The insurance company did not pay extra for compulsory motor liability insurance, what should I do?

What to do if the insurance company has paid little under compulsory motor liability insurance?

Cases of underestimation of insurance payments have become more frequent. Almost 90% of victims face underestimation of insurance compensation. In this article you will find detailed instructions that will help you resolve this issue.

You dealt with the accident and submitted documents for insurance compensation without delay. But the amount of the insurance payment turned out to be inappropriate: instead of the expected 20 thousand rubles, only 8 thousand were credited to your account. 90% of victims make such complaints. Insurance companies don't pay extra very often. But it is possible to restore justice.

The main thing is not to panic, but follow our recommendations.

DO NOT HURRY TO GET YOUR CAR IN ORDER.

The quieter you go, the further you'll get! Wait for the insurance payment to make sure it is correct and complete.

CONTACT THE INSURANCE COMPANY WITH AN APPLICATION FOR ISSUANCE OF AN INSURANCE ACT

If the amount of payment under compulsory motor liability insurance is small, then contact the insurance company again. In addition to the insured event report, you must receive an appendix on the inspection report of the damaged car with the conclusion of an independent examination (assessment)

ORDER AN INDEPENDENT DAMAGE EXAMINATION

Independent specialists will also ask for a certificate of the accident and an inspection report from the insurance company in order to draw up a new estimate of the cost of auto repairs. The insurance company must also be notified of the date and time of the re-examination. The specialists of “DTP HELP” will conduct a free independent examination with an objective assessment of even hidden damage. Don't be afraid to turn to professionals! This is the best way to get a fair payment.

WRITE A PRE-TRIAL CLAIM TO THE INSURANCE COMPANY WITH A DEMAND TO PAY THE UNPAID INSURANCE COMPENSATION.

An independent conclusion about the damage caused is the basis for demanding additional payment from the insurance company.

The requirement is a well-known sample addressed to the director of the insurance company. In it you indicate the reason for your request and the expected amount of compensation. Don't forget to add a new expert assessment of the damage, include your policy number, vehicle details and receipts. You can use this example

If within 10 days your claim is denied or the insurance company does not pay you extra, feel free to move on.

On a note! In accordance with clause 70 (OSAGO Rules), within 30 days from the date of receipt of all necessary documents, the insurance company is obliged to either pay under OSAGO or send a refusal to pay insurance compensation.

FILE A CLAIM IN COURT.

Remember, the insurance company must deny your claim before filing a lawsuit. The following must be attached to the court application:

- Documents for the vehicle.

- Copies of documents from the traffic police.

- Insured event report.

- Vehicle inspection reports.

- Report on the assessment of damages by the insurance company.

- Conclusion of an independent expert.

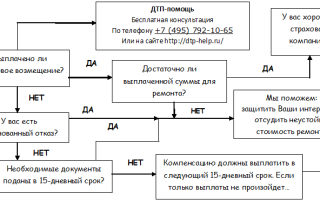

Brief scheme of actions in case of repeated insurance compensation

Advice!

Even if your position is obvious, the assistance of a knowledgeable lawyer will increase the chances of a satisfactory conclusion to the case. And the speed of payment of compensation will depend on the stage of involving a specialist in the dispute. After submitting documents, the trial process may also drag on for some time, and another examination may be appointed.

Why did the insurance company count so little money? Sometimes it is not so easy to understand all the details of the insurance industry: take into account the maximum amount limit, the need for legal recovery or the correct organization of the examination. There is a reliable way to alleviate this fate - the help of qualified lawyers. The company "DTP-pomoshch" has been operating since 2004. They trust us because we really help without prepayment, and we only take remuneration upon winning the case.

Green light on all roads!

About our company

Our auto lawyers provide assistance in case of accidents, legal and expert services in the field of auto insurance. Our opinion is trusted by the largest TV channels in Russia, covering the problems of car insurance and situations when the insurance company does not pay insurance or underestimates insurance payments.

Our advantages

Become our partner

Tell car owners about a way to receive their insurance payments in full! Help others not to be deceived by insurance companies!

