not establish a specific period during which citizens must apply for compensation for damage. The exception is registration of the incident according to the “European protocol”. Then the interested person must submit an application no later than 5 working days after the accident.

What is the statute of limitations?

The law establishes a certain period of time when a person can apply to the court for protection. The law allows 3 years for this.

If the specified period has expired, the person can contact the insurance company and file an application with the court. However, the defendant may indicate that the period for possible consideration of claims has ended. In this case, the court refuses to consider the claim.

Insurance companies keep track of deadlines. If the application is received 3 years after the accident, the organization will ignore such an appeal.

The period of 3 years is set to discipline the stakeholders. If a person has not needed to receive insurance money all this time, it means that his interests have not been violated. Also, a temporary restriction makes it possible to streamline the system of economic relations so that after 10-15 years the victims do not file claims demanding an increase in compensation and payment of penalties.

How is the statute of limitations calculated?

Time is counted from the moment when the citizen learned or should have learned about the violation of his right. When paying compensation under compulsory motor liability insurance, this may be:

- The date when the person received a refusal of compensation from the insurance company.

- The day the decision on an accident came into force, for which the at-fault driver was held accountable.

- The day you receive money from the insurance company or send it to a service station for repairs.

- The date when the deadline for preparing the company’s response to the citizen’s appeal expired.

- The day when the owner of the car was notified of the real cost of repairs.

The three-year period does not include time:

- when a person served in units of the Russian Armed Forces under martial law;

- when filing an application was prevented by a natural disaster or other emergency.

In accordance with Article 203 of the Civil Code of the Russian Federation, the term may be interrupted if the insurance company recognizes the debt. The following actions may indicate this:

- sending a letter of guarantee to the citizen, where the insurance company undertakes to compensate for repair costs in a certain amount;

- written referral to a service station;

- transfer of money by postal order or to a citizen’s account;

- written notification that the insurance company will provide compensation, but after conducting additional examination or research.

These actions indicate that the insurance company recognizes the person’s right to receive compensation. Therefore, the limitation period will be counted anew from the date of receipt of the money or document.

The period is suspended when a citizen files a lawsuit in court. The proceedings will continue as long as necessary to reach a decision.

In any case, it is better not to wait for the end of the limitation period, but to immediately resolve disputes with the insurance company.

How are disagreements resolved?

Most controversial situations are related to several events:

- The amount received, in the opinion of the car owner, does not compensate for the actual damage. This happens, for example, if some damages are excluded from the list of those caused by the accident.

- The company does not acknowledge the fact of the accident. For example, if the accident was registered according to the European protocol, but the insurance company suspects fraud.

- The deadline for transferring money or issuing directions for repairs has been missed.

- The company did not consider the citizen’s application within the required time frame.

A citizen contacts the insurance company regarding an accident and receives a written response with official explanations. Article 16.1 of the Law on Compulsory Motor Liability Insurance contains the procedure by which a citizen is obliged to forward a claim to a potential defendant before going to court.

The document must reflect the following information:

- name of the insurance company, postal address;

- FULL NAME. citizen, residential address, telephone number;

- information about the accident - date, place of occurrence, which vehicles were damaged;

- information about the culprit;

- information about the submitted documents (MTPL policy number of the culprit, details of the accident certificate, etc.);

- data on the current state of the case, for example, the insurance company provided a referral for repairs, but underestimated the cost of the work;

- the essence of the citizen's claims;

- arguments and evidence, for example, price lists from the service station where the victim was sent;

- the applicant’s requirement (to provide a letter of guarantee for a service station for a large amount);

- the statement that in case of refusal the citizen will go to court;

- list of attached documents;

- date, signature, surname and initials.

It is advisable to attach copies of the following documents to the application:

- certificate of accident;

- citizen's passport;

- the insurance company's response to the victim's complaint.

You can contact the insurance company in person by submitting an application at the company’s office, or by sending an application by mail with acknowledgment of receipt. It is important that the person retains physical evidence of the filing of the claim, so a telephone call is not suitable.

The procedure and statute of limitations for contacting the culprit of an accident

Today, the amount of compensation under compulsory motor liability insurance is determined according to reference books and methods approved by the Central Bank of the Russian Federation. The victim may not have enough money to return the car to its original condition. This happens, for example, if a person installed more expensive spare parts on his car.

In this situation, the difference can be claimed from the person responsible for the accident. The victim also has 3 years to do this. Time is counted according to the same scheme: from the date of the accident or from the moment when the person learned about the violation of his rights.

