When will new MTPL poles appear?

New MTPL insurance policies will appear gradually

On July 1, 2016, it is planned to begin replacing all OSAGO policies with policies of a new type . They will have a special degree of protection.

The exact form of replacement has not yet been thought through, but they promise that new MTPL insurance policies will appear gradually and the replacement will be absolutely free.

The Russian Union of Auto Insurers (RUA) wants to completely redo existing forms in order to exclude the fact that new forms are being counterfeited. The new policies will be equipped with a high degree of protection, which was not previously present on them.

At the moment, work is underway with the Goznak of the Russian Federation to develop and new OSAGO insurance policies are being developed, but the exact date for the start of changing the policies has not yet been set. At the moment, RSA does not reveal all the cards, and no one has yet seen the exact original of the policy; this was done in order to exclude the fact of forgery.

It is expected that the transition will be gradual and all motorists will be given time to change their MTPL policies. RSA does not rule out the fact that it is possible that policies will be changed centrally, and that after a year, new MTPL insurance policies will be issued instead of old ones.

The Bank of the Russian Federation assumed control over the replacement of policies. At the same time, the Bank of Russia expressed its wish to the RSA that the replacement would take place in stages, and that a bloated queue would not form, and that new MTPL insurance policies would be issued to everyone as the validity of the old-style forms expired.

In addition, the Central Bank indicated its opinion to all insurers so that MTPL policies would include all information about the bonus-malus ratio (BMR) . The Bank believes that providing this information will make it easier to determine the current ratio.

Igor Yurgens , the head of the RSA, made an official statement that changing the MTPL policy will necessarily be free, otherwise it will affect the well-being of citizens of the Russian Federation, all monetary costs will be borne directly by the state, as well as by the insurance companies themselves.

A public statement about changing policies has another goal. Those who want to get a policy now (especially illegally) should understand that it will soon become invalid. And motorists will have to change the old policy model to a new one. They want to involve traffic police officers in the process of changing policies; their function should be to identify counterfeit policies, as well as control them during the shift. To completely exclude the possibility of using old policies beyond the specified period.

Particular attention will be focused on those motorists who already have fines for various violations. They are planned to be checked first. Also, the Legislative Assembly of the Russian Federation plans to pass a bill that will provide for huge fines for driving a car without a policy. Fines will also be imposed for those who are found to have counterfeits.

The state, for its part, has already begun control over Internet resources that post information on the Internet about the sale of policies, or assistance in obtaining them. Currently, a large amount of content is blocked, and criminal cases have been initiated for fraud on an especially large scale.

Therefore, think about whether it is worth purchasing a fake OSAGO policy . You may soon experience big troubles.

According to information provided by RSA, over the past year over 1 million counterfeit policies were sold in the country - according to statistics, this is every thirtieth document. And if we take into account the fact that there has been a reduction in penalties in cases of quick payment, then official insurance companies are afraid of doubling these figures.

It is for this reason that the government decided to switch to a more modernized and improved type of forms that will have a high degree of security.

What will the new OSAGO policy look like?

- 1. Why do they change the policy form?

- 2. The difference between old and new OSAGO policies

- 3. Type of improved policy

- 4. Introduction of new OSAGO forms

New MTPL policies have been valid throughout Russia in paper and electronic form since 2018. The main change is the mandatory QR code. Thanks to it, you can check information about the car and the owner anywhere with Internet access. This is convenient when registering an accident under the European protocol, when the owners independently check the authenticity of the documents.

The authorities made the decision to change the policy due to frequent falsifications of insurance documents. After the 2016 policy change, scammers quickly learned to counterfeit the enhanced protections. It is assumed that the QR code will help reduce the level of counterfeits.

You can issue new OSAGO forms electronically, but provided that this is not the first car insurance. We recommend an electronic form: it guarantees 100% protection against counterfeiting, is easy to use, and takes little time to complete. The procedure must be carried out either independently or with the help of qualified specialists. Many fraudulent organizations fake insurance and sell it at a low price. Sometimes the owner is sure that he has a genuine policy, but after checking it turns out that this is not the case. Be sure to check the company through which you decided to purchase the new 2018 MTPL policy.

Why do they change the policy form?

Insurance companies have raised the price of insurance to 5,000–6,000 rubles, and sometimes up to 10,000, so the market is flooded with fakes that cost 1,500–2,000 rubles. Counterfeit documents are produced to a high standard and are difficult to distinguish from the original.