What to do if you don’t have enough money for repairs under OSAGO

A compulsory insurance policy presupposes a certain limit of payments to the victim. As a result, there may not be enough money for repairs. Let us consider in detail what to do if compulsory motor liability insurance does not cover damage, in what situations this is possible and what are the features of such an accident.

What to do if the policy does not cover damage: step-by-step instructions

A similar situation can arise in two cases:

- The insurance company deliberately underestimates the payment amount.

- Repairs cost more than the company can afford.

The procedure depends on the reason why the amount paid was small.

Who pays extra for repairs?

It often happens that a car service center, having not received a sufficient amount for repairs, requires additional payment from the car owner. But this is illegal; the policyholder should not bear the costs of restoring the vehicle if he is not at fault for the accident.

If the payment under compulsory motor liability insurance is calculated correctly, but there is not enough money for repair work, the victim has the right to recover the missing funds from the person responsible for the accident. Before submitting claims to the initiator of the accident, you need to take the actions described below (see the section “If the cost of repairs is greater than the payment”). If the calculation of compensation was carried out with an error, then the claim must be submitted to the insurance company (see section “Intentional underestimation of the insured amount”).

Thus, if compensation under compulsory motor liability insurance was not enough for restoration work, the following will be paid extra:

- the insurer, if he made an error in the calculations (and the car owner proved it);

- the culprit of the accident, if the amount of compensation is calculated correctly.

Important! The obligation of the culprit to pay the missing part is enshrined in Art. 393 Civil Code.

Case No. 1: deliberate underestimation of the sum insured

In such a situation, you need to take the following actions.

- Request a copy of the insurance claim from the insurance company. It must indicate all the circumstances of the car accident. The document is issued at the written request of the policyholder within 3 days from the receipt of the application (if the act has already been drawn up) or from the moment the act is drawn up, if the request is submitted before it is ready.

- Check the calculations are correct. To do this, you can use the reference book on the RSA website. If the cost of parts is reduced, it means that the sum insured is calculated incorrectly. It is important to consider that such a check is only a preliminary assessment of the prospects of a dispute with the insurer and does not replace professional expertise.

- Get an independent assessment of the damage. To do this, you need to contact an organization or an individual master who performs such work, provided that he is included in the general register and has the right to do this activity. The cost of the service depends on the region, and the qualifications of the employee can be checked on the official website of the Ministry of Justice of the Russian Federation.

- Submit a pre-trial claim to the insurer. This is a mandatory step before filing a claim (Part 1, Article 16.1 No. 40-FZ). Within 10 days, the company will consider the appeal, pay the missing amount or send an official refusal to satisfy the requirements. If no response is received within this time, you can prepare a statement of claim in court. The claim is drawn up in free form, indicating the details of the parties, the circumstances of the accident, requirements for the insurer, the date and signature of the applicant.

- Going to court. The statement of claim must indicate the same facts as in the complaint. It should also be supplemented with information about an attempt to pre-trial resolve the issue, demands for reimbursement of costs and penalties for each day of delay (1% of the difference in compensation due and received and/or 0.05% for each day of failure to comply with the deadline for a written response to the claim).

Note! If the cost of the claim is no more than 1 million rubles, no state duty is paid. If the amount of claims does not exceed 50 thousand rubles, the application is sent to the magistrate court, if more - to the district court.

If the process is successfully completed, in addition to the basic payments, the victim can count on the transfer of a fine, which will be half of the difference between the paid and due amounts.

Case No. 2: if the cost of repairs is greater than the payment

In such a situation, one should be guided by Part 1 of Art. 1064 of the Civil Code, according to which damage must be compensated by the person who caused it. That is, if there is not enough money for repairs under compulsory motor liability insurance, the missing amount should be recovered from the person responsible for the car accident.

To do this, you need to do the following.

- Obtain documentary evidence of the amount of damage through an independent examination.

- Send a pre-trial claim to the culprit of the car accident demanding payment of the missing amount.

- In case of refusal, send a statement of claim to the court. After the decision is made, the writ of execution should be transferred to the Bailiff Service if the culprit refuses to voluntarily comply with the decision.