From a certificate of an accident or from a resolution to bring the culprit to justice, a citizen can find out information about the residential address of the harm-doer. You can send him a written claim demanding compensation for the difference between the insurance compensation and the actual cost of restoring the car.

Citizens very rarely agree to voluntary payment, as they believe that insurance covers everything. Therefore, it is more advisable to file an application with the court at the place of registration of the culprit of the accident.

What to do if the statute of limitations has passed?

If 3 years have passed, the court will not refuse to accept the claim. However, the defendant can draw the court's attention to this fact, and then the case must be dismissed.

The person needs to restore the statute of limitations. To do this, a citizen must submit a separate request.

The document reflects the following information:

- name of the court, its address;

- FULL NAME. plaintiff, residential address;

- information about the claim filed and the essence of the dispute;

- an indication that the defendant is seeking dismissal of the proceedings due to the expiration of the statute of limitations;

- information about the day when the applicant became aware of the violation of his rights;

- circumstances due to which a person was unable to go to court on time;

- request to restore the statute of limitations;

- list of applications;

- date, signature, surname and initials.

Attached to the appeal are copies of the application for the number of participants in the process and evidence that the citizen was unable to file a claim on time for valid reasons. Usually these are medical documents.

The application will be granted in the following cases:

- serious illness (the citizen was treated in a hospital hospital);

- helpless state (the person suffered from alcohol or drug addiction);

- illiteracy (a person does not speak written language and cannot read).

Such circumstances are given in Article 205 of the Civil Code of the Russian Federation. However, the court may consider other reasons valid.

The above circumstances must have occurred within the last six months of the statute of limitations.

The courts refuse to restore the term in the following cases:

- if the citizen did not know that there are time limits for filing a claim;

- the person did not know how to properly file an application to the court;

- the citizen forgot about the need to submit a claim to the insurance company or was busy with other matters.

If the reasons are found unjustified, the court issues an order to terminate the proceedings.

Statute of limitations for recourse claims

The organization may demand from the culprit a portion of the funds transferred to pay for the repair of the car. This happens if the tortfeasor violated the insurance rules, for example, did not send his copy of the European protocol to the insurance company within 5 days after the accident.

You also have 3 years to file a claim. For a recourse claim, the period is counted from the moment of compensation for damage.

Drivers should apply for compensation in a timely manner. If it is not possible to prepare documents yourself and go to court in person, you can enter into an agreement with a lawyer. The cost of legal services can be recovered from the defendant.

Limitation period for compulsory motor liability insurance

It is not always possible for the insured person and the company that insured him to agree on compensation payments in the event of a traffic accident before the trial. They may not be satisfied with the amount of the payment, the periods of its payment and other issues.

There is only one thing left to do - go to court. And to do this, you should know when the statute of limitations for compulsory motor liability insurance expires.

Limitation periods for compulsory motor liability insurance

The limitation period is the time period during which a citizen who believes that his rights have been infringed can resort to judicial protection. However, he does not have the right to sue after the expiration of this period, since the limitation period has passed.

In Art. 196 of the Civil Code of the Russian Federation, the generally accepted limitation period (SIL) is 3 years from the date when a citizen discovered a violation of his rights and identified the person responsible for their violation.

Civil Code of the Russian Federation Article 196. General limitation period

1. The general limitation period is three years from the date determined in accordance with Article 200 of this Code.

According to Art. 966 of the Civil Code of the Russian Federation LED can be:

- 2 years – for property damage;

- 3 years – when causing harm to the health, life or property of people.

Therefore, a claim should be filed no later than 3 years after the accident. However, in Art. 208 of the Civil Code of the Russian Federation establishes circumstances in which the limitation period is not limited. In particular, regardless of the statute of limitations, a citizen may demand compensation for damage caused to his health and life.

For example, if a driver is injured in an accident and the insurance company refuses to pay compensation, he can sue the company within three years after the refusal. If a claim is filed against the insurance company after 3 years, you will need to show a valid reason why it was not filed in a timely manner.

From what time does the countdown begin?

In Art. 200 of the Civil Code of the Russian Federation stipulates that the time for asserting rights in court will be counted from the day when the citizen:

- found out or was obliged to find out about the infringement of his rights;

- found out who was violating his rights.

If we apply these rules to compulsory motor liability insurance, then there are explanations in the Resolution of the Plenum of the Armed Forces of the Russian Federation dated January 29, 2015 No. 2, according to which the statute of limitations for compulsory motor liability insurance is calculated:

- From the date when the citizen discovered or should have discovered the insurer’s disagreement to pay compensation.