Analysts are confident that the new model of compulsory motor liability insurance will reduce the number of counterfeit forms, and the increase in information will facilitate the procedure for registering an accident under the European protocol. When you access the Internet, you will receive information about the car and the owner.

The difference between old and new OSAGO policies

After signing the agreement, the new type of MTPL insurance policy will begin to be valid in 72 hours. The new policy added:

- QR code - increased protection;

- barcode;

- table for calculations with bonus-malus coefficients;

- fields for additional information on the back of the policy.

Another difference is that the insurance premium field is now located at the very top of the policy. All changes are designed to reduce counterfeiting and improve self-service. The new type of MTPL policy will provide access to the RSA database and will allow you to familiarize yourself with the intricacies of the concluded insurance.

Type of improved policy

What will the new OSAGO policy look like and what are its differences from the old one? The electronic version has an inscription notifying that this is an electronic form. Provide the traffic police officer or other person with a sufficient document printed on a black and white printer. It is not necessary to do this, and no one has the right to demand this, since the policy has been verified through the RSA database since September 2015.

From the first day of 2018, by order of the Bank of Russia, new forms came into force. Over time, the old models will be completely replaced. The new MTPL insurance policy looks like this:

- color scheme - yellow smoothly flows from lilac to lilac. A graphic drawing of a car appeared in the center and the inscription “RSA” on the sides;

- font size—letters and columns have increased;

- security features - increased watermarks, metallic stripe, etc.;

- QR code - located at the top right, contains information about the car and the owner.

The changes affected the policy series:

- Until 2018, when applying for a policy at an insurance company, forms with the EEE series were used. If the policy was issued electronically, then it had the XXX series;

- from the beginning of this year until June 1, 2018, policies were issued by insurance companies with the MMM, KKK and EEE series;

- from June, compulsory motor liability insurance is issued only with the MMM and KKK series; electronic policies have the XXX series. The EEE series ceased to exist.

Introduction of new OSAGO forms

When will the new OSAGO forms be introduced? The bill came into force in January of this year, but if the validity date of the old policy has not expired, then you should not immediately run and re-issue it, since their powers are equal. An acceptable option is the electronic form of the new OSAGO policy.

We recommend making sure that the old sample is genuine, since there is a high level of counterfeit on the market. Sometimes the owner is unaware that the policy is invalid. You should be careful, as this threatens:

- a fine of 80,000 rubles;

- arrest for up to six months;

- correctional labor for up to two years;

- 480 hours of forced labor;

- a fine in the amount of salary or other income for 6 months.

Cars

Insurance

Russia will change OSAGO

From July 1, all issued OSAGO policies will become invalid

In the near future, more than 40 million Russian drivers will have to change their existing MTPL policies. Already in the summer, the authorities plan to introduce new forms into circulation, which should seriously complicate the lives of fraudsters selling fake insurance throughout the country. In this case, all costs of the reform will fall on insurers. Experts criticize the decision - they are sure that the mass of car owners will still not change their policies, and the rest will have to stand in queues.

By July 1, 2016, all car owners will be required to exchange their existing OSAGO policies for new ones. In the fight against fraudsters, insurers intend to seriously strengthen the protection of forms. You will have to get a new policy, even if the old one has not yet expired. The Russian Union of Auto Insurers (RUA) announced a loud decision on Thursday.

According to RSA, about 1 million counterfeit MTPL policies are sold in Russia per year, with a total volume of 42 million policies. “This measure will make it possible to remove counterfeit policies from circulation, and will also complicate the possibility of producing a new counterfeit and will force policyholders to think about whether to buy a counterfeit policy now, since after July 1 it will have to be purchased again,” explained the essence of the initiative, the head of RSA Igor Yurgens.

The press service of the union explained to Gazeta.Ru that the stated date for the mass replacement of MTPL policies is not yet exact and the transition to new forms may occur later.

The Central Bank and RSA strengthen supervision over auto insurers

“The dates can be adjusted, but not much,” said RSA. “We have already announced the date to clearly indicate that this will definitely happen.”

RSA also noted that the new forms will help eliminate the appearance of counterfeit policies within three years.

Insurers have not yet specified how the process of exchanging policies will be organized and what will happen to those who do not manage to do it on time.

Representatives of the union assure that drivers will not have to bear additional costs - the costs of mass exchange of policies will fall on the shoulders of insurance companies.