Thus, the general procedure for receiving insufficient compensation after an accident is:

- certification that the payment does not cover the damage;

- an attempt to resolve the problem peacefully by filing a pre-trial claim with the insurer or the person responsible for the accident;

- going to court if the situation cannot be resolved otherwise.

Required documents

For pre-trial settlement, the following minimum documents will be required:

- insurance claim report;

- independent expert report.

If the case is sent to court, this list must be supplemented:

- copy of passport;

- documents for the car (PTS and STS);

- certificate of accident;

- protocol;

- MTPL policy;

- a copy of the pre-trial claim;

- a copy of the response from the insurer or the culprit (if it is not available, you must attach a postal receipt confirming that the claim was sent);

- audio/video materials and testimony of witnesses as the validity of their claims (if any);

Depending on the specific situation, additional documents may be required.

How to collect the missing part: features

- To receive funds from the culprit if the payment from the insurance company is not enough, you need to follow the algorithm given above.

- An independent examination is mandatory, since only on its basis the amount of damage is established.

- Compliance with the pre-trial procedure for resolving the problem remains at the discretion of the insured. If recovery is made from the culprit, you can immediately file a lawsuit.

- It is mandatory to go to court if not only material, but also moral damage (causing harm to life and health) has been caused. According to judicial practice, such requirements are almost always satisfied.

Let's sum it up

Despite the obligation of insurance companies to compensate for damage caused as a result of an accident, the victim is not always able to receive an amount that is sufficient for restoration work. The features of such situations are as follows:

- the insurance payment may not be enough in two cases: the insurer deliberately underestimated its amount, or the repairs turned out to be more expensive than the allowable compensation;

- if the amount is deliberately underestimated, the money is recovered from the insurer; if restoration work turns out to be too expensive, the money is recovered from the person responsible for the accident;

- in order to qualify for additional payment, you need to obtain a copy of the insured event report and conduct an independent examination, on the basis of which you can judge the advisability of starting a dispute;

- the pre-trial procedure for resolving the issue is mandatory, when money is recovered from the insurance company, when the claim is sent to the culprit, the victim can immediately go to court;

- when initiating the process, you can receive not only additional financial resources for restoration work, but also a penalty for each day of delay, as well as reimbursement of legal costs;

- if not only material, but also moral damage (to life or health) is caused, the likelihood of winning the lawsuit is almost guaranteed;

- Before starting a dispute, it is necessary to prepare a package of documents, which is supplemented when the case is sent to court.

Thus, if the amount received from the insurance company after the accident turned out to be too small to restore the car, you can get the missing funds by initiating a dispute. The insurance company or the person responsible for the accident will pay extra.

Under compulsory motor liability insurance they paid less: what to do if the insurance company underestimated the payment

OSAGO is a compulsory insurance that, by law, any driver must take out so that in the event of an accident, the expenses of the guilty party are covered with this amount. It often happens that the insurance company pays less under compulsory motor liability insurance than the cost of repairs, and the client has to fight for justice on his own. Why is there a reduction in the amount of payments under compulsory motor liability insurance, what to do in such a situation, and how to properly file a claim in court on this issue?

How do you know if you paid less than you were supposed to?

In the event of an accident, one of the participants must call the traffic police service, whose employees will record the fact of the occurrence of an insured event. Self-registration of an accident is also allowed if the amount of damage is within the regional limit.

The person at fault for the accident submits to the insurance company employees a protocol that records the fact of the accident in order to receive monetary compensation. The amount is determined by a specialist from a particular insurance company.

This happens after the compensation is transferred by the company to the citizen’s account. An independent examination can be carried out at car dealerships, where independent experts will calculate the specific amount of damage.

In order for the special examination to be successful, it is necessary:

- find an independent expert;

- draw up an agreement and pay;

- deliver the car;

- wait for the official conclusion with the amount of damage.

Next, the amount received as compensation and the amount calculated during the examination are compared. For small differences, there is no need to require additional payment. If the difference between the amounts is large, then it is necessary to file a claim and defend your rights.

Why would an insurance company underestimate the amount of compensation?

Since 2014, each insurance company has been calculating the amount of compensation in accordance with uniform standards that were approved by the Central Bank of Russia. Despite this fact, many companies deliberately underestimate the amount of payments.

