Re-registration of compulsory motor liability insurance for another car

We purchase a car without losing the previous policy: is it possible to transfer the insurance to another car and other nuances

Many car owners are wondering whether it is possible to renew an insurance contract from one car to another and how to do it correctly?

It often happens that the car owner recently purchased an insurance policy and sells the car for various reasons.

What now happens to the policy for which the money was paid?

How to rewrite insurance?

Is it possible to rewrite the insurance, transfer it and transfer it to another car, and how to do this? To solve this situation, there are several options, all of them differ in certain features:

- Terminate the insurance early and then take out a new one.

- Renew the insurance contract for another car by agreement with the insurance company.

When it is necessary to transfer the compulsory motor liability insurance of a car to a new owner, the right of insurance is transferred to the buyer, and the seller of the car, in order to return the money spent on insurance, provides the insurance company with certain documents, which will be discussed below.

By agreement

If the insurance was concluded with one company, then you can simply transfer it to another car. This option is as simple as possible, but not everyone can use it, but only those car owners who have another car, and the insurance contract for it is also issued by this insurer.

This method of renewing insurance is also suitable for those people who buy a new car and it is insured by the same company. Such a case requires an agreement with the policyholder . If all the conditions are exactly the same, then the insurance company can simply reissue insurance for a new car. It is very convenient that those insurance payments that remain unused will be taken into account when concluding a new contract.

It only takes one day to reissue a compulsory civil liability policy.

Early termination of the contract

A common option is to terminate the insurance contract early and then enter into a new one. If there are concerns about non-use of funds, then the insurance company pays financial compensation for the time when the insurance was not used.

When an MTPL insurance contract is drawn up, there is a clause that describes the conditions for transferring ownership to another person. And the document loses its validity from 00.00 the next day after the car was sold. Read more about compulsory motor liability insurance when buying and selling a car in a separate article.

In order for everything to be problem-free in this regard, you need to contact your insurance company in time with a certain package of documents. Documents must confirm the transfer of ownership of the car . Then the insurance company undertakes to return compensation for the time when the person is no longer the owner of the car.

Early termination of an insurance contract is carried out in a certain way.

An application for early termination of the insurance contract is written. The application must be submitted in writing; many companies have ready-made forms. The reason must be the sale of the vehicle.

After submitting the application, the balance of funds under compulsory motor liability insurance is calculated. When calculating, the insurance company can withhold up to 23%. For some car owners, this comes as an unpleasant surprise, but such a clause is included in the insurance contract. So, you need to think about whether it is worth going this way. Of these funds, the insurance company retains 2% as a fee for services for conducting business, and another 3% goes to the Russian Union of Auto Insurers.

The insurance company must pay the remaining money within 14 days from the date of filing the claim. Find out more details about whether it is possible to get a refund under compulsory motor liability insurance when selling a car and how to do it in a separate article.

Signing a new document

Now you can conclude a new MTPL agreement for a new car. It is strongly recommended that you enter into a new insurance contract with the company that already issued compulsory motor insurance for your previous car. Her attitude towards the policyholder will be more loyal.

You will need documents such as:

- vehicle purchase and sale agreement (photocopy thereof);

- a copy of the vehicle's passport;

- the insurance itself;

- all receipts for payment of compulsory motor insurance.

Such documents do not require notarization. As for the registration certificate and the document stating that the car has been sold, practice shows that insurers do not look closely at them. The main goal of the insurance company employees is the insurance itself, which must be paid for. But all documents must be provided in full.

Practice shows that insurers are reluctant to terminate a contract and are even more reluctant to return unused funds. So there is no need to give reasons to delay the procedure.

Adding another owner to the policy

Another way is to include the new owner of the car in the insurance policy. But then it is necessary to take into account that the new owner of the car will enjoy all the rights of the previous owner.

With this decision, it is necessary to conclude an agreement with the buyer (it must be notarized). The contract must state that the buyer undertakes to compensate for the time when the previous owner does not use the insurance policy and, accordingly, the car.

Such a document is regulated by Article 96 of the Civil Code of the Russian Federation. According to it, the rights to own a vehicle are transferred to another person in whose name the insurance contract is drawn up, then all obligations are transferred to the one who is the buyer.