- From the date when compensation was not fully reimbursed.

- The day after the insurance company decides to issue a referral for vehicle repair.

If the compulsory insurance contract stipulates the obligations that the policyholder had to fulfill after the accident, for example, provide some documents, then the statute of limitations starts from the day the policyholder fulfills this obligation, that is, in this situation, presents the documents. Even if the person in the obligation changes, for example, during subrogation, the statute of limitations for compulsory motor liability insurance and the procedure for calculating it will not be changed.

Break in time

The flow of LEDs can be disrupted:

These circumstances are regulated by two different articles of the Civil Code of the Russian Federation. The flow of LED is suspended in accordance with Art. 202 of the Civil Code of the Russian Federation, if:

- the citizen was unable to file a claim because force majeure prevented him from doing so;

- one of the parties was at that time serving in the Russian Armed Forces, which were under martial law;

- a moratorium on the fulfillment of obligations was introduced;

- the law regulating this relationship was suspended.

These facts are relevant if they occurred in the last 6 months of the limitation period. IDA stops when the parties decide to settle their dispute out of court. For example, before a court of general jurisdiction, citizens can apply to an arbitration court, or conduct mediation (when the parties, with the help of a mediator, come to a solution that suits them). In this case, the suspension occurs for 6 months.

Previously, there were two reasons that could interrupt the limitation period: the filing of a claim and confirmation of the debt by the defendant. Today, according to Article 203 of the Civil Code of the Russian Federation, this period is interrupted only if the defendant takes actions recognizing the debt. After an interruption, the period is resumed if no agreement has been reached.

Civil Code of the Russian Federation Article 203. Interruption of the limitation period

The running of the limitation period is interrupted by the obligor performing actions indicating recognition of the debt.

After the break, the limitation period begins anew; the time elapsed before the break does not count towards the new deadline.

What happens to the deadline when a citizen goes to court? From the day he applied to this authority, in accordance with Art. 204 of the Civil Code of the Russian Federation, this period is suspended. Moreover, it will be suspended until the judicial defense takes place. Then it continues. If there are less than 6 months left until the end of the term, it is extended by an equal period, i.e. by 6 months.

Is it possible to restore SD?

The statute of limitations can be renewed if the court considers the reason why the citizen missed the time to submit an application to the court to be justified. This reason is a serious illness, a serious condition. The court will also take into account the fact that the person cannot read or write.

.

Such preferences are not provided for a legal entity. That is, if the insurance company itself does not go to court on time, it will not be able to recover compensation for expenses from the defendant. But at the same time, the defendant himself must declare that the statute of limitations has expired.

SD on recourse and subrogation

The statute of limitations for regressive claims and subrogation is the same and is equal to 3 years. But its countdown in both cases begins from different dates. According to clause 3 of Article 200 of the Civil Code of the Russian Federation, the filing period for recourse begins from the day on which the main obligations were fulfilled. That is, the company can make recourse claims against the culprit of the accident only when it pays out the insurance. And with subrogation, the period will be counted from the day the accident occurred.

Civil Code of the Russian Federation Article 200. Beginning of the limitation period

…

3. For recourse obligations, the limitation period begins from the date of fulfillment of the main obligation.

Paragraph 4 of Article 14 of Federal Law No. 40 stipulates that recourse also applies to cases of direct compensation under compulsory motor liability insurance.

The right of recourse is considered in the Civil Code (Article 1081) and in the Federal Law “On Compulsory Motor Liability Insurance” (Article 14). Moreover, the latter stipulates the conditions under which a recourse claim can be applied to the person responsible for the accident:

- if the driver initially intended to cause damage to the victim;

- if he drove the car while drunk or under the influence of drugs;

- he did not have a license to drive this car;

- he left the scene of the accident;

- he is not designated in the OSAGO policy as a person allowed to drive a car;

- The accident occurred during a period of time not included in the MTPL agreement;

- the culprit did not provide the insurer with a copy of the accident form within 5 working days;

- before the expiration of 15 days after the accident, the person began to restore or dispose of the car without allowing the insurer to inspect it and conduct an objective technical examination;

- the diagnostic card at the time of the car accident was expired;

- a citizen provided false information to the company that insured him in order to pay a lower insurance premium.

The right of subrogation is considered in the Civil Code in Article 965. In this case, both the rights and obligations of the victim are transferred to the insurance company as the acquirer. The same thing can happen to another beneficiary:

- he informs the auto liability insurance company about the accident;

- provides an application for reimbursement and attaches the required documents

- submits a claim.