The reasons for underestimation are:

- Method for assessing damage. The amount of compensation directly depends on how the examination is carried out. Having examined the car by touch, the appraiser can put forward a final amount that differs significantly from the amount of actual compensation.

- Knowledge and experience of the appraiser himself. A beginner or non-professional can make big mistakes and make mistakes when assessing the amount of damage, missing important details.

- Conditions of examination. The inspection must take place during the day, and the car itself must be provided in a clean condition. At dusk, some damage may simply be lost by a specialist, who ultimately will not include it in the report.

An underestimation of the amount of compulsory motor liability insurance payments can also occur for legitimate reasons.

Legitimate reasons

There are three legitimate reasons:

- Wear and tear of vehicle parts. Often this reason is the basis for a legal reduction in payments under compulsory motor liability insurance. Approximately 80% of drivers file claims because of this. However, the maximum limit for reducing the cost of parts was set by the Central Bank. It is 50% of the current market price.

- Removing damage from the final report. If, for example, more than 25% of the paintwork on a car is damaged, then the insurance company has the right not to take into account the costs of its restoration. The same rule applies to corrosion damage on your car.

- Calculation of the amount of damage without including loss of marketable value. This reason is also the reason for many lawsuits. Insurance companies withhold the amount of compensation, although by law they must pay for loss of marketable value.

What to do if you paid less under compulsory motor liability insurance?

Having studied all the rules and regulations related to the problem of compulsory motor liability insurance, conducting an independent examination, making sure that the differences in the actual amount of damage and the amount paid are really large, a citizen can begin to file a claim and defend his rights.

How to file a claim with an insurance company?

If you determine that the insurance company made a mistake in the amount of payment under compulsory motor liability insurance, then begin filing a claim. It is sent not to the judicial authorities, but to the actual address of the financial company.

A claim is a document designed to resolve disagreements peacefully without involving justice workers.

The claim displays the following data:

- the name of the insurance company that violated the terms of payment of compensation;

- Full name and other general information about the victim, his contact information;

- a brief description of the accident situation (location of the accident, what vehicles were involved);

- what amount of compensation was provided to the insurance company after inspection and assessment;

- amount of compensation after assessment by an independent expert;

- form for obtaining an opinion (either in person or online);

- personal signature and transcript.

In order not to make mistakes in drawing up a claim, download its template. If you have any difficulties with the document, contact a specialist on the website or ask your question using the “Leave a comment” button.

The completed claim is handed over to the secretary or loss distribution specialist. In response, you will be provided with a copy of the document, which will indicate acceptance of the claim. Next, wait for the conclusion to come. Typically, this waiting period does not exceed five working days.

If it is impossible to hand over the ticket in person, it will be sent by registered mail or courier.

Compensation for damages through the court

If the insurance company does not agree with the claim or has ignored it, you should contact the judicial authorities by filing a statement of claim.

In order to simplify your work in preparing for going to court, download the claim template on our portal.

Also included as information is information about the financial company, transport, place and time of the accident.

What documents are needed?

The annexes to the statement of claim are:

- copy of Russian passport;

- documents for the car.

The remaining documents on the list are more difficult to collect, but they are no less important:

- Vehicle examination report. This document is drawn up by the manager of the company. To obtain a certificate, contact your insurance company and ask them to legally provide it to you.

- Protocol from traffic police officers. After drawing up the protocol, be sure to make a copy of it.

- Notification of an accident if the accident was registered without calling the traffic police. It is drawn up in 2 copies between the two parties to the accident. In this case, a copy of the document is also necessary.

- A claim filed against an insurance company. After submitting a claim, the victim keeps a copy of it with a mark of acceptance.

- Response to a complaint. The original document in which the insurance company responds to the citizen’s request to pay the required amount of compulsory motor liability insurance.

- Conclusion of an independent expert. Such a document can only be obtained after an independent examination. Moreover, a receipt for payment is also attached.

What to do in the event of an accident so that the amount of compulsory motor liability insurance is not underestimated?