According to preliminary data, the price of forms for the company will increase by 6–15%. There is no final decision on this matter yet.

“Currently a policy form costs about 4.7 rubles. The increase will be maybe 20 kopecks per new policy. But the final cost of the policy for the car owner will not change,” said Evgeny Ufimtsev, executive director of RSA, on Thursday.

Vice President of Ingosstrakh Ilya Solomatin notes that the possibility of queues at insurers' offices is the main issue that is being actively worked on. “Of course, we will try to stop the traditional Russian maybe,” Solomatin tells Gazeta.Ru. “There are several options to avoid collapse when replacing policies, and they are being worked on now.”

The interlocutor notes that in 2015 there was a sharp increase in the number of counterfeit OSAGO policies. “That’s why it was decided to quickly introduce new policy forms into circulation. This decision was fully supported by government agencies, including the traffic police,” he says.

Blue Buckets coordinator Petr Shkumatov criticized the RSA initiative - he believes that it will primarily hit law-abiding car owners. “Now the sale of policies is already at its limit, there are enough forms,” Shkumatov told Gazeta.Ru. — Recently, before the tariffs for compulsory motor liability insurance were increased, there were huge queues at the insurers’ offices of those wishing to have time to purchase insurance at the old prices. It’s clear that there weren’t enough policies. It will be even worse if the old forms are replaced with new ones at a time. I’m sure that many drivers simply won’t want to stand in line and will continue to drive with the old forms.”

The cost of the MTPL policy will increase by 40–60% from April 12

According to the activist, the insurer will still not be able to refuse to pay insurance in the event of an accident, since the insurance contract itself is essentially in no way connected with the form.

“As a result, the opposite effect will occur: there will be even more car owners who find themselves, so to speak, in the gray zone.

It is also important to note that at first insurers achieved an unreasonable increase in rates for compulsory motor liability insurance, and now they are complaining about the increase in the number of car owners who drive with fake policies. It’s obvious that some drivers don’t want to sponsor the appetites of insurance companies, while others cannot,” says Shkumatov.

In addition, the interlocutor doubts that the RSA has the authority to make decisions on the transition to new OSAGO forms. “In my opinion, they do not have such a right - this can only happen on the instructions of the regulator, that is, the Central Bank,” notes Shkumatov.

In addition to introducing new forms, insurers intend to take a number of measures to curb the spread of counterfeits. In particular, control over the sources of distribution of fake policies will be strengthened.

Payments under compulsory motor liability insurance in 2014 amounted to 88.8 billion rubles

RSA states that work in this direction has been going on for several months, during which 41 domain names have been removed from delegation; 19 hosting accounts, 104 accounts and 73 groups on social networks were blocked; violations on 11 resources were eliminated; 192 publications on forums and message boards were deleted.

It is possible that car owners who decide to save money during the crisis and not purchase compulsory motor liability insurance at all may be subject to a higher fine.

“A legislative initiative to increase the fine for driving a vehicle without a policy is currently being discussed,” said Igor Yurgens.

— This decision is especially relevant due to the fact that from January 1, 2016, the procedure for 50% discounting of fines when paid within 20 days came into effect. This measure partially serves as a motivator for the use of counterfeits, so an additional economic lever in the form of an increased fine for those who drive without a policy or use a fake form is important.”

In the near future, control over the presence of a legal policy may be entrusted to photo recording cameras. As part of the pilot project, insurance will be checked for drivers caught speeding, running a red light, or driving into a designated lane.

Update of MTPL insurance policies from January 1, 2018

Good afternoon, dear reader.

This article will discuss the updated MTPL forms that have been used since January 1, 2018.

I would like to immediately note that the updated policies contain more information about the contract, which is useful for car owners:

QR code in OSAGO

1.4. The document certifying the implementation of compulsory insurance is the compulsory insurance policy, issued by the insurer in the form specified in Appendix 2 to these Regulations.

1.4. The document certifying the implementation of compulsory insurance is the compulsory insurance policy, issued by the insurer in the form specified in Appendix 3 to these Regulations. A two-dimensional bar code (QR code measuring 20 x 20 mm) contained in the compulsory insurance policy is printed (except for cases of concluding a compulsory insurance contract in the form of an electronic document) and contains information used for direct access through the official website of the professional association of insurers in the information and telecommunications network “Internet” (hereinafter referred to as the “Internet”) to the following information about the compulsory insurance contract: name of the insurer; series, number and date of issue of the insurance policy; the start and end dates of the period of use of the vehicle during the validity period of the compulsory insurance contract; make, model of the vehicle, vehicle identification number and its state registration plate.