This procedure is very convenient, but is only possible with the buyer’s consent. It is necessary to count on his understanding, so this method of re-issuing insurance is often found when it comes to relatives or good friends.

Conclusion

Now it is clear in what ways you can renew your MTPL insurance contract for another car. It is possible to conclude an agreement with the buyer by renewing the insurance contract for him, or there is the opportunity to simply terminate the transaction early and then conclude another one. It is the latter option that is more common.

If you plan to sell a car, and the insurance contract is already coming to an end, it does not always make sense to re-register. Especially if we are talking about not the most significant amounts. But, if there is still a lot of time left until the end of the MTPL insurance contract, then it is worth seriously taking up the re-registration procedure.

If the insurance company, under various pretexts, does not pay compensation for unused insurance, the first thing you need to do is write a pre-trial claim. If this document does not have the desired effect, then you can contact the Russian Union of Auto Insurers and the court.

If you find an error, please select a piece of text and press Ctrl+Enter .

Renewing an MTPL policy for another car: when is this possible? Required documents and procedure

Every car owner is required to apply for compulsory motor liability insurance for their vehicle. Without this, he will not have the right to drive this car. If a person owns several cars at once, insurance will have to be provided for each of them. It happens that the owner sells one car, but the insurance policy on it is still valid.

When re-registration is not possible

But renewing the policy for another car is impossible (except for one situation). When the insured vehicle is sold, the old policy remains issued to it. There are the following ways out of the situation:

- Terminate the insurance contract with the insurance company . In this case, the car owner will be returned that part of the funds that corresponds to the unused period of validity of the compulsory motor liability insurance policy.

- Renew insurance for the future owner of the vehicle with the expectation that he will financially compensate for the remaining period of validity of the insurance policy.

- If the compulsory motor liability insurance period expires in less than a month, then nothing can be done.

It is worth keeping in mind that, based on clause 1.16 of Chapter 1 of the OSAGO Rules, upon termination of the contract with the insurer, 23% of the refunded funds will be withheld. Of these, 20% goes to the insurance company itself (for services provided), and the remaining 3% is paid to the RSA. When renewing a policy, this 23% fee will not be charged.

In what cases is it permissible to transfer insurance?

There is one exception when it is still possible to reissue an MTPL policy.

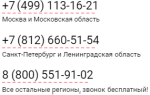

Dear readers! In our articles we consider typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , please contact us through the online consultant form on the right or call us at:

+7 (499) 110-33-98 Moscow, Moscow region

+7 (812) 407-22-74 St. Petersburg, Leningrad region

+7 (800) 600-36-17 Other regions

Online consultant >>

It's fast and for free !

There is no direct indication in the law to transfer insurance to another car. But the internal instructions of some insurance companies may allow this to be done in the following situation: a citizen owns two cars, both insured by the same insurance company by the same person. One of the vehicles is sold and a new one is purchased instead. It will be possible to transfer the insurance policy from the car that will be sold to the new car.

If the car owner, after the sale of the vehicle, does not remain in the possession of the insured car, it will not be possible to transfer the MTPL insurance policy to the purchased car.

How to re-register OSAGO for another car

The procedure is as follows:

- First, you need to make sure that the owner of the vehicle has the right to reissue an MTPL policy . To do this, the above conditions must be met.

- Collect the necessary documents.

- Arrive with your documents at the office of the insurance company.

- Fill out an application for renewal of insurance for a new car and attach a list of necessary documents to it.

- Get an updated insurance policy.

If necessary, you can immediately apply for an insurance renewal. In this case, the remaining validity period will be extended, and the insurance for the new car will last exactly one year.

The extension will be made for an appropriate surcharge, the amount of which will be calculated by an employee of the insurance company. In this case, payment can occur either at one time or in stages.

Required documents

Documents you need to prepare:

- Vehicle purchase and sale agreement.

- Vehicle passport , where its new owner is registered (or invoice certificate).

- Passport of the second vehicle or STS.

- The policyholder's passport or other identification document.

- Driver's licenses of all persons who are allowed to drive a car.

- Both insurance policies.

- If the second car is older than three years - a diagnostic card.

- If a trusted person acts on behalf of the policyholder - a certified power of attorney.