All these procedures are carried out if the victim himself has not carried them out before.

To summarize, we can say that every driver should remember the permissible period for filing a claim. This knowledge will help you receive the required payments, as well as save your strength and nerves during legal proceedings.

Limitation period for MTPL recourse

The topic of insurance compensation, when a lot of time has passed since the traffic accident, often comes up among motorists. Therefore, in this article we will discuss what the limitation period for compulsory motor liability insurance is and what requirements apply to it.

The essence of the concept of “statute of limitations”

Promotion. Legal consultation 2500 rubles FREE until December 21

The statute of limitations (abbreviation - SID ) is a period of time that limits the time limits for the possible filing of a claim with representatives of the court regarding any case. If the permissible period within which the claim could be filed has expired, then the court may refuse to allow the consideration of the claim.

Possession of knowledge about LED under compulsory motor liability insurance can be useful in the following cases:

- When you need to receive a certain insurance payment from an insurance company (abbreviation - SK) or compensation payment from the culprit of an accident.

- When a claim under compulsory motor liability insurance is filed against you in court. In such cases, the topic of regressive claims or subrogation is usually raised. Often, a participant in an accident is given the right to recognize claims for compensation as illegal or to reduce the amount of payment.

What does the law say about the limitation period?

According to the requirements of Article 199 of the Civil Code of the Russian Federation, the limitation period is considered within the framework of the court if any of the parties declares it.

Attention! If a claim is filed against a participant in an accident in court after the time limit for filing a possible application has expired, the defendant will need to rush to the court in person and warn about the violation of this deadline. Only in such a situation will the judge be able to refuse the applicant.

Otherwise, the trial will take place, and the judge's decision may not be on the side of the defendant.

On a note! Failure to appear in court may have a negative impact on the defendant.

How to restore LED?

All individuals (except individual entrepreneurs) have the right to restore the permissible period within which a claim can be filed in court through the courts. But for this, it will be necessary to prepare an application with the provision of evidence indicating the impossibility of filing a claim earlier (the reason could be, for example, an illness).

Attention! If the prescribed period of time is missed by a legal entity or entrepreneur, then the right to restore the ID is not granted (according to Resolution No. 43 of the Plenum of the RF Armed Forces of September 29, 2015).

Limitation period limits for compulsory motor liability insurance

The Civil Code of the Russian Federation (namely, Part 2 of Article 966) establishes that the statute of limitations for all types of motor vehicle liability risk insurance, including compulsory motor liability insurance, is 36 months .

Note. Current laws do not provide for time limits for filing claims related to personal injury. However, in the MTPL insurance system, this period has limits - it should not exceed a three-year period. Thus, compensation can be demanded from the insurance company through the court for the restoration of health only during the first three years (according to the Civil Code of the Russian Federation, Part 2, Article 966) after the incident.

When the debtor has recognized the debt, the permissible period for filing a claim is suspended, after which a new countdown begins. When officially contacting a judicial institution, he is also stopped.

In cases where the claim was not considered for some reason, the LED will be counted further. An exception is the refusal to consider a claim due to the fault of the individual plaintiff.

At what point does the countdown begin?

The starting point for the possible registration of a claim begins from the day when a person learned of a violation of the legally prescribed rights to receive compensation for damage received and identified the person who is obliged to compensate for the damage. Against this background, disputes often occur that are easily resolved in court.

We remind you! You can have your situation assessed by a lawyer - it's free! Call!

Features of filing a claim against the insurance company

Legislation allows you to initiate legal proceedings against the insurer within three years. But the date for calculating the time for filing a claim should be counted based on the Civil Code of the Russian Federation, Article 200, which states that it makes sense to start counting from the day when a person learns about the violation of personal rights.

If after the accident the insurance company did not give an intelligible answer regarding the compensation payment, then proceedings can be started against it in court after the 20-day period when the insurance company was notified of the road accident. It was during the twenty-day period that the insurance company was supposed to assign compensation for car repairs.

Claim against the culprit of a traffic accident: acceptable deadlines for filing

For three years, the owner of the damaged car has the right to file a claim against the culprit of the accident demanding compensation for damages. The filing period starts from the day when the injured party learned who should make the compensation payment.

Recourse and subrogation: how are payments made?

Insurance companies have the right to calculate the amount of damage by recourse or subrogation from the participant in the accident. The differences between the two processes are as follows:

- In case of recourse, the insurance organization begins the process regarding its client. The reason for assigning a recourse may be violations of insurance conditions or traffic rules (example: a participant in an accident was under the influence of alcohol or drugs). Officially, the statute of limitations for recourse is calculated from the day the compensation was paid.