If an accident suddenly occurs, in order to receive the full amount of payment under compulsory motor liability insurance, you must act according to the following plan:

- After stopping the vehicle, install a sign indicating an emergency situation.

- Ask the culprit about the availability of the OSAGO contract form and find out all the necessary information (name of the insurance company, form number, date of registration of the contract).

- Call the traffic police or emergency commissioner.

- Complete the European protocol provided when purchasing a vehicle license.

- Take a photo of the accident on your phone. This is especially necessary if traffic police officers have not arrived for a very long time.

- Explain to the inspector the entire situation with the accident, read the incident report and sign if you agree with everything;

- Make a visit to the office of the insurance company and present them with all the collected documents.

In conclusion, we can say that drivers often have to solve the problem of underestimating payments under compulsory motor liability insurance. Usually people are lost and don't know what to do next. The main thing is not to panic, file a claim with the insurance company and take it there. If the company informed you that it refuses to pay compensation or simply ignores the fact that it has received a claim, feel free to go to court.

In order not to make mistakes in drawing up documents and not to lose anything, be sure to consult with specialists.

If you have ever had problems with an understated payment under compulsory motor insurance, leave a review below to help readers find the right solution. Display the following information:

- where to go with a claim for payment of compensation under compulsory motor liability insurance;

- what amount was cut by the insurance company;

- How was the difference between the amounts calculated?

We remind you that our website has an online consultant who will always answer your questions. You can set them in the form in the lower right corner of the screen.

We ask you to rate this article! Thanks to you, we can make content better!

Leave your opinion in the comments what you liked and what you didn’t!

Average rating: / 5. Total votes:

We are sorry that you do not find our content useful!

We will try to improve the article!

Thank you for your opinion!

Alexander Ivanov

Expert. I provide assistance in insurance matters and advise in the event of an insured event.

They paid little under compulsory motor liability insurance: what to do next?

If you are not satisfied with the amount of payment under compulsory motor liability insurance, you must take measures to fully reimburse it. After all, the policy insures the driver’s civil liability to other road users. The amount of payment after an assessment of damage by a representative of the insurance agent must be sufficient to restore the vehicle to its original condition.

Why doesn't the insurer pay extra?

There are often cases of going to court due to a significant underestimation of compensation. This happens due to the unprofitability of the insurance business. Today, the number of vehicles and inexperienced drivers on the roads has increased. As a result, the frequency of requests for payments under compulsory motor liability insurance after an accident has increased.

This pushes insurance organizations to violate contractual obligations. As a rule, formal reasons or controversial circumstances of the case are used for refusal, which can be interpreted in different ways.

Do not think that a specialist assessing the damage cannot carry out a realistic calculation of the cost of repairing a damaged car.

Underestimated amounts appear as a result of interaction between the expert and the insurance agent. This is done with the expectation that out of the entire large mass of dissatisfied clients, only a few will go to trial.

Drivers rarely go to court because they do not believe that they will be able to defend their position or they think that the amount of additional payment will not exceed legal expenses. But analytics of court cases shows that only 2% of the total number of claims are claims in which the difference between the price set by the appraiser and the amount determined by an independent expert does not exceed 10,000 rubles.

How to determine how much to claim

Insurance legislation obliges, upon the occurrence of an insured situation, to pay funds in the amount of up to 400 thousand rubles. If damage is caused in an accident:

- 240 thousand rubles are given for the health and life of several victims;

- One person – 160 thousand rubles;

- Property of some persons – 160,000 rubles;

- Property assets of one person – 120,000 rubles.

Compensation is calculated taking into account the depreciation of parts. Its percentage will depend on the release date of the vehicle and its mileage. The oldest models have a long service life, and accordingly, their wear and tear will be higher.

Insurance organizations use the services of experts who lower the cost of car restoration in their interests. Therefore, there is a very high probability that the actual amount of compensation will be underestimated compared to the actual estimate. In this regard, before such a procedure, it is worth ordering an independent examination of the damage by a specialist from another company.

How to find out if the amount is insufficient

You need to understand that the driver’s assessment of damage is usually subjective. You can identify underpayments using the following methods:

- The service center could make a settlement in an amount greater than the insurance agent. For example, using different spare parts codes;

- A unified method for calculating spare parts, which can be used on the RSA website, will help to identify the insurer’s intent.