The procedure for renewing insurance for a new vehicle is quick. The policy will be reissued on the same day when the policyholder contacts the company’s office. At the same time, there is no need to pay any additional fees, duties, etc. – the procedure is completely free.

Only the policyholder or an authorized representative who has the authority to make changes to the insurance contract can contact the insurance company with an application to transfer insurance to a new car. All other persons do not have the right to change the contract, and therefore will not be able to reissue the policy.

Or ask a question to a lawyer on the website. It's fast and free!

When can you reissue an MTPL policy for another car: all the features of the procedure

In Russia today, vehicle driver liability insurance is a mandatory procedure. If you own several cars, then you must purchase a car insurance policy for each of them. That is why, in the civil liability agreement there is a column in which information about the car is entered (vehicle brand, vehicle registration number and VIN code).

The amount of the insurance premium is affected not only by vehicle registration data, the number of drivers and their experience and age, but also by the type, power and category of the car (how to calculate the cost of compulsory motor liability insurance online?). We will look at how to get money back for an unused insurance period and what options exist for reissuing this insurance product in our article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 938-40-67. It's fast and free!

When is renewal not possible?

Many car owners often wonder whether it is possible to reissue an existing policy when selling a car for another car? Yes, indeed such a possibility exists, but there are many nuances in this matter that you should be aware of.

- Most often, car sellers terminate the existing contractual relationship with the insurance company and receive a refund for the unused period of insurance from their insurance company.

- The second option is that the car owner can reissue the auto liability policy to the buyer, in which case the buyer must make a refund for the period of time when you are not using the contract.

You can read more about the conditions and nuances of re-registration of compulsory motor liability insurance for a new owner when selling a car in this material.

If you sold your car and purchased a new car in return, you will be required to go through the procedure of auto liability insurance for the new one. The policy that was issued for the sold car, you can:

- Put it on the shelf and do nothing with it; if there is less than a month left before the expiration of this agreement, then there is no point in terminating such an agreement.

- Terminate your deal with the insurance company and receive compensation for the period during which you will not use this insurance product. Read about how to correctly fill out an application for termination of a contract under compulsory motor liability insurance here.

- Re-register your auto liability contract to the buyer of your car, and accordingly receive compensation for the unused period from it.

An auto liability policy for an old car will not be useful to you when operating a new car - in this case, such an agreement is invalid, because it reflects information about a vehicle that has already been sold. This issue is regulated by Article 6, Clause 9 of the “Law on Compulsory Motor Liability Insurance”, namely: if in the event of an accident, harm to the victim was caused by a car that is not listed in the auto liability policy, then the damage caused to the victim does not apply to the insured event.

If the damage was caused by a driver whose car is not included in the auto liability policy, then the driver of the vehicle, and not the insurance company, will be required to pay compensation for the damage caused.

It follows from this that it is impossible to reissue your existing auto liability policy for another vehicle. But not everything is as simple as it seems at first glance, and it is possible to re-register a car title agreement.

Under what conditions is it permissible to transfer?

There is an option where you can transfer the policy to another car.

Also, this option for re-issuing a civil liability contract is suitable for those citizens who immediately after selling a car purchase a new vehicle. That is, not all vehicle owners can resort to this option, but only those citizens who at the time of selling the car have another vehicle insured with the same insurance company.

This option of re-issuing an insurance contract is extremely rare, since in order to carry out such a procedure, a citizen must have at least two cars that were insured by the same insurance company.

How to do it?

Required documents

The procedure for re-issuing a motor third party liability policy is standard. In order to transfer insurance from one car to another, you will need to write an application at the insurance company office and provide the manager with the following list of documents:

- An agreement confirming the purchase and sale of your vehicle.

- PTS in which the new owner is entered or an invoice certificate.

You also need to have with you:

- A document that confirms your identity.

- PTS or STS for a second car.

- Driver's licenses of all those citizens who are allowed to drive your vehicle.

- Automobile insurance policy for the first and second car.

- Diagnostic inspection card for the second car (if the car is more than 3 years old).

Procedure

As mentioned earlier, to re-issue a motor third party liability contract for a second car that is insured by the same insurance company and belongs to you, you need to visit the office of the insurance company and write an application. A list of required documents is attached to the application.