- During subrogation, the insurance organization makes demands on the person at fault for the road accident in order to make compensation payments. In practice, subrogation occurs more often, since the reasons for its occurrence are: lack of compulsory motor liability insurance for the second participant in the incident; situations when the amount for car restoration exceeds the insurance amount included in the contract.

In the case of subrogation, the SID is counted from the date of the traffic accident.

Arbitrage practice

The countdown of the limitation period is designated at the legislative level and is calculated from the date when the insured event occurred. Therefore, it is beneficial for the insurance company to delay the decision on insurance payment so that the permissible period for filing a claim expires.

Also from legal practice, we can highlight several important nuances that car owners should be aware of, and which can contribute to a positive court decision:

- After concluding a mandatory MTPL agreement, it is not allowed to make any changes to it.

- Individuals must file a claim in the courts of general jurisdiction. Legal entities can file claims only in arbitration courts.

An important clarification regarding valid balances: parts of the damaged car that were replaced, but their condition remained operational, are returned to the driver and do not take part in the calculation of the compensation payment.

Current questions and answers

- Question: An accident occurred, the guilty party does not have a compulsory motor liability insurance policy.

How long does it take to file a lawsuit against the person responsible for an accident for compensation for damages? Answer : It is possible to file a claim with the court for compensation within three years, starting from the day the incident occurred. - Question : There was an accident, the culprit fled the scene.

When can an injured party bring a claim if the SID is limited and the defendant has not yet been identified? Answer : The permissible period for filing a claim will begin to count from the day the culprit is identified. - Question : The damage after the accident exceeded the amount of the possible insurance payment.

When can you file a claim against the culprit of an accident to compensate for the missing part of the damage that the insurance company ignored by not paying? Answer : After receiving information from the insurance company that the insurance does not compensate for all damage, the countdown of a specific LED begins.

The article is over. Do you have any questions? FREE legal consultation

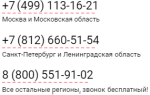

☎ 8 (800) 550-72-89 hotline for Russian regions

What is the statute of limitations for compulsory motor liability insurance?

Vehicle owners who live in our country have long been no longer surprised that in the absence of a valid MTPL insurance policy they should not drive a car. After all, the use of compulsory motor liability insurance has contributed to making traffic on the roads much safer.

It should be noted that, as a rule, no problems arise in the process of purchasing this insurance policy, unlike the procedure for collecting compensation in case of accidents. That is why the owner of OSAGO needs to control the statute of limitations under OSAGO in order to avoid problems in disputes with insurance companies.

What is the statute of limitations under compulsory motor liability insurance?

The statute of limitations is a certain period of time that determines the period during which it is allowed to file lawsuits in any cases related to the recovery of compensation for repairs of car breakdowns arising as a result of road accidents. And if the petition was submitted outside the specified period, then the owner of the car may be denied satisfaction of his claim.

Knowledge about the specifics of the limitation period under an MTPL insurance policy can be useful in several cases:

- If a person needs to ensure the protection of his interests, as well as force his insurance company to pay compensation or extract it from the person responsible for the accident;

- If claims regarding compulsory motor liability insurance were brought against this person. After all, most often such requirements are quite regressive, and collection of payment of funds occurs through subrogation.

In the first case, it is necessary to understand until what time it is possible to demand recovery of damages from the insurance company without violating the relevant clauses of the current federal legislation.

In the second situation, the owner of compulsory motor liability insurance receives a legal basis for the presented claim to be recognized as unlawful. Thanks to this, most often it is possible not to pay the amount to compensate for losses under the claim or to reduce the amount of payment.

Normative base

Limitation periods are established by several articles of current legislation:

- Art. 11.1 of Bill No. 40-FZ - according to it, the maximum period for writing an application to the insurance company to cover expenses is five working days. However, it does not regulate the limitation periods for the MTPL insurance policy;

- Ch. No. 48, art. 966 of the Civil Code – the period is two years;

- Art. 196 of the Civil Code – the period may exceed five years.

What are the deadlines for compulsory motor liability insurance?

The statute of limitations under a compulsory motor liability insurance policy against the insurer is three years. In addition, it should be noted that it can be both general and special. The difference between them is due to a number of reasons, the main one of which is that the legislator imposes more stringent requirements for compulsory MTPL insurance.

Thus, for legal disputes based on the terms of CASCO, there are separately established limitation periods, which are also provided for by the requirements of the Civil Code.