The amount to be reimbursed is calculated using a unified methodology for determining the amount of costs for repairing damaged vehicles, approved by the Bank of Russia. In accordance with Article 12 of the Federal Law “On Compulsory Motor Liability Insurance”, the amount of costs for the purchase of spare parts is determined taking into account their wear and tear that must be restored. But for such components, assemblies and parts, wear cannot be charged more than 50%.

A review of the practice of courts considering cases related to compulsory motor liability insurance of vehicle owners, approved by the Presidium of the Supreme Court of the Russian Federation dated June 22, 2016 No. 22, established that the calculation of the amount of harm compensated by the causer is carried out using a Unified Methodology. Therefore, no other calculations will be taken into account by the court. In addition, the calculation should be based on expert research.

What to do if the insurance company paid little?

When the payment amount does not suit the car owner, you can follow two ways to solve the problem:

- Independently apply to the judicial authorities for compensation for harm.

- Contact specialists who carry out the repurchase of such cases.

Sequence of actions after a collision:

- You must immediately call a traffic police officer to draw up a protocol (Europrotocol).

- Contact the insurance company with an application for payment, attaching a package of necessary documentation.

- The insurer assesses the damage caused.

- Based on its results, a payment is made (or not made).

If the car owner does not agree with the amount of payment under compulsory motor liability insurance, he has the right to contact independent appraisers to calculate the amount of damages.

Before ordering a professional opinion, you must notify the insurer of this fact. The regulation on the rules for carrying out technical expertise establishes the need to notify the specialist by the initiator of its implementation about the existence of an analysis that has already been carried out, and the victim must be notified in advance of the time and place of its implementation.

If there are no objections from the parties to the content of the initial inspection report of the damaged car, the assessment can be carried out without a new examination of the vehicle, based on the originally drawn up document, indicating such a fact in the conclusion. The assessment results will serve as the basis for sending a claim to the insurer; the review period is no more than 10 days.

By virtue of Article 16.1 of the Law “On Compulsory Motor Liability Insurance”, before submitting claims for payment to the insurance agent, the injured participant in the accident must send him an application for compensation of losses with the necessary documents provided for by insurance legislation.

The emergence of disagreements between the parties due to the fulfillment of insurance obligations or the victim’s disagreement with the amount of compensation entails sending a claim to the agent with documentation substantiating the requirements, subject to consideration no later than ten calendar days, excluding non-working days and holidays.

During the specified period, the requirement for the proper fulfillment of insurance obligations under the MTPL agreement must be fulfilled or a justified refusal to fulfill it must be sent. The appeal must contain information about:

- The name of the insurance organization where it is sent;

- Data of the injured person, including full name, residential address or postal address to which the insurer’s response can be sent;

- Requirements for the company that issued the policy, outlining the circumstances that served as the basis for sending the letter, based on the rules of law;

- Details of the bank account to which the amount of compensation must be transferred if the claim is recognized as justified;

- Full name and position of the representative, his handwritten signature, if the appeal was sent by the institution.

The following documents must be submitted with the claim: originals or copies thereof, certified in accordance with the established procedure:

- The applicant's civil passport;

- Papers certifying the owner's right to damaged property, or the right to receive insurance compensation;

- Certificate from the traffic police about the incident, protocol and resolution on the accident;

- Notification of an accident, if it was issued without the presence of police officers;

- OSAGO policy.

Taking these steps will help you collect the full amount of compensation for a car collision.

Going to court. Procedure

It should be noted that all costs related to the trial will be borne by the applicant. But, if the requirements are satisfied, they will be recovered from the defendant.

Disputing an insufficient amount paid occurs as follows:

- An invitation is sent to the insurer to participate in an independent assessment.

- An expert assessment of vehicle collision damage and loss of marketable value is carried out.

- Based on the results of the specialist’s conclusion, a claim is sent to the insurance company regarding the need to pay additional compensation for repairs in accordance with the results of the assessment.

- If the request is ignored, a statement is filed with the court.