Of this, the organization deducts 20% from you for its services in handling this case, and the insurance company sends 3% to the RSA. In fact, when re-issuing a motorist’s civil liability policy for another car, this is an option when the compensation part for the unused period of your contractual relationship with the insurance company goes towards payment for the currently valid motor third-party liability policy or towards repayment of the extension of the second contract.

That is, the unspent funds will be posted by the insurance company as future payments towards another vehicle.

Deadlines and costs

Re-issuance of a motorists' civil liability policy occurs on the day the client contacts the insurance company. There is no need to make an additional payment for re-registration of contractual relations with the insurance company.

If the policyholder and the owner of the vehicle are different people, then it should be taken into account that the policyholder must appear at the insurance company office, since it is he who has the right to make changes to this agreement.

The insurance company manager, if necessary, will recalculate the amount of the insurance premium for prolonging the contract for a second car. You have the right to pay the missing amount of the contribution (which is not covered by the compensation amount for the first contract) immediately, or you can pay in stages.

In addition, we advise you to study the conditions and nuances of obtaining temporary insurance. Especially for you, our specialists have prepared materials on the rules and cost of issuing a policy:

If you sell your car, you are free to deal with your civil liability agreement for motorists at your own discretion. For some, it will be easier to terminate the transaction with the insurance company (what is needed to cancel the contractual relationship?), and for others, it will be easier to re-issue the existing contract to the buyer of the car (when and how can this be done?) and receive a refund of unspent funds from him.

Well, if you are the owner of two cars insured by the same company or are planning to buy a new vehicle immediately after the sale, you can renew the contract for another car, thereby saving on future payments.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 938-40-67 (Moscow)

+7 (812) 467-30-58 (St. Petersburg)

Is it possible to transfer insurance from one car to another?

According to Russian legislation, all citizens in whose official ownership a vehicle is registered are required to take out an insurance policy. This service is paid and the insurance contract lasts for a certain time. The amount of insurance is proportional to the number of vehicles.

Can insurance be transferred to another car, as well as transfer features?

According to practice, it is possible to transfer MTPL insurance to a new car. But before starting the procedure, the vehicle owner understands the various nuances of the re-registration.

Persons who legally use vehicles terminate contracts with the insurance company. The insurer itself must return the funds for the duration (in days) of the insurance coverage that they did not have time to use.

Another option is for the owner of the vehicle to issue a car title to the person who buys the car. But in this case, the money will be returned not by the insurance company, but by the buyer himself.

If one vehicle is sold and another car is purchased, insurance is taken out from the beginning, under a new contract. How to deal with documents for an old car:

- the documentary transaction with the insurance company is terminated and funds are returned for the unused period;

- insurance documentation is put aside until the contractual legal relationship is completed. Relevant if there is about a month left;

- OSAGO is purchased for the buyer of the car and amounts are required from him for the time not used in the contract.

In this case, the auto insurance policy will not apply to the old car, due to the fact that the policy is being rewritten for a new one, the legal relationship is terminated in any case, since the documentation contains information about the sale of all vehicles. The Federal Law “On Compulsory Motor Liability Insurance” contains information that in case of an accident involving a car that is not included in the policy, compensation is not returned.

The procedure for renewing insurance for another car

The law stipulates that it is necessary to redo the compulsory motor liability insurance for each of the registered vehicles within the established time frame, since this is the responsibility of each driver. If you do not rewrite the policy, in accordance with the requirements of the Code of Administrative Violations, penalties in the amount of 800 rubles are imposed. Therefore, it is recommended to transfer the insurance documents as soon as possible by creating a new contract.

Renewal of an MTPL policy for another car

You cannot independently re-register MTPL for a second car. In the process of preparing the document, data will be entered into the database not only about the motorist who owns the vehicle, but also about the technical characteristics of the car.

The insurance premium also depends on these indicators. Therefore, the usual transfer of data from one policy to another is not possible.

To do this, a free-form statement is written stating that the transaction is canceled due to the official sale of the car. You should submit documentation from the traffic police on the fact of deregistration, from the tax service, an agreement with an act of a completed transaction - sale. Insurance company specialists promptly cancel the transaction, and cash for the unused period is given personally to the owner. If the agreement does not have a separate indication, the company will compensate for losses minus compensation for premature termination of legal relations, which is often 20%.