How to determine the statute of limitations for filing a claim?

According to generally accepted conditions, the limitation period can be calculated in calendar months or years. In relation to those involved in an accident, sometimes events occur that affect the calculation of this period. In this regard, according to Art. 202 of the Civil Code, the running of deadlines can be suspended, and Art. 203 allows you to interrupt it completely.

In the event that the limitation period was suspended for an unknown reason, the renewal of the period occurs immediately after the disappearance of these circumstances. However, if during a certain period the insurance company paid part of the amount to cover the damage, then the calculation of the period under certain circumstances is interrupted completely, and after the break, the calculation must begin again.

Time for pre-trial settlement of issues

Before collecting documents in order to challenge the refusal, the owner of the MTPL insurance policy and the insurer can try to solve their problems on their own.

There are a number of reasons why pre-trial claims may be made:

- Significant underestimation of the amount of damage;

- Unreasoned refusal to pay compensation;

- Quite often, a company uses uncertain conditions of an accident as a reason;

- Refusal to cover expenses due to violation of the terms established by the contract.

In practice, it is extremely rare that such issues are resolved in court. After all, insurers are trying to reach an agreement with the client, as well as maintain a good reputation. In addition, trials often last longer than one month and sometimes drag on for several years. Thus, pre-trial resolution of issues with compensation is very popular.

Payments for recourse and subrogation

A fairly important feature in the work of each insurer is its ability to recover a certain amount of money from the culprit of a traffic accident in order to cover the damage of the victim. This is due to recourse, as well as subrogation.

The above legal terms have several significant differences, despite the fact that they have similar wording:

- Regression - it can arise from the insurer in relation to its clients in cases where during an accident there were violations of certain rules specified in the insurance contract. The most common reasons today include the state of drug or alcohol intoxication;

- Subrogation is the presentation of financial claims to the driver who caused the accident. Its use is practiced much more often than regression. The reason for this in most cases is the absence of compulsory motor liability insurance for the party to the accident, as well as a noticeable excess of the amount of damage caused compared to the amount specified in the insurance policy.

An equally significant difference between these terms is the statute of limitations. Indeed, for recourse, the period of possible filing of a lawsuit is counted from the moment of payment of damage to the injured car owner.

At the same time, for subrogation, this period begins to be calculated immediately after the accident occurs. In addition, recourse is not considered applicable if the driver of the car did not have a compulsory motor liability insurance policy or if the insurance had expired at the time of the accident.

Quite often, in order to attract more clients, insurers in the proposed contracts separately stipulate a clause that subrogation should not apply to the culprit of a road accident. However, in reality, this method of “protection” turns out to be not very effective because its effect extends exclusively to situations with unintentional loss. However, if the person at fault for the accident has clearly become a violator of the PLL, then subrogation will not apply.

In addition, do not forget that the amount of subrogation payment specified in the claim cannot be higher than the amount of damages caused - this condition is stipulated in clause 3 of Art. 965 Civil Code.

Rules for filing a claim after an accident

All drivers need to be aware of the procedure to act in the event of an accident on the road, written down in the instructions issued by the insurance company. In the same way, you need to collect the entire package of documents to receive monetary compensation.

Important : according to the current legislation, the victim of an accident is given five working days to complete all the necessary paperwork.

However, if unforeseen circumstances arise, this period may be changed by the insurer.

First of all, after an accident, the vehicle owner needs to monitor the correctness of the traffic police officer’s report on the accident or fill out a special European report in the event that the participants in the accident decided to do without the traffic police (this is possible if the amount required is less than fifty thousand rubles).

If the insurer refuses to cover repair costs, then the owner of the MTPL insurance policy should collect a package of documents, which includes:

- A correctly drawn up application addressed to the magistrate regarding compensation for losses under compulsory insurance. This paper must indicate the circumstances of the accident, as well as all claims against the insurer. In addition, the owner of the car has the right to offer one or more options for resolving the dispute;

- A copy of the insurance policy;

- Documents that were previously also provided to the insurer - a claim, as well as an application for direct payment of funds to cover expenses;

- Certificate of accident issued by traffic police officers;

- Refusal to initiate administrative proceedings against other participants in the accident;

- A report with the amount of damage caused. This document has two forms - a certificate from an independent expert and a certificate issued by the insurance company.

It is on the basis of the above documents that the court decides to begin consideration of the case. Therefore, if a driver who has an MTPL policy is going to go all the way, then he should be prepared for the fact that this proceeding may drag on for quite a long time.