Based on the results of court proceedings, the following decisions may be made:

- The requirements are met;

- Refuses to collect the missing amount;

- A forensic examination is ordered. It is carried out when the results of both opinions differ greatly or there is reason to believe that there is collusion with the appraiser.

If a positive decision is made, a writ of execution is submitted to the court and sent to the insurance agent for payment of funds within the prescribed period.

If the insurer refuses to pre-trial satisfy the claim, the court will impose a fine in the amount of 50% of the stated claims, which is regulated by Article 13 of the Law “On Protection of Consumer Rights”.

There are insurers who, regardless of the situation, underestimate the established payments under compulsory motor liability insurance by almost three times. This behavior is also the calling card of Rosgosstrakh. The most interesting thing is that you can find out about the amount of compensation only after receiving the money on the card. It should be noted that court proceedings in such cases 100% end in favor of the applicant and, by the way, writs of execution for them are paid without any dispute, and court decisions are not appealed and representatives do not appear at court hearings. It turns out that such situations are designed for those who will not defend their rights in court.

By the way, on the basis of Article 966 of the Civil Code of the Russian Federation, it is possible to recover the amount of money underpaid under compulsory motor liability insurance within a period of up to 3 years from the date of the accident.

What to do if you paid less under compulsory motor liability insurance?

Home » Road accident » Compensation for damage from road accidents » What to do if you paid less under compulsory motor liability insurance?

When a driver gets into an accident, especially not through his own fault, he hopes that the insurance company of the person responsible for the accident will cover all the costs of restoring the car.

Unfortunately, many drivers are disappointed, since payments under compulsory motor liability insurance rarely cover the real costs of car owners to repair the damaged car.

In most cases, they have to pay extra for repairs from their own pockets. Some drivers don’t even try to contact insurers because they don’t see the need for it. They understand that the compensation offered will be much less than required.

Car owners sometimes spend several times more on restoring their car than they later receive compensation from the insurer.

If this is exactly what happened in your situation, never despair. Gain knowledge, patience and seek justice. Often insurance companies hope that people simply will not want to fight for increased payments, since their health and nerves are much more valuable to them.

And even if it will not be very easy for you to achieve the desired result, you should do it both for your own sake and for the sake of justice.

How to file a claim with an insurance company for underpayment under compulsory motor liability insurance

First of all, let's consider the issue of drawing up a pre-trial claim. Often it allows you to solve the problem without bringing the matter to trial.

Important! The claim must contain the articles of law on which you rely when demanding an increase in payments under compulsory motor liability insurance.

To ensure that your arguments are not unfounded, an independent examination will be required, the report of which should also be attached to the claim.

What does a pre-trial claim consist of:

- First of all, you need to draw up the header of the document. It records information about the insurance company and the culprit of the accident. It is important to write down their exact details;

- Next, you should describe in detail the situation itself, as well as the facts that are the basis for increasing the amount of compensation. Indicate in the document exactly which laws were violated by the insurer;

- At the end of the document the date of its preparation and signature are indicated.

In order for the claim to reach the insurance company, it can be submitted in person or sent by registered mail.

Note! You must have confirmation that the document has been accepted by the addressee.

Is it necessary to go to court if the insurance company has not paid extra under compulsory motor liability insurance?

As a citizen of the rule of law, should you learn to defend your rights?

You should not undertake car repairs before you receive the necessary payments.

The amount of compensation does not correspond to real figures - seek a re-examination. It must be carried out by independent experts. This examination will make it possible to understand how correctly the data on vehicle damage was entered.

You should make sure in advance that your claims are supported by photographic evidence of vehicle damage resulting from an accident.

In the event that payments cannot fully cover the cost of repairs, demand full compensation from insurers.

By waiting for payments, you can save on repairs. To obtain the certificate, you need an expert assessment and cost calculation.

To receive this report and calculations, write a corresponding application to the insurance company. They have no right to refuse you. This procedure is enshrined in Art. 71 of the Rules on Compulsory Insurance.

When you have all the documents in your hands, bring in an independent expert. Please note that the amount in the act is indicated without taking into account wear and tear of car parts.