There is another way to resolve the issue with less losses. OSAGO from the old car will be transferred to the new one. This is rarely done, since insurers rarely agree to this. The first and second cars are serviced by the same insurer. If the company agrees to the request, an application is submitted, as well as documentation:

- passport details;

- driver's license;

- PTS;

- confirmation of technical inspection;

- former VHI.

Insurance specialists will change the information in the current OSAGO with the calculation of the difference that was paid. The owner can make an insurance transaction for a less favorable amount than with a new transaction.

Re-registration of CASCO for another car

When replacing a vehicle, it is mandatory to renew the insurance contract and CASCO for a new vehicle, since the protection will be extended to the car itself. But when the driver changes, the contract is still reissued.

If the car owner is going to purchase a new car or does not want to transfer the current insurance to the buyer, the MTPL is canceled and the remainder is transferred to a new contract. To complete this procedure, an application must be provided with the attached policy. The company’s specialist deducts the amount based on the days that passed before the transaction was completed, and also transfers the entire balance free of charge. This makes it possible to terminate the contract while simultaneously executing another. If the car is sold, the new owner will have to take out CASCO insurance for himself.

This method applies to a policy without payments for time used. A convenient option for drivers who are immediately buying a new car.

You can terminate the contract and receive the balance. This procedure is available if a person has 2 cars at his disposal, one of which is sold under a purchase and sale agreement, and the insurance policy for the second was obtained from the same company. The same citizen acts as the insurer of the cars.

The same option for re-registering a documented transaction is suitable for persons purchasing a new car immediately after the sale. This means that only vehicle owners who have another vehicle insured by the same insurer can use the census.

This option of renewing the insurance contract occurs in rare cases, since, in addition to having two cars, you also need insurance from one institution. You can calculate using an online calculator what the transaction cost and balance will be. On the official websites of insurance companies there are special calculators where you just need to enter data on your car.

The process of transferring the policy to a new car occurs within a few days. If you have the necessary documents, re-registration will be available at the company’s office within one day. No additional payments, duties, etc. will be needed, since the process is completely free.

Contacting an insurance company with a request to transfer insurance to a new car is carried out exclusively by the policyholder or an authorized representative who has the authority to transfer changes to the insurance contract. All other citizens do not change the clauses of the contract, so the policy will remain unchanged.

Renewal of insurance for another car

After purchasing a car, the owner must register it within 10 days and issue a compulsory motor liability insurance policy. To buy a new car, you often have to sell your old one. Then the question arises of what to do with the still valid MTPL policy. Is it possible to renew existing insurance for a new car, and what actions are possible, we will consider below.

By law, car liability insurance is mandatory for every driver. The absence of a policy, according to the Code of Administrative Violations, faces a fine of 800 rubles. However, its cost is high, so drivers want to save money and get a new one at the lowest cost. There are several ways to do this.

Is it possible to simply transfer the insurance to another car?

Unfortunately, you cannot do this yourself without breaking the law. When preparing a contract, information not only about the owner, but all the main technical parameters of the vehicle are entered into the database and document. They also influence the size of the insurance premium. Therefore, it is impossible to simply transfer data from one policy to another.

However, there is a way to return unspent money on the old policy by investing it in the registration of a new one.

To do this, you need to write an application for termination of the contract in connection with the official sale of the car. Bring documents from the traffic police about deregistration, from the tax authorities, an agreement and an act on the transaction, that is, the sale. The insurance company will cancel the policy by returning funds for the unused period. Moreover, if such a clause was separately specified in the agreement, the company can recover its losses by deducting compensation for early termination (usually up to 20%).

How to renew insurance for another car

There is another way to resolve the issue with the least losses. The insurance from the old vehicle is transferred to the new one. This is rarely done, only in agreement with the insurer. Both cars must be serviced by the same insurance company. If the company agrees, all you have to do is write an application, attaching the following documents:

- passport;

- driver license;

- PTS;

- document confirming passing the technical inspection;

- previous insurance contract.

The insurance company will make changes to the current MTPL policy and calculate the difference you will pay. As a result, you will be able to get insurance for less than when concluding a new contract, and you will be able to drive without breaking the law.