In addition, experts recommend first consulting with an experienced lawyer in order to avoid any mistakes in the further course of the case.

Watch a video about changes to the MTPL policy

What to do if the deadline was missed?

If the owner of the car missed the agreed period for any reason, then he should write a statement to the court asking for its restoration. Such a request cannot be rejected. If there is any good reason, the plaintiff must add to the application a document confirming it - for example, a copy of a letter from a business trip, sick leave, or a certificate stating that the claim materials were received with some delay.

Help : an application, if necessary, can be submitted along with the claim. If the petition is granted, the materials will be accepted for the purpose of conducting legal proceedings with further proceedings.

Thus, we can summarize the following results regarding the limitation period:

- This is the period during which the owner of the MTPL policy has the right to file a claim in court;

- Its use is practiced only after a statement about its expiration has been written;

- Typically, the term lasts for three years;

- A variety of events can become the starting point;

- In most cases, the starting point is considered to be an accident, the insurer’s refusal to compensate for damage, or the car being sent for repairs.

Limitation period for compulsory motor liability insurance

Under the MTPL policy, everyone can expect to receive compensation for damage caused as a result of an accident. The current legislation determines the time limits for applying for the protection of one’s rights, including in court.

What is the statute of limitations for compulsory motor liability insurance?

The statute of limitations is the period of time during which you can file a claim in court and compensate for the damage caused.

This mainly applies to cases where the victim seeks to recover funds from an insurance company that refuses to pay them for “far-fetched” reasons.

The specified period also applies to cases where compensation must be recovered from the guilty party.

The limitation period also applies in cases where claims are made against the holder of a compulsory motor liability insurance policy. In such situations, liability can be avoided if the period has expired and there are no grounds for its restoration.

What is the deadline?

The duration of such a period is determined by Article 196 of the Civil Code of the Russian Federation. It is equal to three years. In relation to compulsory motor liability insurance, the period is established by paragraph 2 of Article 966 of the Civil Code of the Russian Federation. It is also equal to three years.

What if the deadline has expired?

The expiration of such a period of time does not deprive the interested party of making a claim for damages. In such cases, the period can be restored. But for this you will need to send a separate application to the court to restore the deadline . It will be necessary to provide evidence of the fact that the person concerned could not make a claim for damages within the specified period.

The list of such circumstances is not approved by law. Article 205 of the Civil Code of the Russian Federation lists only a few of them - illness, helpless state, illiteracy. In any case, the interested party will need to prove that the reason for missing the deadline is valid.

From what moment does the countdown begin?

According to the rules of Article 200 of the Civil Code of the Russian Federation, such a period of time is calculated from the moment when the victim learned or could find out about the violation of his rights, as well as who is really to blame for causing the harm.

Examples of such situations could be:

- payment of insufficient compensation;

- violation of terms for compensation of damages;

- bringing to justice a person who has nothing to do with the accident. For example, a person other than the one who was prosecuted was driving the car.

On the application and restoration of the limitation period

The limitation period is applied according to the rules of Article 199 of the Civil Code of the Russian Federation. The application for the protection of violated rights is accepted by the court for consideration regardless of how much time has passed. But the expiration of the specified period is grounds for refusal to satisfy the requirements.

The missed deadline can be restored. To do this, you will need to prove the validity of the reasons for the absence. Confirmation may be, for example, a medical commission’s conclusion about a serious health condition.

How to file a claim against an insurance company?

Requirements for the insurance company are made according to general rules. First of all, you need to draw up a statement of claim.

It states:

- The name and address of the court to which the claim is being filed.

- Last name, first name, patronymic, place of residence, passport details and contact telephone number of the plaintiff.

- Name and address of the insurance company.

- Date and number of the MTPL policy.

- A detailed description of the incident as a result of which the plaintiff suffered damage.

- The essence of the dispute.

- The measures taken to resolve the issue pre-trial and the result obtained.

- Plaintiff's claims.

- List of attached documents.

- Date and signature of the applicant.

The following are attached to the application:

- plaintiff's passport;

- a copy of the application for the defendant;

- a copy of the MTPL policy;

- materials related to the incident - protocols and resolutions of the traffic police, medical certificates, expert opinion;

- correspondence with the insurance company;

- power of attorney of the legal representative, if he takes part in the case.

You will need to pay a state fee for consideration of the claim. Its size depends on the amount of claims and is determined according to the rules of Article 333.19 of the Tax Code of the Russian Federation.