In the case where the amount of payments is equal to the necessary costs, it turns out that the reason for underestimating the amount of compensation is incorrect calculations for compulsory motor liability insurance. Most likely, they were carried out taking into account the wear of parts. That is, no proceedings on this issue will help you.

What are the insurance payments for victims of road accidents under compulsory motor liability insurance?

What to do if the insurance company does not pay for compulsory motor liability insurance, read here.

In what cases will payments be reduced:

- when the insurer underestimates the cost of hours for certain types of work at a service station;

- if all necessary work is not taken into account;

- when the cost of materials and parts needed for replacement will be lower than their actual price;

- if the general calculations do not take into account the costs of components at all.

The report on the actual damage assessment is ready - make a claim and send it to the head of the insurance company.

In the document, state the requirements, explain the reason for writing the document, the amount of payments that are actually necessary.

Note! Insurers are required to respond to your request within 10 days.

Support your actions by writing a complaint to the RSA and the FSSN.

If there is no response to your claim, send a statement of claim to the court.

A copy of the complaint will confirm the fact that you tried to solve the problem without going to court.

In addition to a copy of the claim, prepare the following documents to submit to the court:

- documents for the car;

- protocol and certificate of accident;

- insurance claim report;

- examination report;

- cost calculation;

- directly the statement of claim.

The claim must indicate the amount of your claims against the insurance company. It includes the following components:

- cost of repairs;

- expenses for the services of an independent expert;

- moral damage;

- expenses for sending a claim, telegrams about the examination, etc.

Important! When drawing up a statement of claim, namely, indicating the amount of compensation, do not forget to subtract from it the funds that you have already received from the insurance company.

If the amount of payments amounts to 120 thousand rubles, demand that the person responsible for the accident be summoned to the court hearing.

Which court should I go to?

Such cases are usually dealt with by magistrates or district courts.

Even if you have to wait for a court decision for several months, you should not stop and give up.

Moreover, in judicial practice there are most cases when the court took the plaintiff’s side.

What amount to claim under compulsory motor liability insurance?

The maximum amount of payments under compulsory motor liability insurance in an insured event is 400 thousand rubles.

Basic payments under compulsory motor liability insurance:

- if damage is caused to the life or health of several victims, an amount of 240 thousand rubles is paid;

- when one person was injured in an accident, the amount of payments will be 160 thousand rubles;

- in case of damage to the property of several victims, the amount of compensation will be 160 thousand rubles;

- when causing damage to the property of one person - 120 thousand rubles.

Important! Insurance payments are calculated taking into account wear and tear of parts.

To correctly calculate this indicator, the year of manufacture of the car and its mileage are taken into account. Typically, the older the vehicle, the higher its mileage and the higher the wear and tear on parts.

Therefore, you should demand from the insurance company the difference between the actual repair costs and the amount you have already received.

Why do insurance companies not pay extra for compulsory motor liability insurance?

Recently, there have been fewer and fewer cases of citizens filing lawsuits against insurers who either refused to pay compensation or significantly underestimated it.

The fact is that every year the insurance business becomes not as profitable as before. There are, in fact, a lot more cars, as well as accidents on the roads.

Where else should a victim turn if not to his insurance company? Everyone hopes for payments under compulsory motor liability insurance.

This situation negatively affects the level of service insurance companies provide to their clients. Most often, refusals to pay are not sufficiently motivated.

If you think that the expert accidentally did not include some damage to the car in his report, then you are deeply mistaken. This scheme of interaction between the expert and the insurer is quite modern, and gives positive results to both.

In this situation, insurers are hoping “at chance.” What if the client does not understand anything, or does not want to fight for his rights. This will suit dishonest insurers very well . After all, out of 10 policyholders, one or two people will seek justice, nothing more.

Then why are OSAGO owners not frequent guests in courts?

The fact is that people are disappointed in the actions of some judges, and also do not want to spend money on lawyers. And without them it is quite difficult to win a trial.

Although it is known from judicial practice that in almost all cases of this kind the court makes decisions in favor of the policyholder.

In 2% of cases considered in court, the difference between payment of compensation and real costs will be about 5-10 thousand rubles. In other cases it is much higher.