The first important change is the mandatory inclusion of a QR code in the upper right corner of the policy. An example of such code is shown in the figure on the left.

This code is an encoded link to a page on the Internet. To decode it you need to use a special application for your smartphone. In this case, the QR code must be photographed with the smartphone’s camera, after which the program will decode it and automatically go to the page with information.

In this case, the QR code on the OSAGO policy leads to a page on the website of the Union of Automobile Insurers (RAA), containing the following information:

- The name of the insurance company that issued the policy.

- Series, number and date of issue of OSAGO.

- Start and end dates for compulsory motor liability insurance.

- Vehicle details (make, model, VIN number, vehicle registration number).

Thus, the QR code will allow anyone to verify that they are holding a genuine MTPL policy in their hands. Just go to the page and compare the information with the data in the policy.

For example, this may be required when registering an accident without the participation of traffic police officers. The driver can quickly check that he is holding a valid policy of the second participant in the incident, and then proceed directly to filling out the notice.

QR codes are available both in pink OSAGO policies (purchased directly from the insurance company) and in printed eOSAGO policies (purchased electronically). That is, any OSAGO policy issued in 2019 can be checked using a QR code.

Changes to the insurance policy form

Let's look at the changes that have been made to the OSAGO insurance policy form:

1. QR code in the upper right corner (this was discussed above).

2. In the “Vehicle Owner” field, the class at the beginning of the annual insurance period is additionally indicated. Let me remind you that when purchasing compulsory motor liability insurance with an unlimited number of drivers, the class is assigned specifically to the owner, and not to each of the drivers. Based on the driver’s class, the KBM coefficient is calculated, which affects the cost of compulsory motor liability insurance.

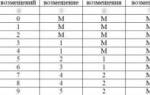

3. A new column has been added to the table listing drivers allowed to drive a car. It indicates the class for each driver.

4. A table has been added to the “Calculation of the insurance premium” column of the insurance policy, giving a detailed idea of calculating the cost of the insurance policy:

OSAGO 2018 – what’s new and what changes?

OSAGO is constantly changing, and 2018 has become one of the richest in innovations: from new policy forms to taking into account fines and dangerous driving of drivers at the cost of insurance - some of all the innovations have already come into force and are in effect, but others are unlikely will it be introduced? The article will talk about compulsory motor liability insurance in 2018: what changes are coming into force and what new awaits car owners. We will look at the subtleties of these changes step by step in a question and answer format.

Will the price of OSAGO change in 2018?

Yes. The cost of the policy consists of the base rate and then the coefficients applied to it, mainly increasing the final price of insurance.

In May 2018, the Central Bank announced an increase in the final cost of the MTPL policy. The change is planned for the end of summer 2018 and will affect the increase in the range of applied prices for the basic insurance rate, as well as an increase in two coefficients:

- across the insurance territory (region of Russia),

- according to the experience and age of the driver.

The base rate will be increased from the corridor of 3432-4118 rubles to 2746-4942 rubles. But this will make the policy grow even more.

We discussed changes in prices for compulsory motor insurance in detail in a special article on the rise in prices of policies.

Today there is a 20% corridor for base rates (but rest assured, almost all insurance companies use the maximum figure in this corridor):

- for individuals for passenger cars: from 3432 to 4118 rubles,

- for legal entities for passenger cars: from 2573 to 3087 rubles.

The average cost of an MTPL policy for 2018 is just over 5,500 rubles.

Calculate the cost of your MTPL policy

Are MTPL policies changing?

Yes. They have already changed since January 1, and insurance companies only sell insurance with the new forms. There are few changes, but they are all quite significant. Let's look at them!

The most important thing is that the new OSAGO 2018 policy now has a QR code measuring 2x2 cm, which allows, firstly, to identify it as not counterfeit, and secondly, to obtain basic information about the insurance holder.

So, when you scan the code (this can be done with any smartphone with the application installed), you will be taken to the website of the Russian Union of Auto Insurers, where you can find out information about the insured driver. In fact, this is the most basic information about the owner of the MTPL - what is indicated on the policy itself:

- name of the insurance company,

- insurance identification numbers,

- car data,

- validity period of the concluded MTPL agreement.