The material must be submitted to the court. The plaintiff can do this in person, through his legal representative or by mail. In the latter case, it is necessary to send documents by registered mail with acknowledgment of delivery to the addressee. An inventory of the materials being sent must be included in the envelope.

The parties are notified of the day of the meeting by sending summonses or via mobile SMS messages.

The statement of claim is considered within two months from the moment it is registered in court.

About claims against the culprit of an accident

Claims can also be made against individuals in a similar manner.

You will need to prepare a statement of claim and attach to it documents confirming the validity of the claims, as well as a receipt for payment of the state fee. In addition to this, you can attach photos and videos of the violation.

The plaintiff can recover from the guilty party not only compensation for physical, but also moral damage, as well as the costs of securing the claim and the services of an expert.

The statement of claim is considered within two months from the moment it is registered in court.

What might the court decision be?

On the appointed day of the hearing, the parties must come to court or send their legal representatives. After studying the materials and interviewing those who appeared, the court makes a decision, which is communicated to the parties to the dispute by reading it aloud. After entry into force, the decision is sent to the parties for information and execution. Judicial decisions can be of three types according to their content.

The first is refusal to satisfy the requirements. It may be due to various reasons, including the expiration of the statute of limitations. They may refuse due to lack of necessary evidence. For example, the plaintiff did not provide evidence that the statute of limitations was valid, or there is no data about the incident itself.

The refusal may also be due to the fact that the demands were presented to an improper defendant, for example, to the insurance company with which the victim had terminated the contractual relationship before the accident, or the demands were presented to a person who was not driving the vehicle at the time of the accident. The reasons for refusal are always reflected in the court decision. In this case, the plaintiff has the right to appeal the refusal.

The second is satisfying the requirements in full. This applies to cases where the plaintiff provided the court with irrefutable evidence of his innocence, including confirming the validity of missing the statute of limitations.

The third is partial satisfaction of requirements. This nature of the decision may be due to insufficient evidence or an incorrect determination of the amount of damage. For example, the court may reduce the amount of compensation for moral damage caused. It is not uncommon for a defendant to prove that the amount of physical harm was calculated incorrectly. To do this, it is necessary to submit a petition to the court to conduct an independent examination. As in the case of a refusal, the plaintiff can appeal such a decision.

Limitation period for subrogation and recourse

Subrogation is a transfer of rights from the policyholder to the insurer (Article 965 of the Civil Code of the Russian Federation). Simply put, the insurance company is given the right to make claims for damages against the person who caused harm to the victim.

In practice it looks like this. As a result of the traffic accident, damage was caused to the vehicle and the victim. Under the MTPL policy, the victim received compensation for the harm caused. After this, the insurance company sends a claim for compensation to the at-fault party.

It should indicate:

- Last name, first name, patronymic and home address of the perpetrator.

- Name, location and contact telephone number of the insurance company.

- Date of conclusion of the agreement with the victim.

- Reason for payment and amount of damages.

- Request for reimbursement of expenses.

- Deadline for responding to a complaint.

- List of documents attached.

- Date and signature of the head of the Investigative Committee.

Attached to the claim are a copy of the insurance contract, a calculation of the amount of damage, a certificate of the amount of payment in favor of the perpetrator, a copy of the insurance company’s certificate of registration as a legal entity.

If the claim is left unanswered or refusal to comply with the requirements, the insurance company may file a claim in court. In this case, the general limitation period is three years. It is calculated from the moment when the insurance company learned or could have learned about the violation of its rights. The law in such cases does not divide applicants based on their status. That is, the statute of limitations applies equally to legal entities and individuals.

The general limitation period applies in the case of a recourse claim. For example, an insurance company entered into an agreement with a person who was subsequently injured as a result of an accident. But according to the terms of the agreement, subrogation was not provided for. This does not deprive the insurance company of the right to reimburse its expenses at the expense of the guilty party.

In this case, a written claim for compensation of expenses is also sent, with the necessary documents attached. If a claim is refused or ignored, the insurance company may file a recourse claim against the perpetrator within three years from the moment the insurance company became aware or could have become aware of a violation of rights.

About the break in the limitation period

A break during the limitation period is determined by Article 203 of the Civil Code of the Russian Federation. It occurs when the plaintiff filed an application in court, or when the other party admitted his guilt, for example, sent a positive response to the claim indicating his agreement to compensate for the damage and paid part of the amount.

If during the process of compensation for damage the perpetrator stops making payments, then the break ends and the statute of limitations begins to be calculated anew. In this case, the time elapsed before the break is not counted towards the new term.