This can only be useful for determining whether the policy in front of you is real or fake. For example, when registering an accident under the European protocol, it will be possible to “break through” the non-fakeness of the policy. Doesn't this mean that drivers will soon be held responsible for neglecting such checks? It's a difficult question. But it's quite possible.

A policy with a QR code can only be obtained at the insurance office - when you apply for electronic insurance, you will receive a regular form by email.

But this change in OSAGO 2018 is already more pleasant for drivers, because many of us have already experienced a discount for accident-free driving due to inconsistency in the work of insurance companies (and, perhaps, elementary fraud on their part).

Now, the new 2018 policy form indicates the class at the beginning of the insurance, as well as a table with classes for each driver in case the policy has a limited number of eligible persons, for transparency in calculating the cost of insurance. Photo of such a new policy with a table:

That is, knowing the formula for calculating the accident-free class and the coefficients for the region and others, you can check whether the price of the insurance premium was calculated for you correctly. We suggest that you familiarize yourself with the article on a visual calculation of the KBM.

And in case the MTPL insurance is unlimited, the new policy also provides a field where the class of the owner at the beginning of the conclusion of the contract is indicated.

Will the insurance fine increase?

As of today (we monitor changes in Russian legislation every day), the fine remains the same:

- 800 rubles (400 rubles with discount) if you do not have insurance or it is expired,

- 500 rubles (250 with a 50% discount) if you are not included in the policy or the period of use of the car has expired.

Despite a number of news at the beginning of 2018 about changes to such a fine, all this news is nothing more than “fake”. We have a special article about such news in 2018, and another one about the current fine for lack of insurance.

In the meantime, there is no news from official sources that such a fine may increase before the end of 2018. If this happens, the article will be updated, and you can subscribe to changes in the article below.

Will there be a MTPL reform in 2018?

Unlikely. The reform proposed by the Ministry of Finance of the Russian Federation includes the following innovations:

- variations in the maximum payment under compulsory motor liability insurance from 400 thousand rubles to 2 million and dependence on the policy cost limit in 2018,

- abolition of a number of coefficients (based on car power and region of residence of the car owner),

- additional increasing coefficient for legal entities.

However, today all 3 of these changes are met with criticism and rejection by other legislative departments.

Thus, the variability of the maximum compensation limit is criticized because of the very essence of compulsory motor liability insurance - after all, it is the driver’s liability that is insured under the auto insurance policy, and the victim will thus depend on the desire of the culprit to be insured at one or another limit. However, there is still some logic in the variability of limits, and what exactly the Bank of Russia did not like about this, which opposed the change, remains a mystery.

But there will be changes in the odds. Thus, an additional coefficient for organizations was proposed by the insurance companies themselves, complaining that most often there is no information about which driver will drive such a vehicle and how long his experience and age are. But this is just a suggestion.

But, as we noted above, 2 coefficients will increase: territorial and by age and experience of drivers. Insurers are also proposing to introduce a new coefficient based on vehicle mileage.

Thus, of the listed innovations in the MTPL reform, only changes to the base rate and two coefficients are planned for 2018.

Will insurance become more expensive if there are traffic violations or fines?

No. At least not in 2018. This amendment, by the way, was also proposed as part of the MTPL reform, but it was not destined to come true.

The reason here is simple, and it has a lot in common with the cancellation of the accident certificate last year - the traffic police simply did not give the go-ahead to provide the database of violators to insurance companies. The argument was a reference to the Federal Law “On the Police”, and without specifying a specific article or paragraph. But if you try to search yourself, you will not find a word in the law about prohibiting interaction with third-party organizations or violating the rights of a citizen by transferring information to them. However, the disagreement of the traffic police only plays into the hands of ordinary motorists, because many have fines.

The initiative was based on completely good intentions - if a driver often violates traffic rules, which is reflected in the fact that he has fines, then this means that he is also more likely to get into an accident and become the culprit. And you must agree that this is quite logical! Especially if, to increase the cost of the policy, not all violations of the Rules were taken into account, but only certain ones, for example, such as dangerous driving, repeated speeding, violations of intersections or intentional violations. And such things as driving beyond the stop line, excessive tinting or installing prohibited types of lamps in the headlights - things that do not have a direct impact on the possibility of an accident - were not taken into account.